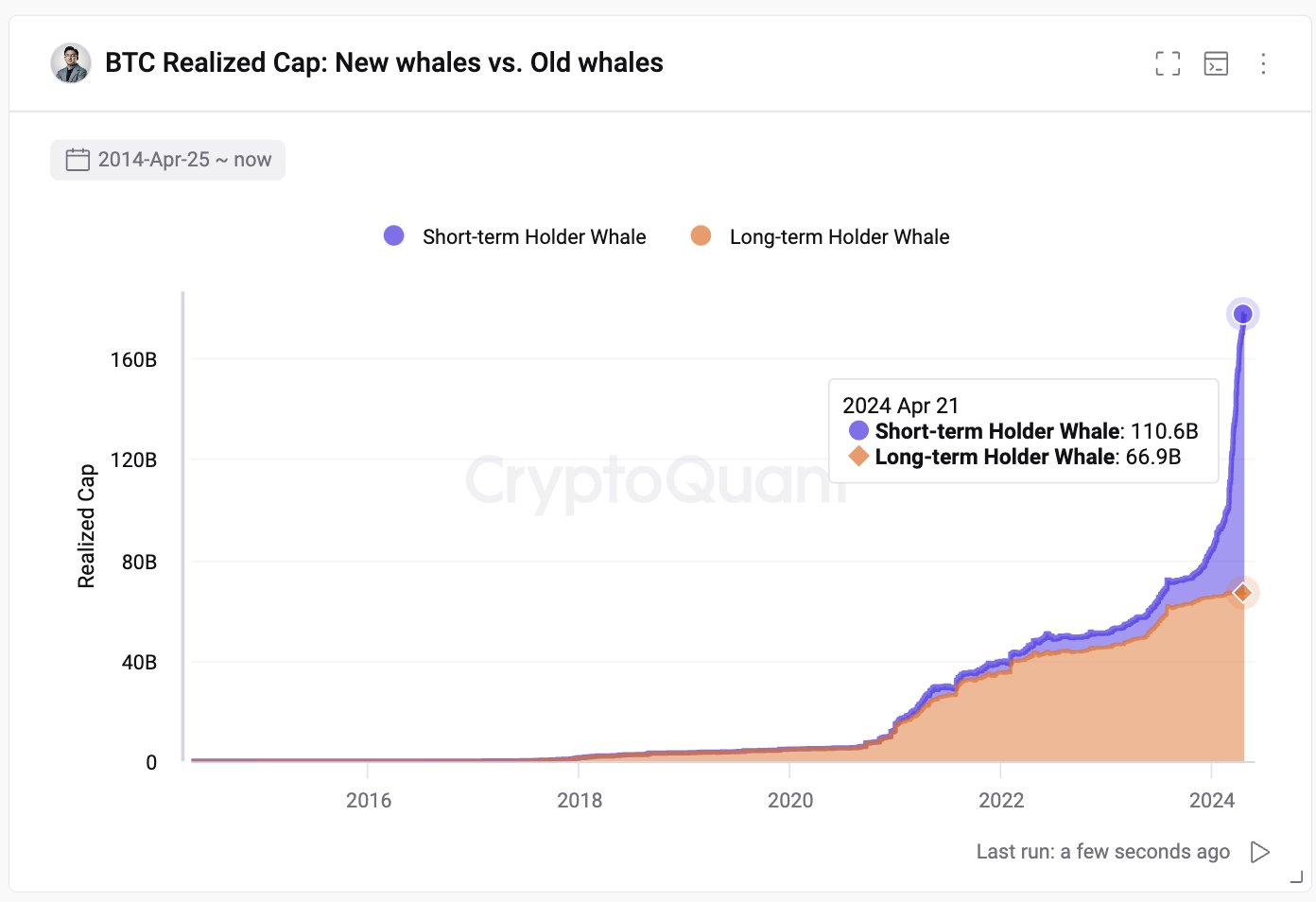

New crypto whales are buying up Bitcoin (BTC) at a faster rate than longer-term holders, according to the chief executive of the blockchain analytics platform CryptoQuant.

Ki Young Ju tells his 343,900 followers on the social media platform X that the new whales’ initial investment in Bitcoin is almost twice the old whales’ cumulative total.

The analytics platform executive defines “new,” short-term holder whales as addresses with at least 1,000 Bitcoin with an average coin age of less than 155 days. “Old,” long-term holder whales hold at least 1,000 Bitcoin with an average coin age of 155 days or more. Young Ju excludes miner and centralized exchange addresses for both.

