- The percentage of BTC supply in profit has declined by 15% since 5 March

- Coin’s Age Consumed and Network Realized Profit/Loss metrics refuted claims of a price bottom

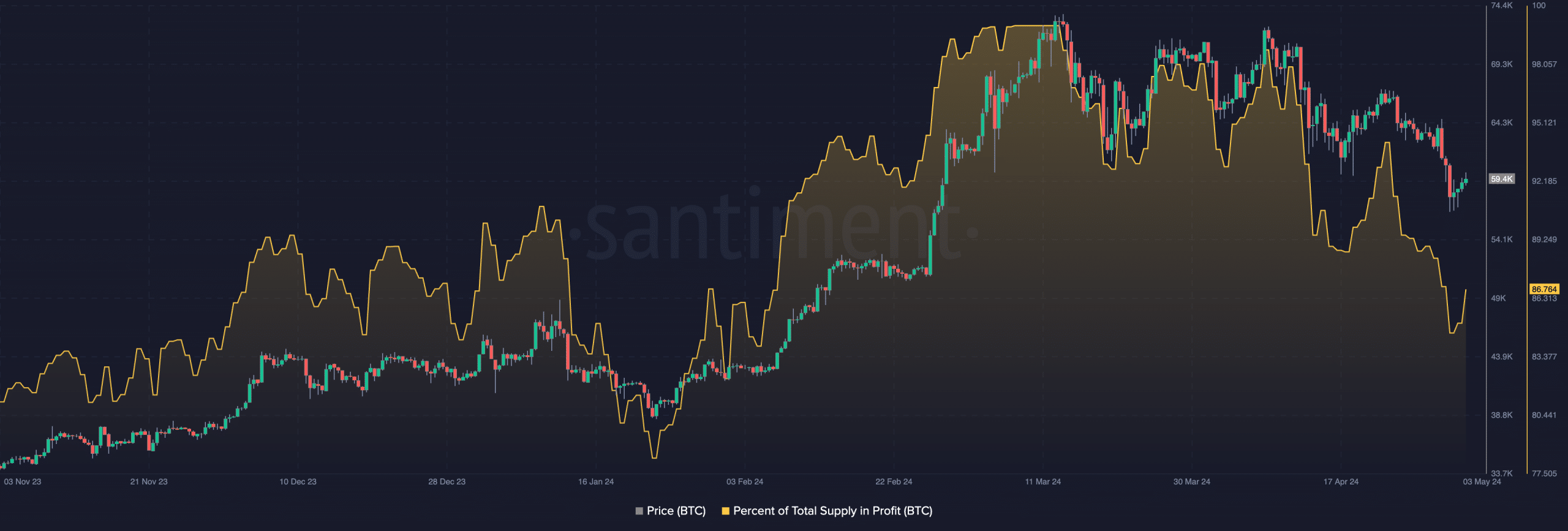

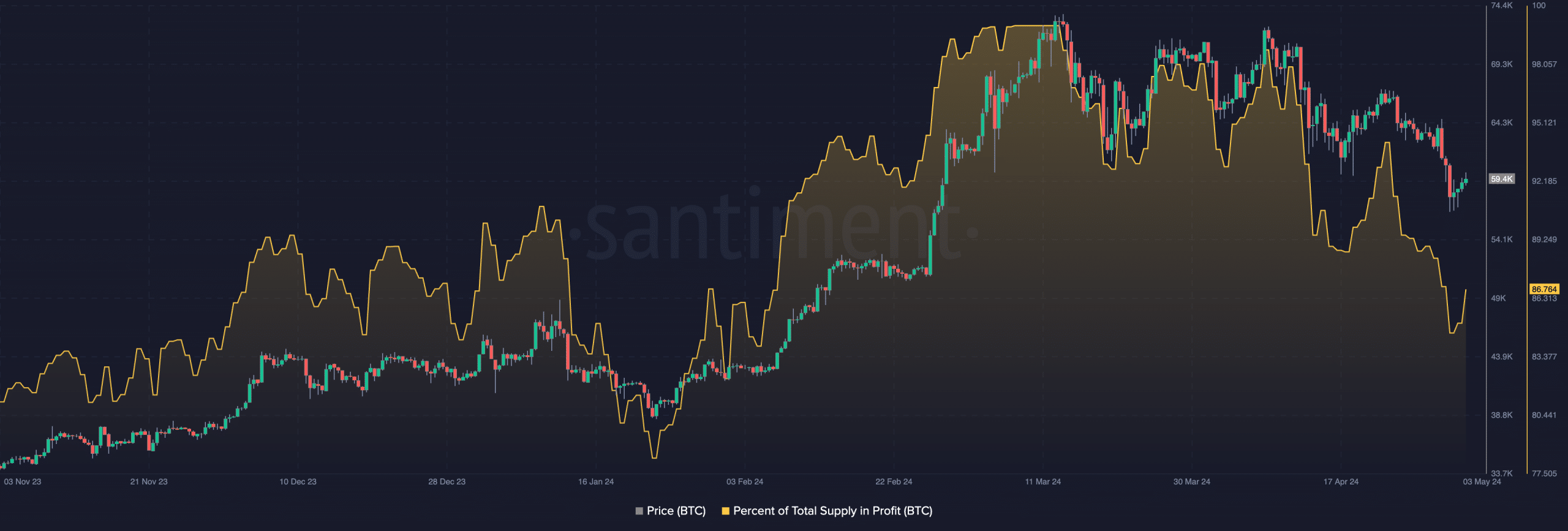

The percentage of Bitcoin [BTC] supply in profit has dropped to a two-month low of 84.4%, according to Santiment’s latest update on X (Formerly known as Twitter).

In fact, according to the on-chain data provider, figures for the same rallied to a year-to-date peak of 99.93% on 5 March. However, it has since fallen on the charts.

Source: Santiment

When this ratio declines in this manner, it means that an increasing portion of BTC investors hold their coins at a loss. This often happens when BTC’s price see a slight correction and short-term holders who bought relatively recently at higher prices panic and begin to sell their holdings.

In its post, Santiment assessed the metric’s historical performance and concluded that “lower levels generally justify more bullish conditions.”

This, because a low supply-in-profit ratio can be viewed as a contrarian indicator. When it falls, it indicates that weak/paper hands have been removed from the market, making way for new demand in the market. A declining supply-in-profit ratio could signal that an asset’s price is approaching its bottom, as there are fewer sellers left in the market.

Is the bottom in?

