- Blast overtook Ethereum in terms of NFT volume

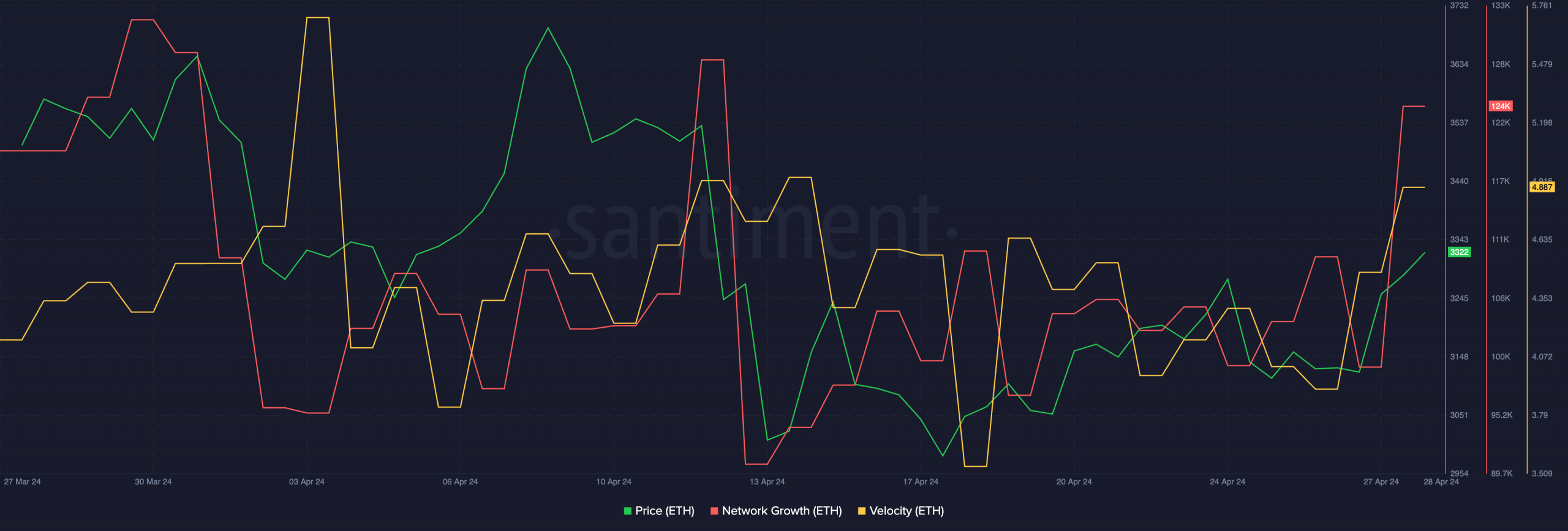

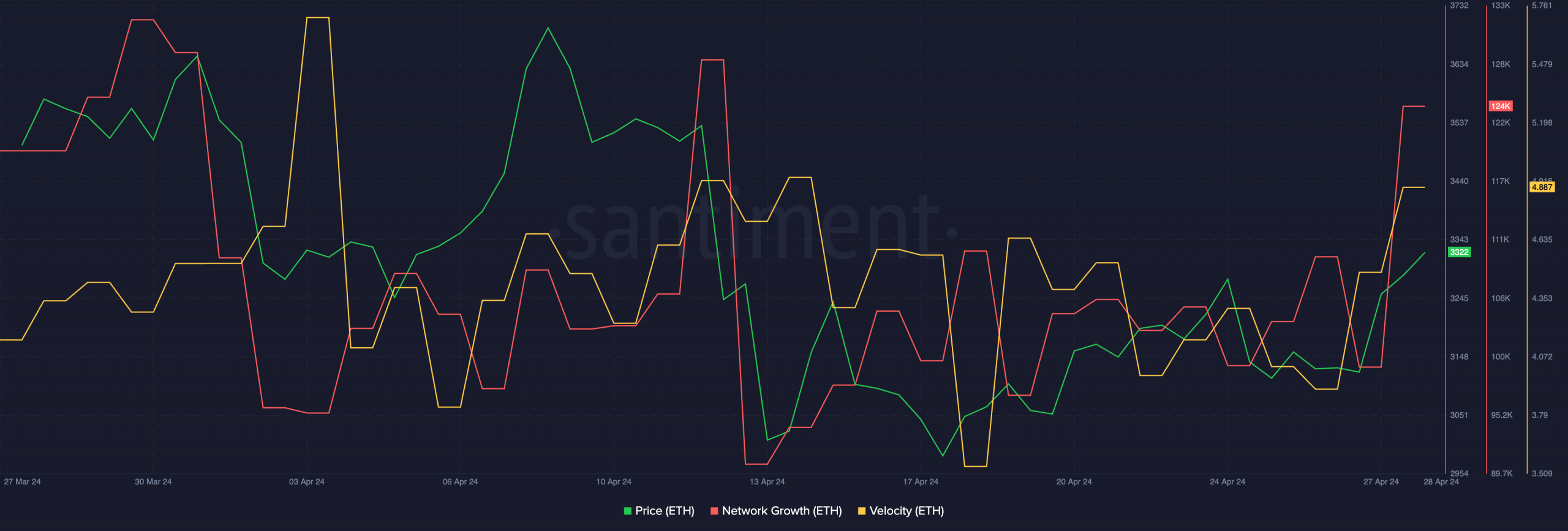

- While ETH’s price fell, network growth and velocity grew significantly on the charts

Ethereum [ETH] has largely been dominant in most sectors across the crypto-space. On a certain front, however, it would seem that the tides have shifted in favor of the Blast network.

