- A bullish invalidation could cause BNB to drop to $561.

- Funding Rate and sentiment were negative, suggesting a bearish bias.

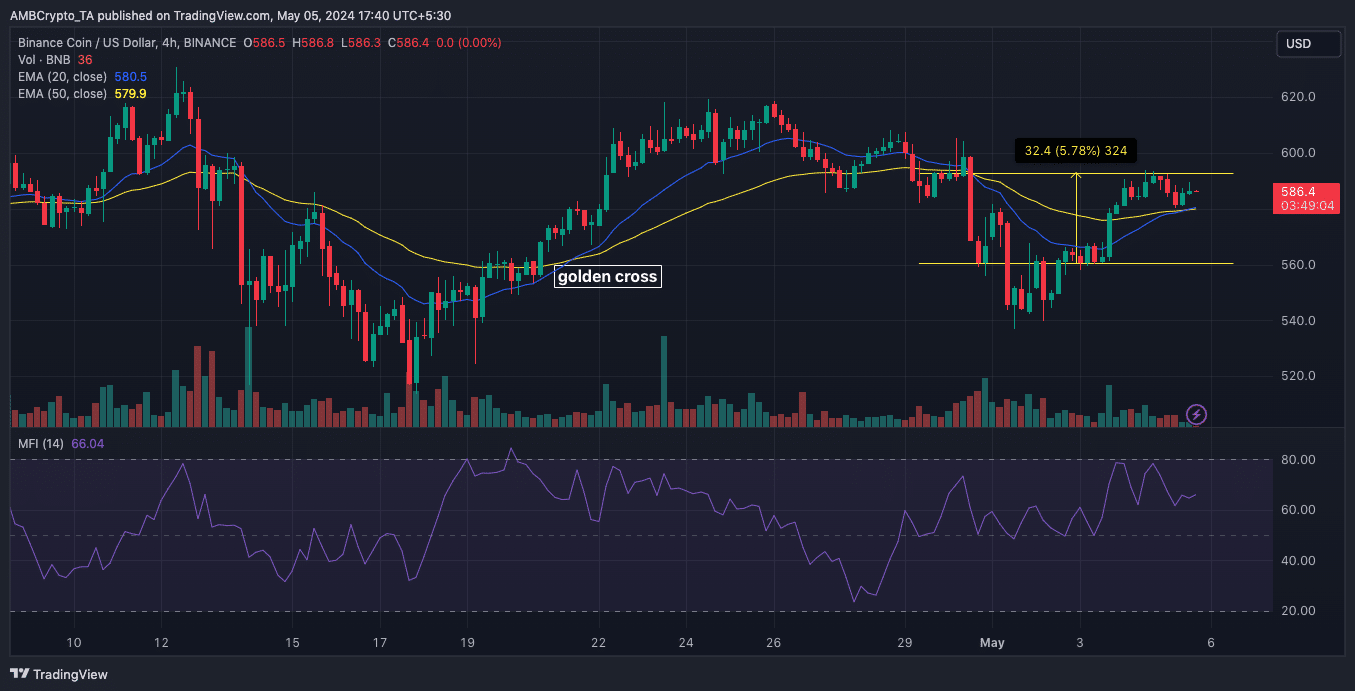

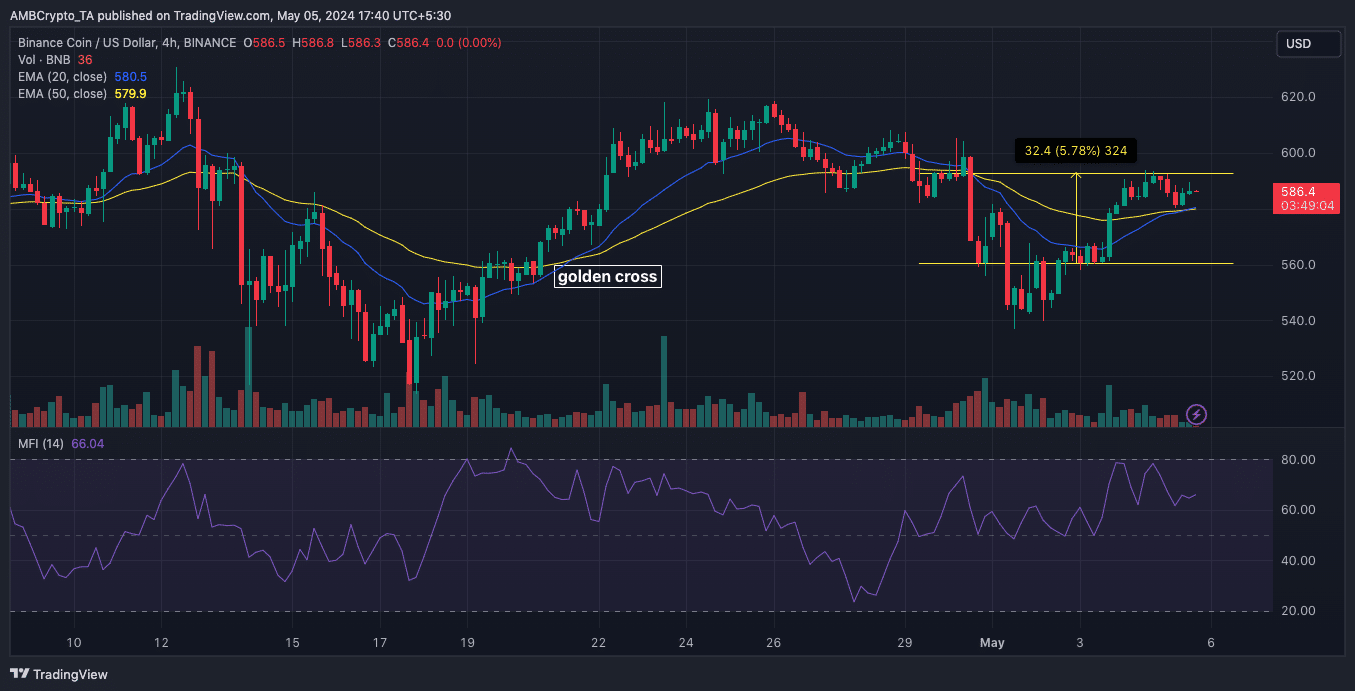

Binance [BNB] might attempt to break out according to the 4-hour chart. But AMBCrypto’s analysis revealed that this effort could be in vain.

One of the reasons for this prediction is the Exponential Moving Average (EMA). This indicator measures trend direction over some time.

At press time, BNB changed hands at $586. But the 20 EMA (blue) and 50 EMA (yellow) were at the same spot. The EMA positions indicated hesitation by bulls and bears to direct the price action.

Hence, BNB might trade within a tight range unless a crossover happens.

Golden cross gone: Death cross next?

If the 20 EMA crosses over the 50 EMA, the price might extend toward $593. But that seemed unlikely as the next target for BNB could be $561 where the last golden cross happened.

For those unfamiliar, the golden cross is the terminology used to describe a situation when the 20 EMA crosses above the 50 EMA. If the 50 EMA rises above it, then it is termed a dearth cross.

Source: TradingView

Apart from the indicator above, another one that suggested a decline was the Money Flow Index (MFI).

This indicator uses the price and volume data to show if a cryptocurrency is experiencing buying pressure or otherwise.

At press time, the MFI had decreased to 66.04, indicating that the BNB’s buying volume had subsided. Should the reading continue to decline, the bearish thesis might be validated.