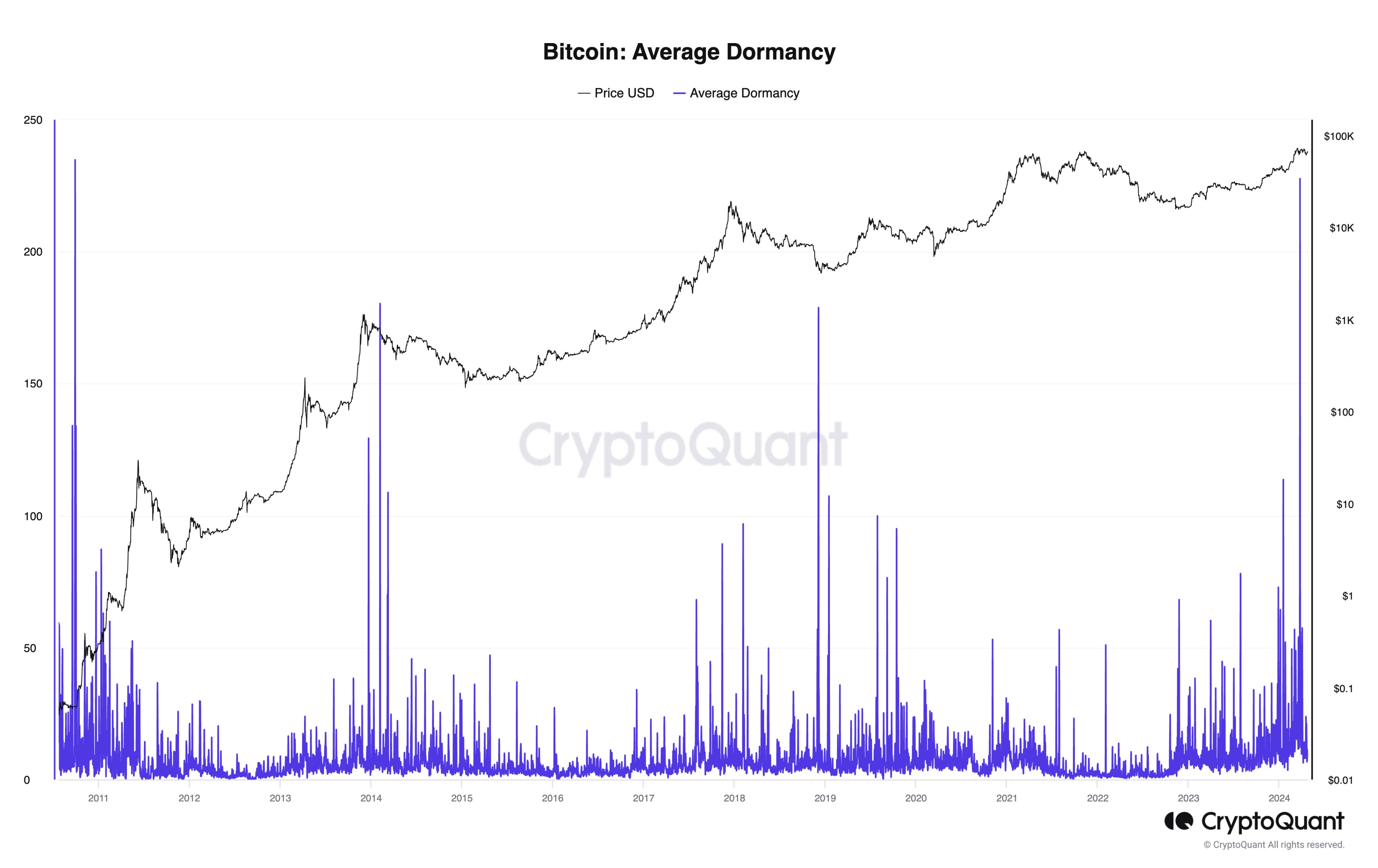

The CryptoQuant CEO also notes that BTC’s average dormancy recently hit a 13-year peak, which he says indicates a transfer of old Bitcoins to new holders.

“The cap table for Bitcoin is shifting, potentially altering the ownership landscape. Who are the new major shareholders?”