NFTs on full Blast

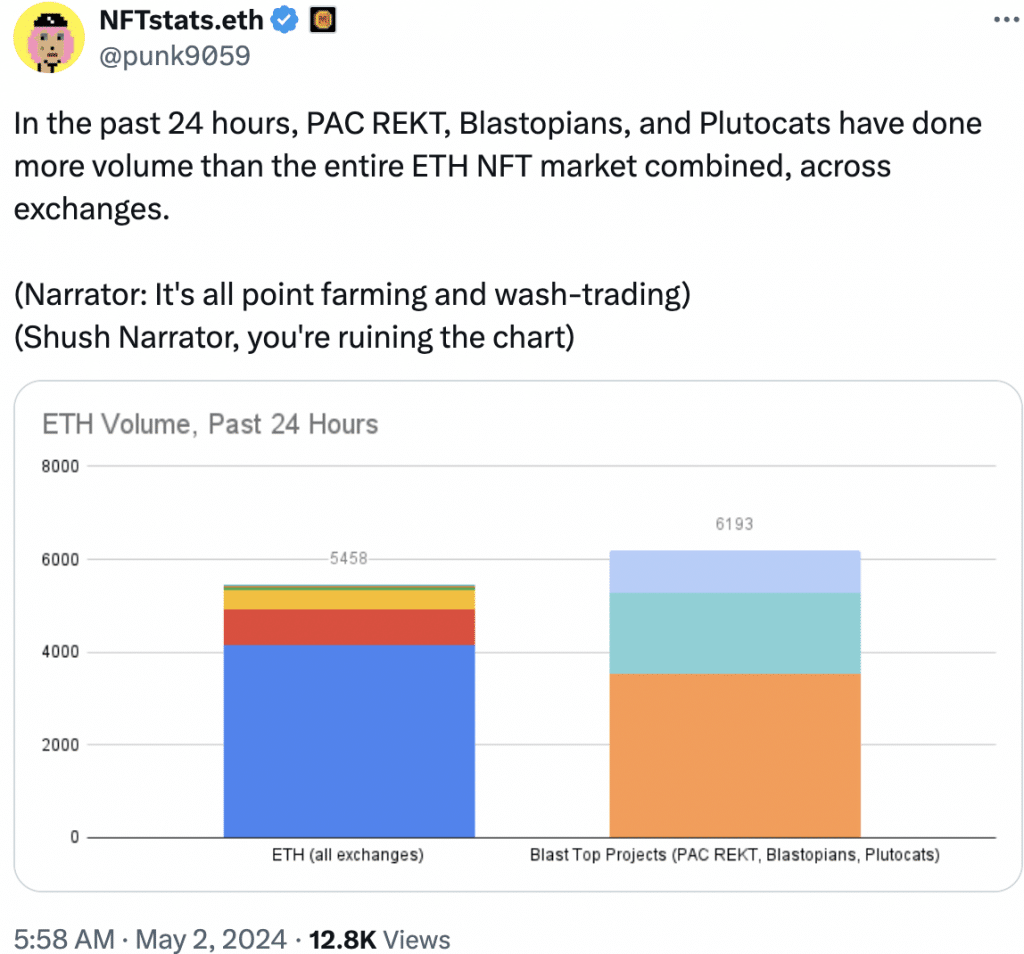

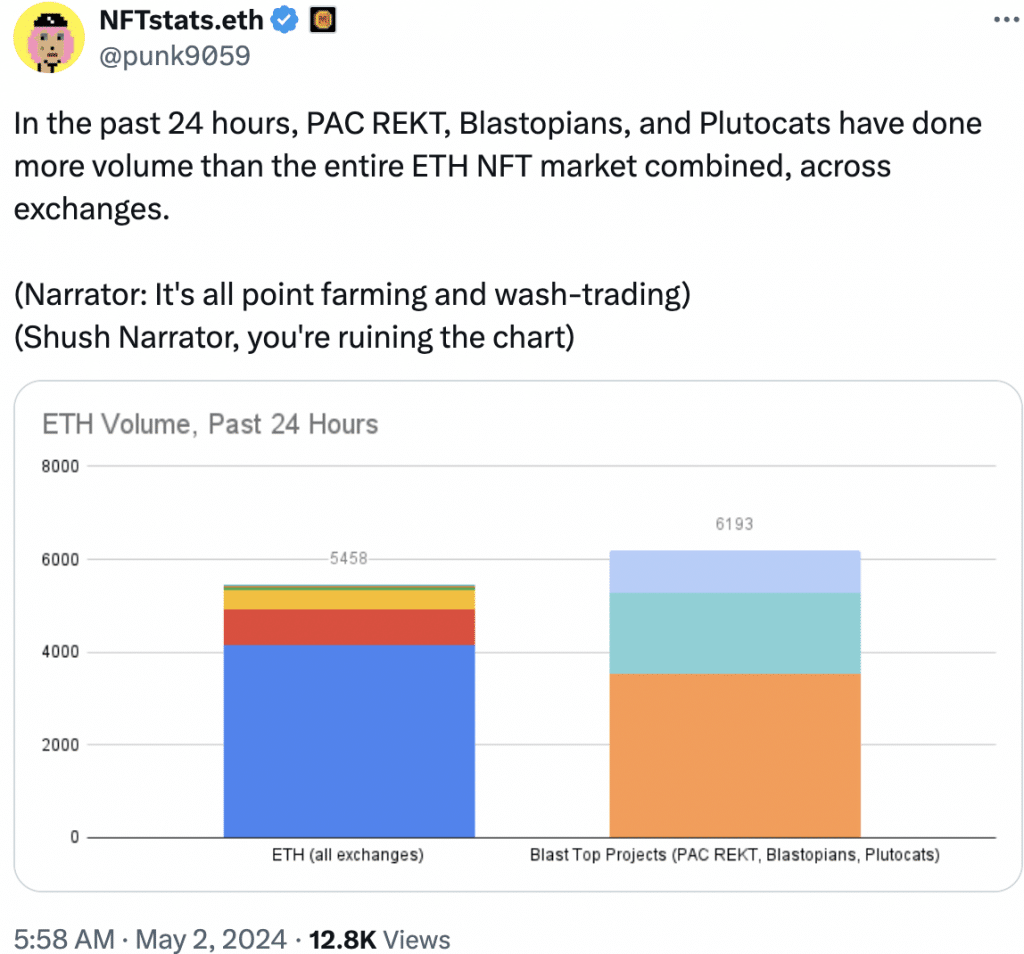

Recent data suggests that over the last 24 hours, Blast NFT collections like PAC REKT, Blastopians, and Plutocrats have collectively generated more volume than the entire Ethereum NFT market across all exchanges.