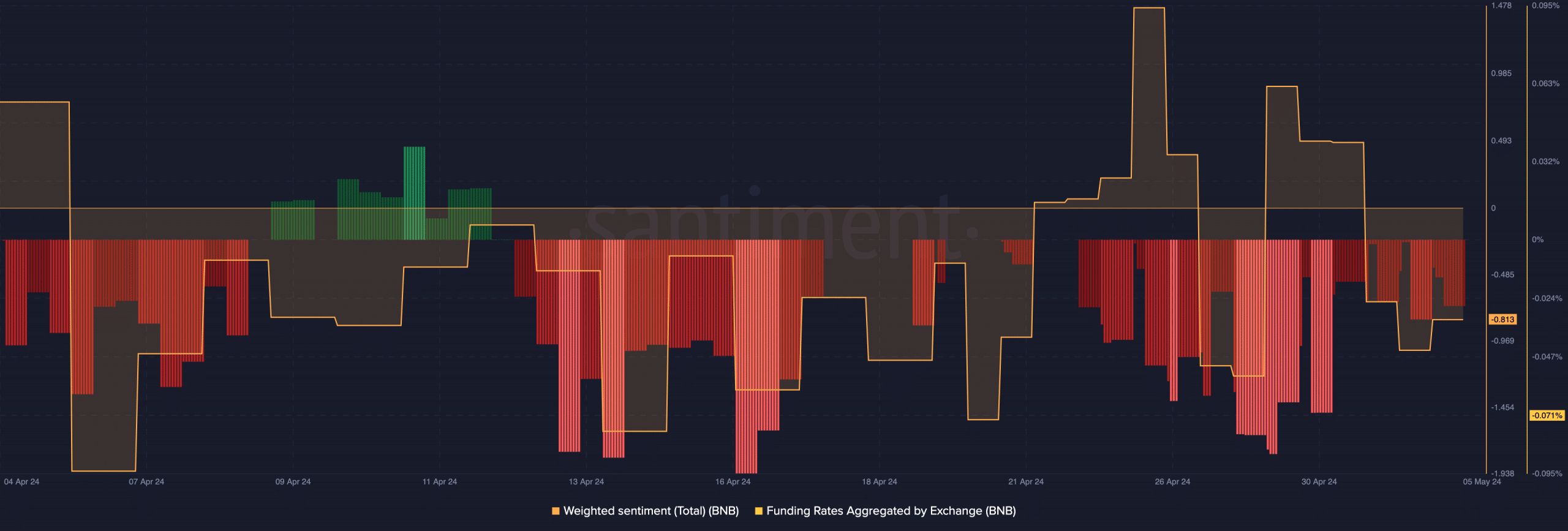

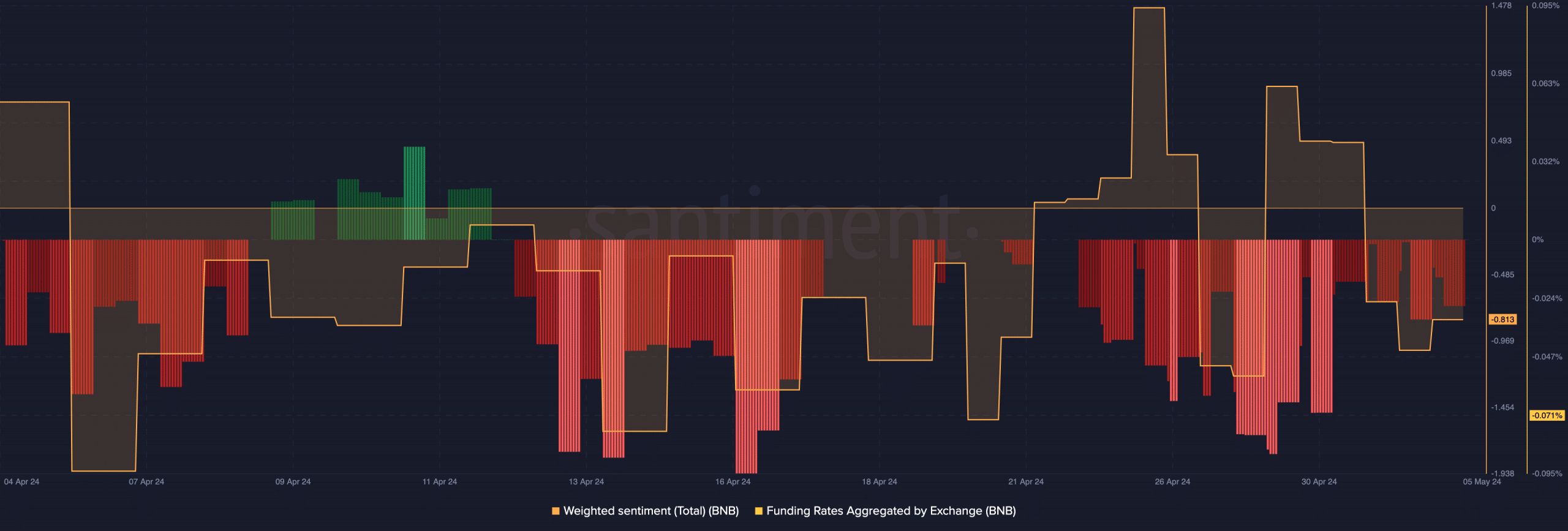

However, this AMBCrypto analysis was not the only one sharing this view. A look at on-chain data revealed that a large part of the market expects the price of BNB to decrease.

Bears double-down on wager

This was evident from the Weighted Sentiment, which was negative at press time. This negative value shows that most comments about BNB on social platforms were bearish.

As long as this remains the same, it could be challenging for the price to jump. On the other hand, if remarks about BNB begin to get optimistic, the trend might change.

Furthermore, a look at the Funding Rate showed that it was on the extreme side of the negative area. The Funding Rate meant more traders leaned toward short positions.

Source: Santiment

If funding was positive, it would have implied that traders were bullish on the coin. In addition, funding also has an impact on the price. From the press time status, BNB’s price moved lower while funding was negative.

Is your portfolio green? Check the BNB Profit Calculator

The reasonable inference here is that perp sellers are aggressive, and were getting rewards for their positions.

In a case like this, BNB might fade a bullish move, and a possible decline could be next unless spot buyers save the day.