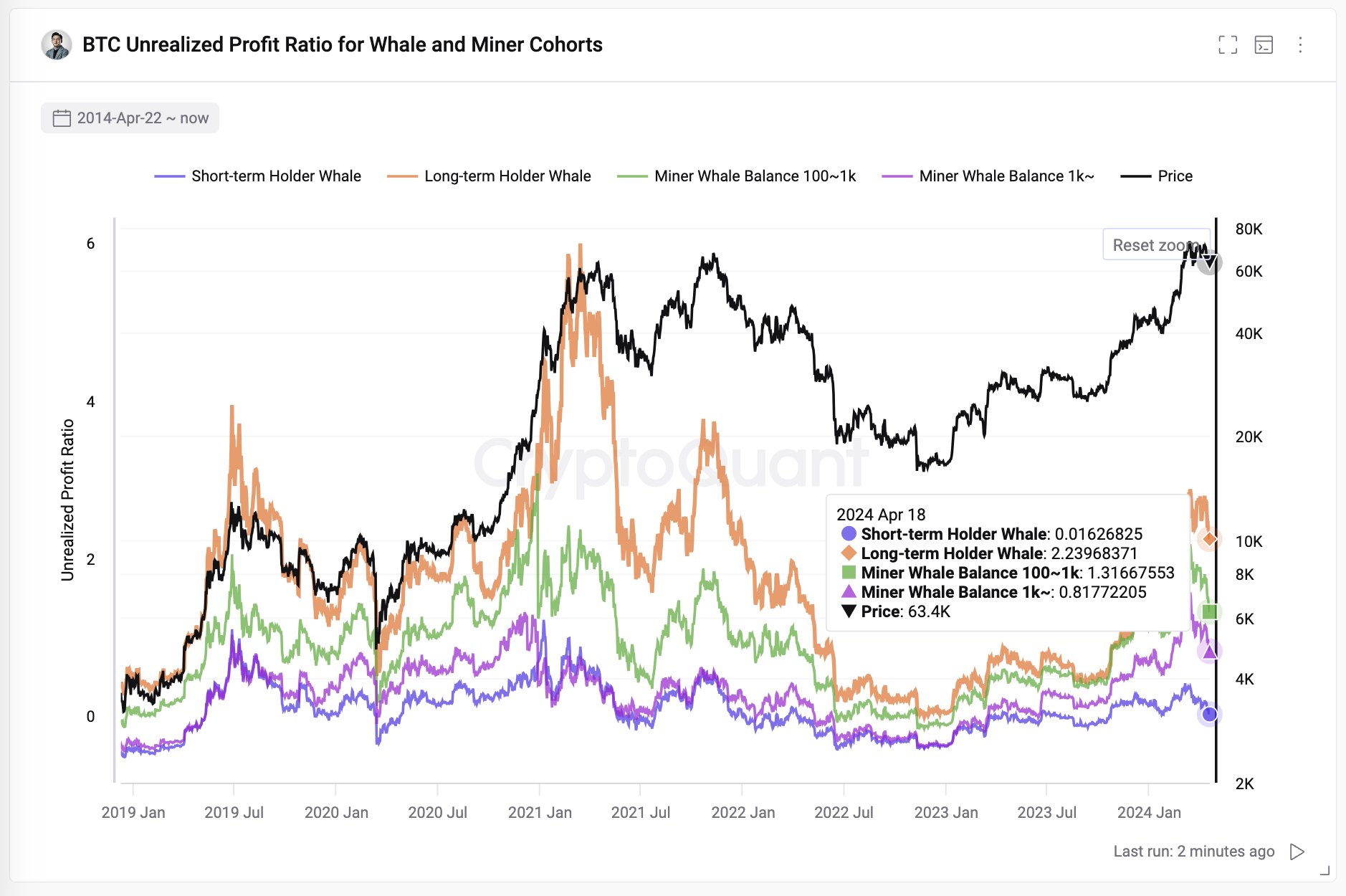

Young Ju also analyzes unrealized BTC profit in the current market cycle.

“Bitcoin Unrealized Profits for On-Chain Cohorts:

- Old whales: +223%

- New whales (TradFi/ETFs [exchange-traded funds]): +1.6%

- Small miners: +131%

- Big miners (Mining companies): +81%

Not enough profit to end this cycle, in my opinion.”

Bitcoin is trading at $64,222 at time of writing. The top-ranked crypto asset by market cap is down more than 3% in the past 24 hours but up more than 5% in the past seven days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Hoika Mikhail