Source: X

Now, even though Blast outperformed Ethereum in terms of NFT volume, a significant portion of this volume can be attributed to wash trading. For context, Wash trading in NFTs inflates trading volume by buying and selling between controlled wallets, creating fake popularity, and misleading investors. It undermines the NFT market by distorting prices and reducing real liquidity.

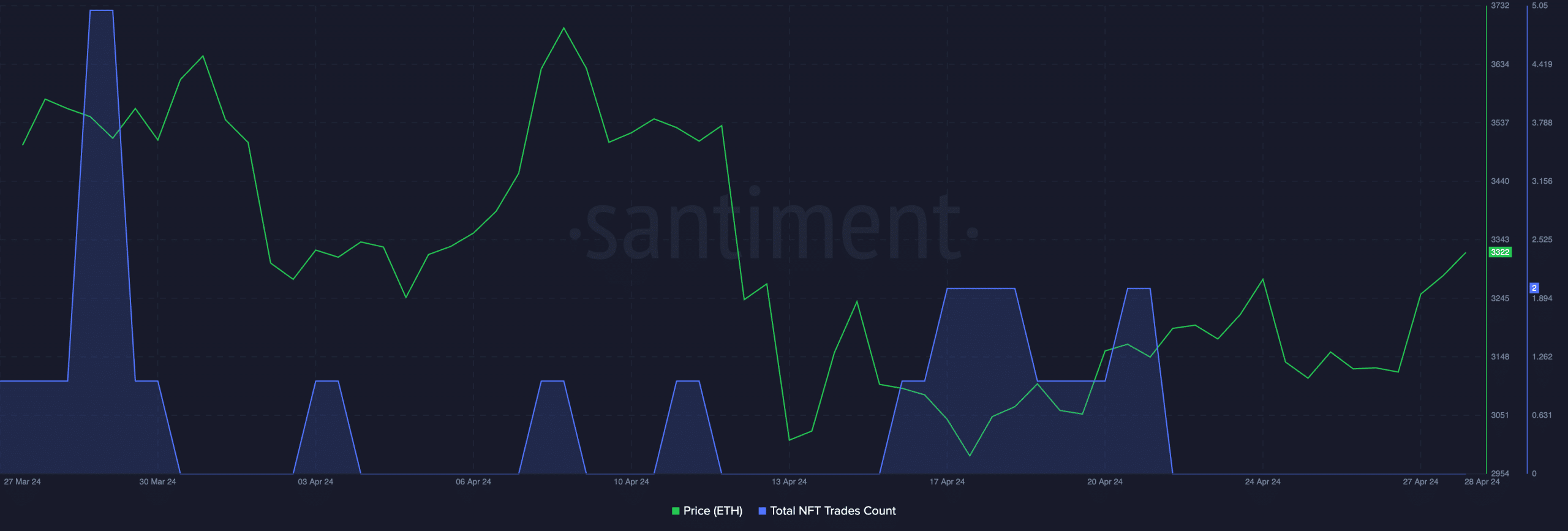

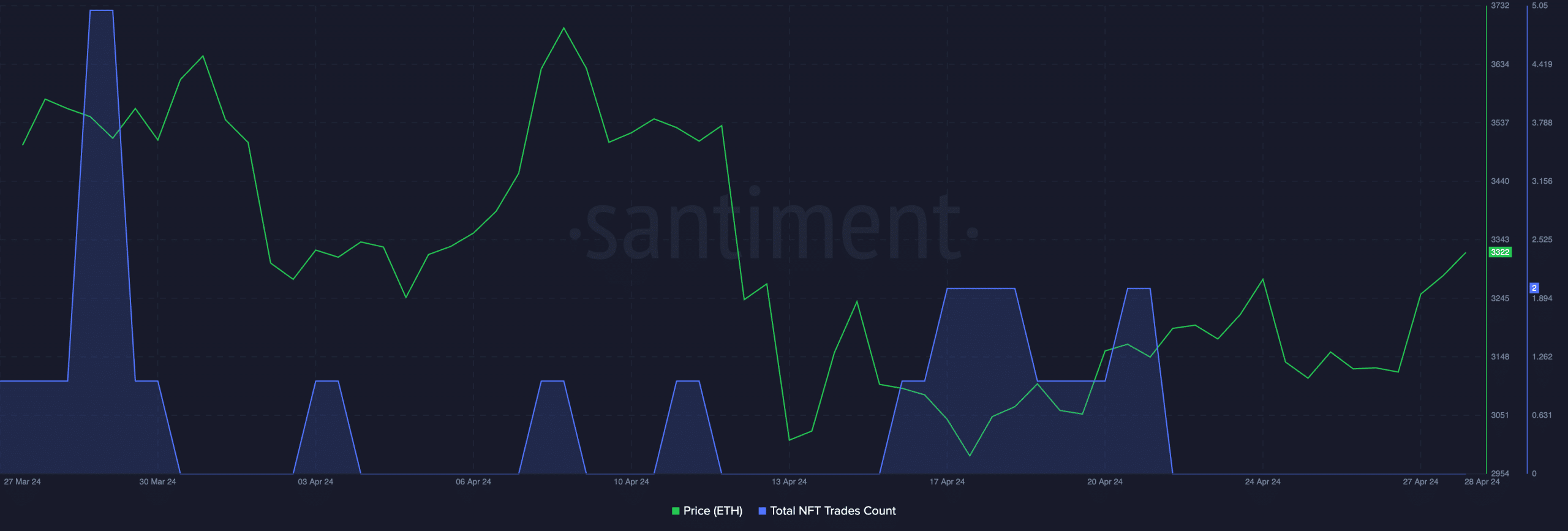

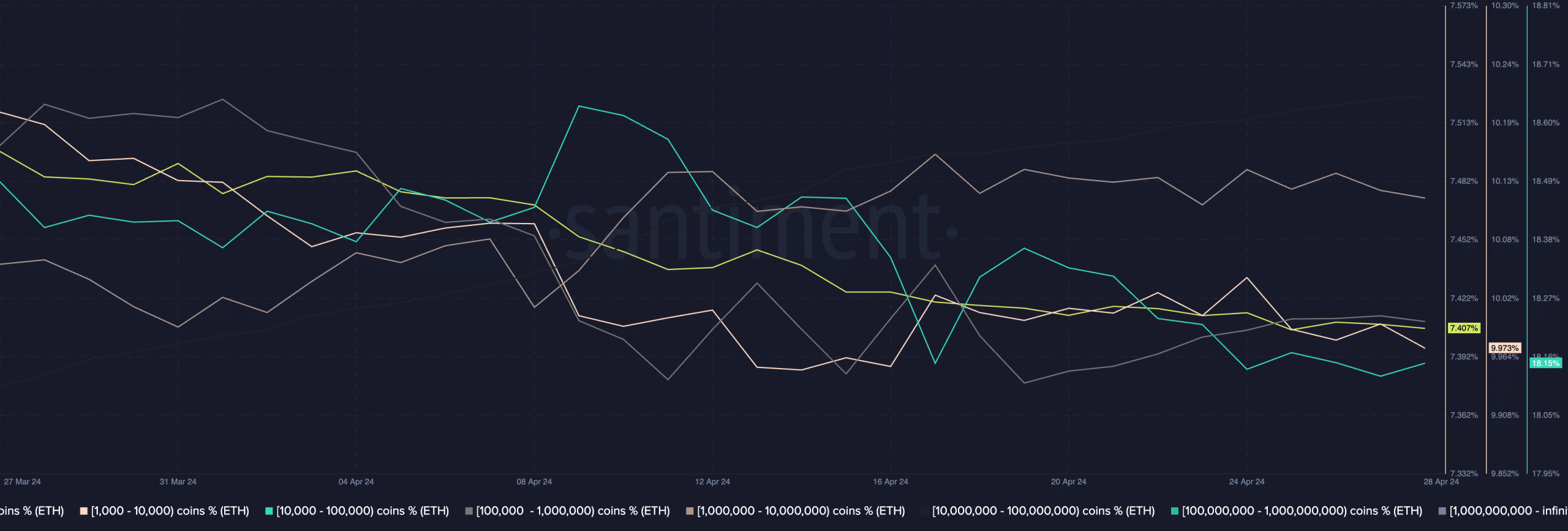

Even though a large part of Blast’s NFT volume can be due to wash trading, the declining interest in Ethereum NFTs does raise concerns about the state of the network. In fact, AMBCrypto’s analysis of Santiment’s data revealed that the number of NFTs being traded has fallen significantly.

