Berkshire Hathaway reported on Saturday a huge increase in first-quarter operating profit compared with the same period last year, while its cash reserves rose to a record level.

The Warren Buffett-led conglomerate posted operating profit, which includes revenue from its wholly-owned businesses, that rose 39% to $11.22 billion from the previous year.

The gain was driven by a 185% year-on-year increase in insurance revenue to $2.598 billion from $911 million. Geico’s profit rose 174% to $1.928 billion from $703 million a year earlier. Insurance investment income also increased 32% to more than $2.5 billion.

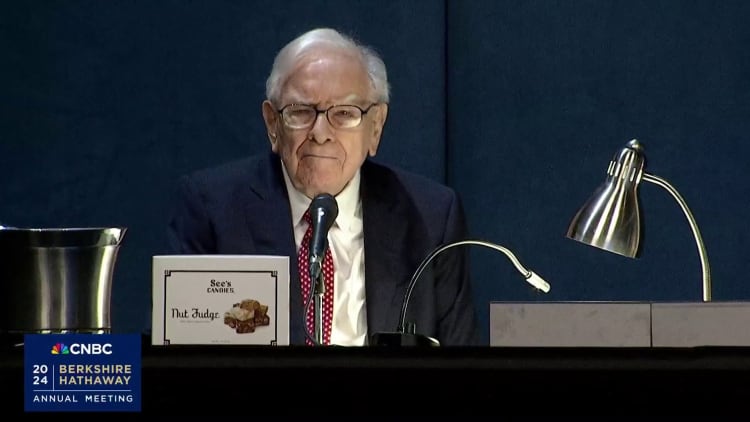

Warren Buffett walks on stage before Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, May 3, 2024.

David A. Grogen | CNBC

Berkshire’s railroad business earned $1.14 billion in profit, down slightly from the first quarter of 2023. Profit at the company’s energy division nearly doubled to $717 million from $416 million a year earlier.

First-quarter net income, which includes fluctuations from Berkshire’s stock investments, fell 64% to $12.7 billion. Buffett calls these unrealized investment gains (or losses) each quarter meaningless and misleading, but the unique conglomerate is required to report these figures to based on generally accepted accounting principles.

Record cash reserves

The company’s cash reserves hit a record high of $188.99 billion, up from $167.6 billion in the fourth quarter. This huge holding, well in excess of CFRA Research’s valuation of more than $170 billion, highlights Buffett’s inability to find the right big acquisition target, something he has regretted in recent years.

It should be noted that Berkshire did reduce its stake in Apple by 13%. However, the iPhone maker remained Berkshire’s largest stock holding.

Berkshire also repurchased $2.6 billion of shares, up from $2.2 billion in the fourth quarter of 2023.

The report is published on the eve of the company’s annual shareholder meeting, known as the “Woodstock of capitalists.” Buffett will answer questions from shareholders about everything from the conglomerate’s assets to his thoughts on investing and the economy.

It will also be the first annual meeting since the death of Vice Chairman Charlie Munger in November.

Berkshire’s Class A shares are up more than 11% year to date, reaching an all-time high in late February. Meanwhile, Class B shares are up more than 12% during that time.

Check out CNBC’s full coverage of this year’s annual meeting. Here.