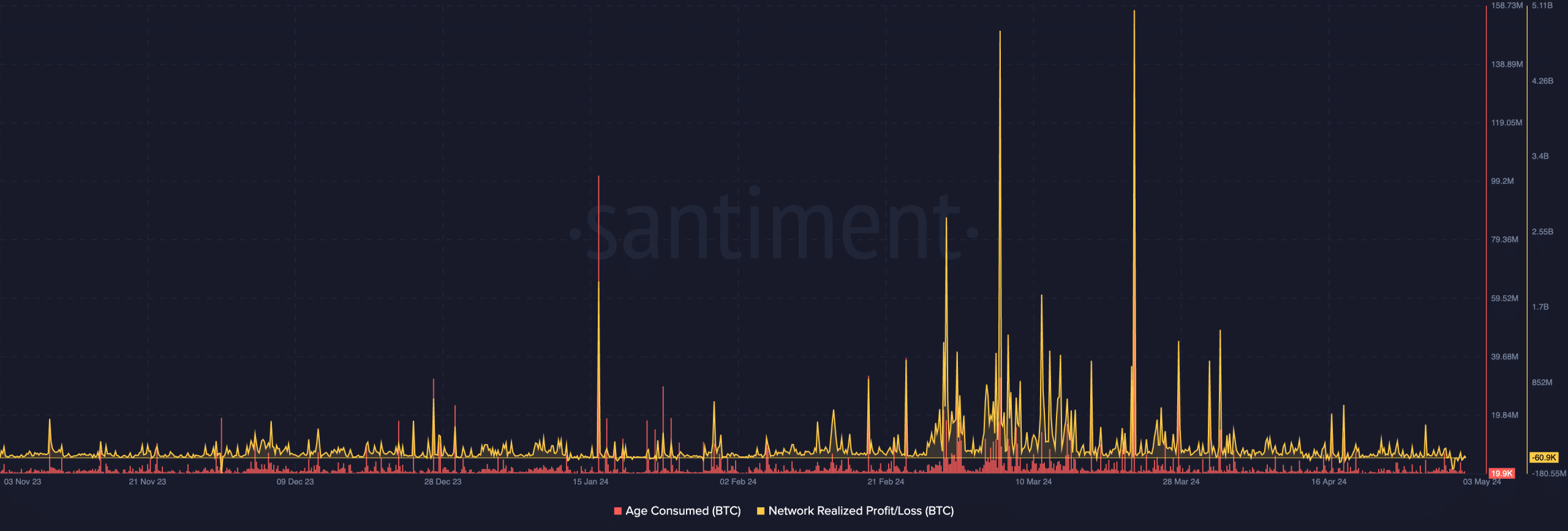

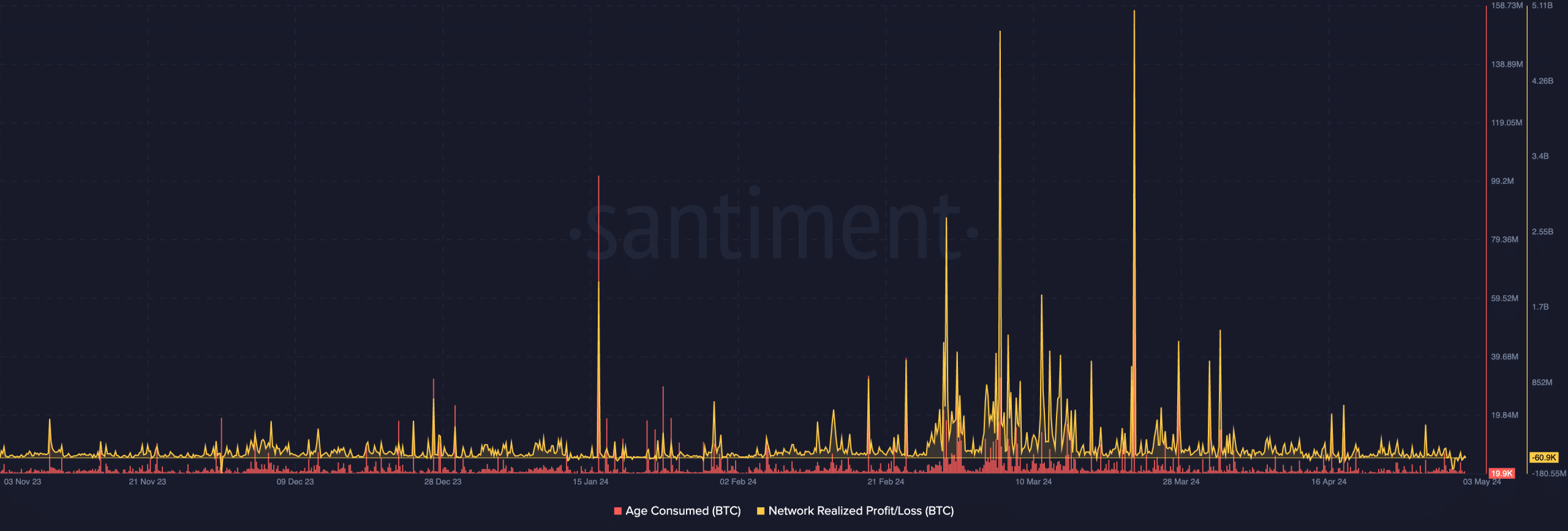

To assess whether BTC’s price has reached its bottom and if a rally is next, a key metric to consider is the coin’s Age Consumed. This metric tracks the movement of its long-held idle coins. This metric is deemed to be a good marker of assets’ local price tops and bottoms because long-term holders rarely move their dormant coins around. As such, when they do, it is noteworthy as it often results in major shifts in market trends.

When this metric rises, it signals that a significant number of previously held idle tokens have begun to change addresses.

Is your portfolio green? Check out the BTC Profit Calculator

Conversely, when it falls, it means that long-held coins remain in wallet addresses without being traded.

According to Santiment, BTC’s Age Consumed has been relatively flat since 3 April, suggesting that there has not been any significant movement of dormant coins, which could have marked a local bottom.

Another important metric to consider is BTC’s Network Realized Profit/Loss (NPL). It tracks the difference between the price at which coins were last moved on the blockchain and their current market price. Historically, NPL declines are a marker for when an asset has reached a local bottom. This, because when these dips happen, they signal the short-term capitulation of ‘weak hands’ and the re-entry of new money into the market.

As per the same, there is no indication that a price bottom has been reached on the charts yet.

Source: Santiment