Source: Santiment

Taking a deeper look

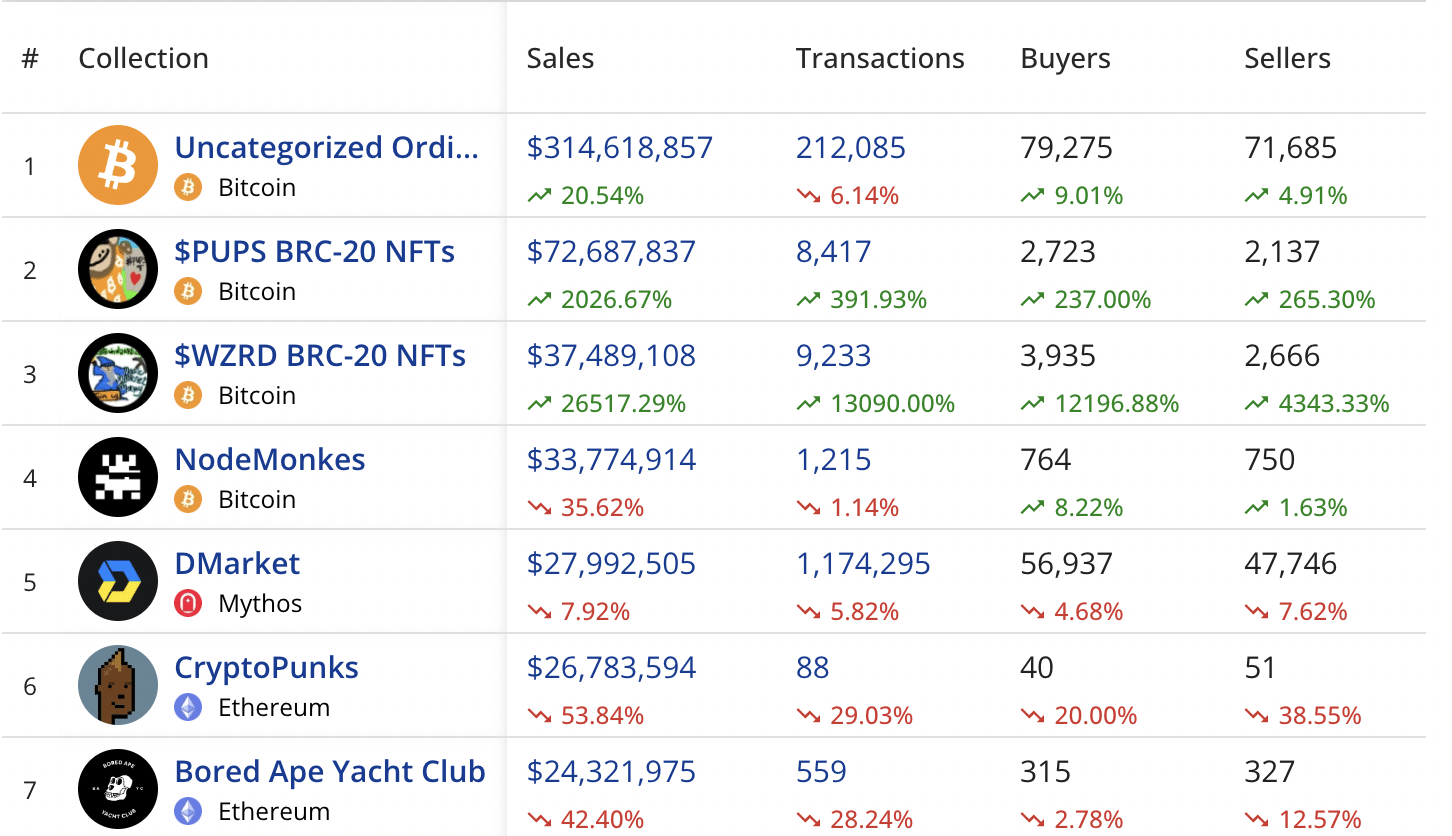

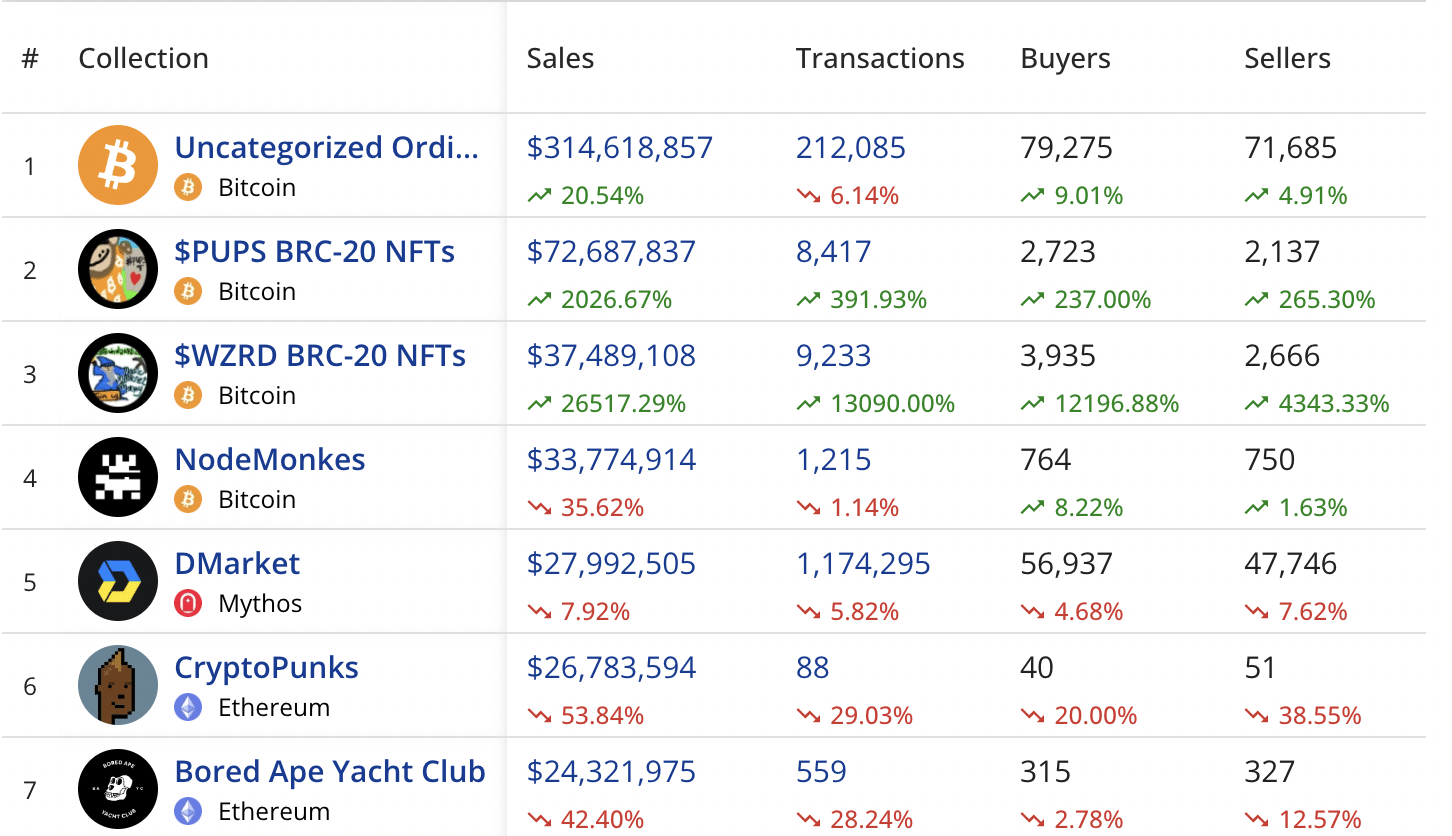

NFT collections on other networks such as Bitcoin and Mythos managed to outperform Ethereum NFTs. According to CryptoSlam’s data, popular Ethereum NFT collections such as BAYC and Crypto Punks were not able to get into the top 5 most sold NFTs over the last month. The number of Crypto Punk buyers fell by an alarming 20%, whereas the number of BAYC buyers fell by 2.78%.

