After a 71-day streak of continuous inflows, BlackRock’s Bitcoin ETF, IBIT, has experienced a sudden stop with no new inflows. This sudden halt has raised concerns among investors, especially as Bitcoin consolidates around the $64,000 level. Many analysts view this as a bearish indicator for Bitcoin’s price, suggesting that the cessation of inflows from a leading Bitcoin ETF issuer could plunge buying demand. This decline in demand may make it challenging for Bitcoin to hold its recovery rally following the recent halving event.

Blackrock ETF Sees No Buying Demand

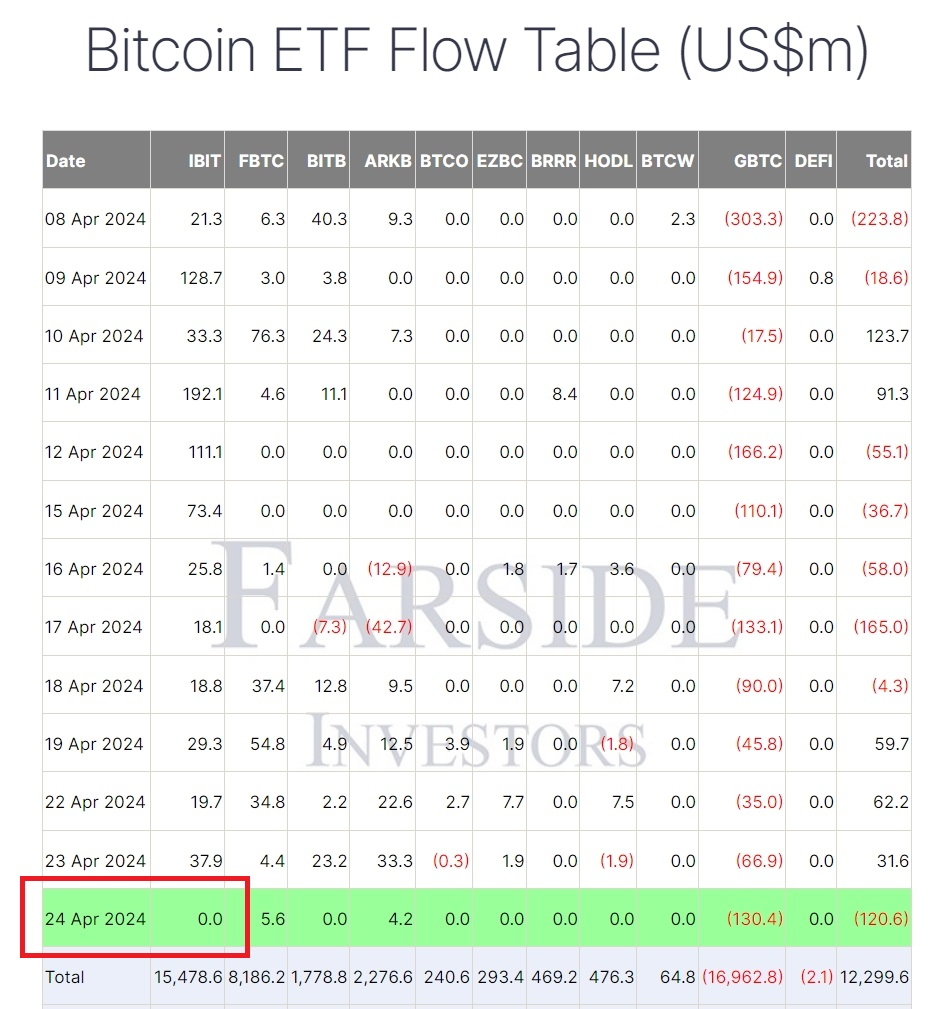

BlackRock’s spot Bitcoin ETF had maintained a remarkable streak of net inflows since its launch on January 11th. However, according to data from Farside Investors, this streak of 71 consecutive trading days with net inflows has now come to an end.

On Wednesday, the iShares Bitcoin Trust (IBIT) recorded zero net flows, breaking a record for a newly launched ETF. While IBIT’s performance was historic for a newly established fund, Bloomberg Intelligence analyst Eric Balchunas noted that other ETFs had longer streaks after establishing themselves over months and years in the market.

IBIT’s streak of inflows reached 71 days on Tuesday, making it the 10th longest streak of all time, as reported in an X post by Balchunas. However, according to data from Farside Investors, net inflows into IBIT came to a halt on Wednesday. On 25 April, IBIT again witnessed zero inflow volume, according to data from The Block.

On the same day, only the Fidelity Wise Origin Bitcoin Fund (FBTC) and the Ark 21Shares Bitcoin ETF (ARKB) experienced minor inflows, whereas the Grayscale Bitcoin Trust ETF (GBTC) recorded net outflows amounting to $130 million.

The conclusion of IBIT’s streak follows two consecutive weeks of net outflows for the 11-fund segment. However, its recent zero inflow volume might not have a big impact on Bitcoin as the sentiment is supported by several other bullish metrics including the recent halving.

Inflow Volume Might Rebound In The Coming Weeks

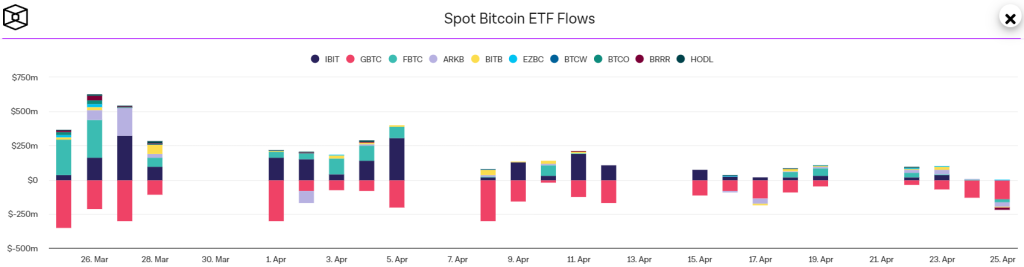

The flow of funds into US spot Bitcoin ETFs has experienced a significant decline in the second quarter. During the first quarter, the peak inflows were observed in February, totaling $6 billion, followed by March with $4.6 billion. January saw $1.5 billion as the market acquainted itself with the new products.

However, ETF inflows for April in Q2 only amounted to $170 million. This raises the question: is the demand for BTC ETFs declining?

Bitwise CIO Matt Hougan disagrees. In a weekly memo addressed to investment professionals, Hougan asserted that the potential for additional inflows remains high in the coming months.

Yesterday marked the first time since its inception that FBTC experienced outflows, amounting to $22.6 million. Concurrently, other funds such as Ark Invest’s ARKB, Bitwise’s BITB, and Valkyrie’s BRRR also saw outflows of $31.3 million, $6 million, and $20.2 million, respectively.

Furthermore, Grayscale’s GBTC, which has been on a 73-day streak of outflows since its conversion from a Bitcoin Trust, witnessed withdrawals totaling $139.4 million. The sole ETF to see inflows was managed by asset manager Franklin Templeton, receiving investments of $1.9 million.