If this trend continues, Ethereum may lose its top spot in the NFT sector soon.

Source: Crypto Slam

ETH holders bleed

As far as ETH’s price is concerned, at press time, it had climbed back above $3,000 on the back of Bitcoin’s recovery. Additionally, the network growth for ETH continued to rise as well.

Rising network growth is a sign that new addresses have been showing interest in ETH. Velocity climbed too, implying a surge in transaction activity on the Ethereum network.

Rising interest from new addresses and growing velocity could help ETH see green and push the altcoin to the levels it was trading at prior to the latest market correction.

Source: Santiment

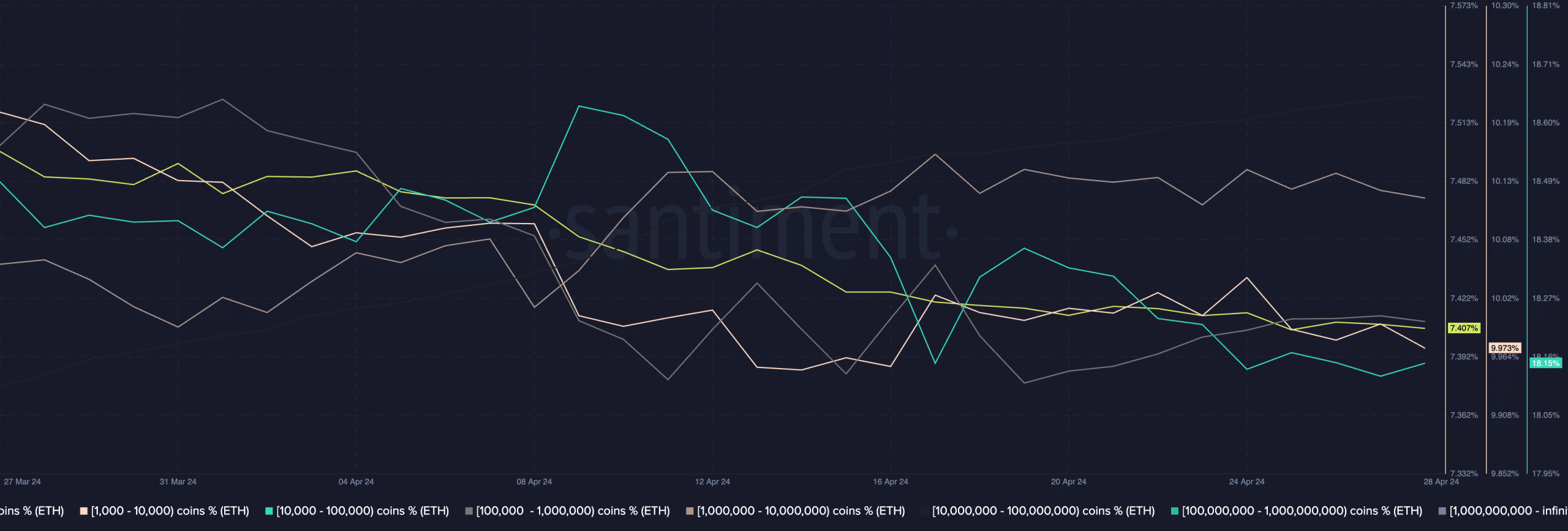

However, the size of the addresses showing interest in ETH will also play a key role in Ethereum’s future price movement.

For instance, addresses holding 100-10,000 ETH were declining at press time, according to Santiment’s data. Substantial purchases made by large addresses can play a huge role in ETH’s price trajectory in the future.

Is your portfolio green? Check out the ETH Profit Calculator

Source: Santiment