- Analysts see $60K as the 2024 cycle’s correction bottom.

- However, price consolidation could extend for longer.

Last week was arguably the worst for markets, especially risk-on assets like Bitcoin [BTC]. US equities closed the week in red.

Similarly, BTC extended weekly losses in April, hitting a low of $59.6K amidst halving, US tax season, and Middle East tensions.

BTC has since improved and was above $66K, ready to reverse recent losses. Additionally, the halving and US tax season are out of focus. Middle East tensions also eased slightly.

This begs the question: Is the Bitcoin halving sell-off over? Some market watchers think so.

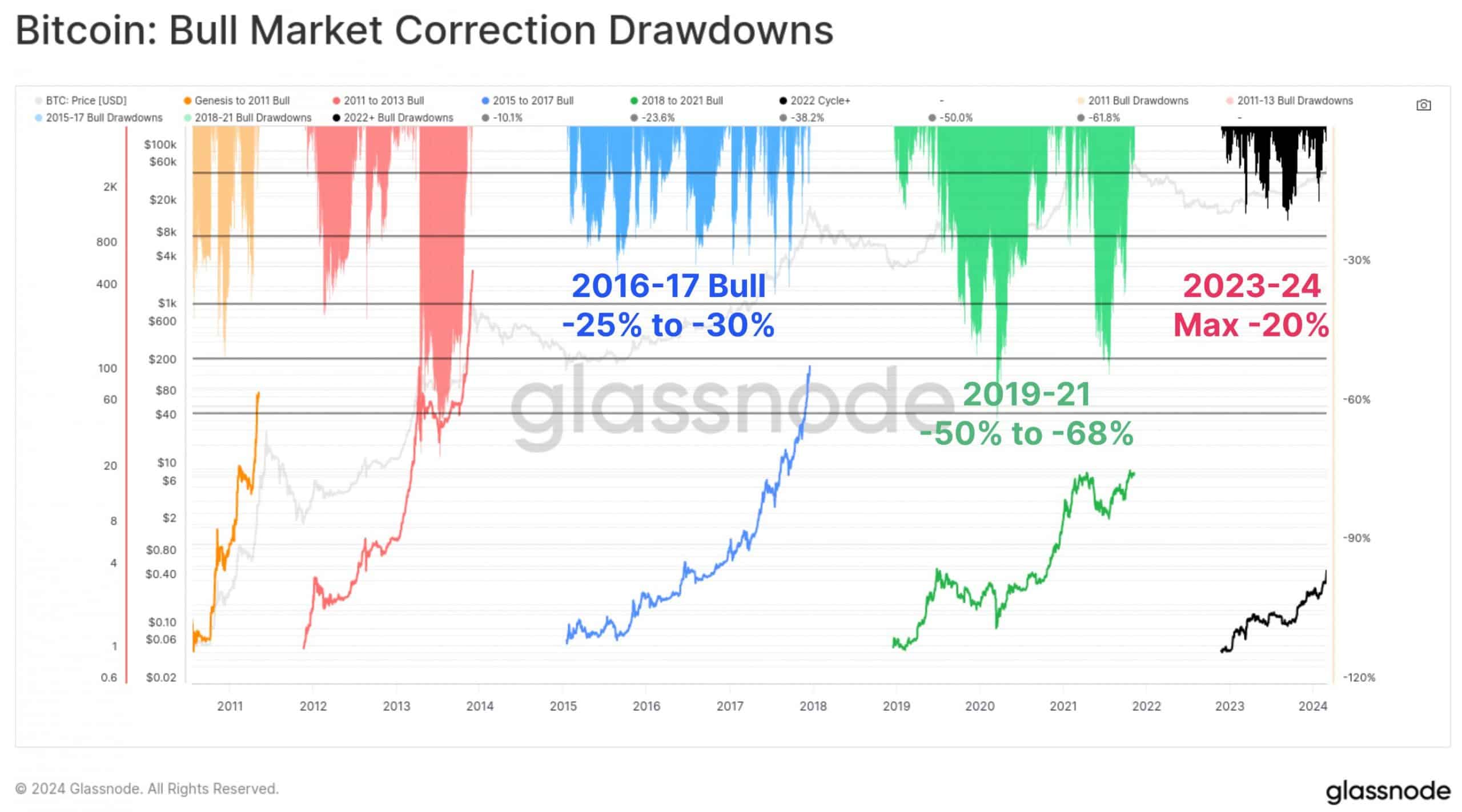

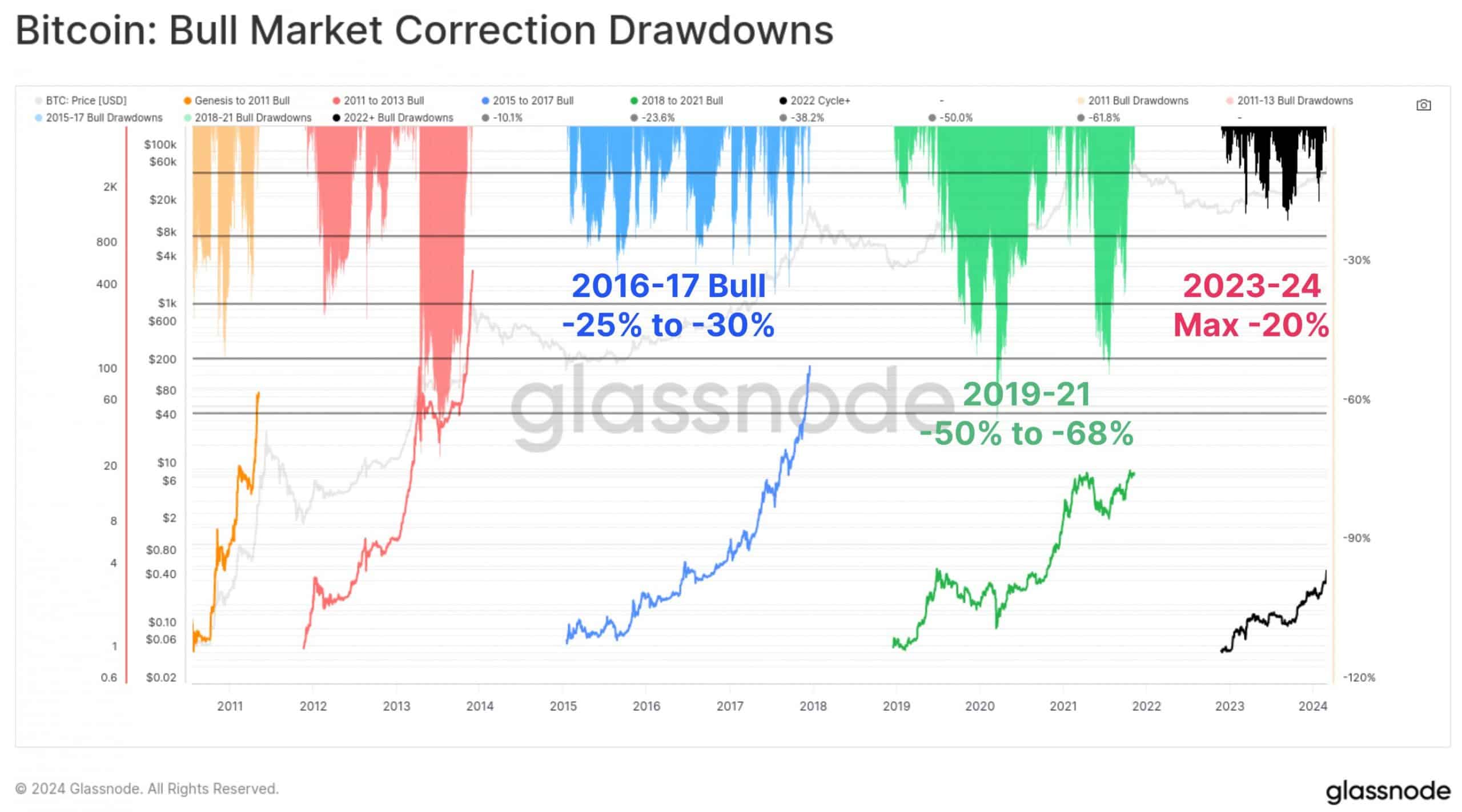

Renowned crypto analyst Tuur Demeester recently stated that $60K could be the bottom of the current correction and fits Glassnode’s current bull pattern.

“Bitcoin: I think it’s likely that $60K ends up being the bottom of this correction. 20% drawdown from the high.”

Source: X/Santiment

What next for BTC price post-halving?

Another pseudonymous crypto analyst, McKenna, echoed Demeester’s correction bottom at $60K. According to McKenna, BTC halving sell-offs could be over, and an extended sideways movement was likely.

“I think there is a high probability that the bottom for the halving selloff is in, but simultaneously, I think there is an equal high probability that we are forming a re-accumulation range. Meaning expect sideways price action for longer than expected.”

McKenna claimed that BTC’s possible sideways movement could rally stronger altcoins. But an AMBCrypto report recently found that the market wasn’t yet ripe for an altcoin season.

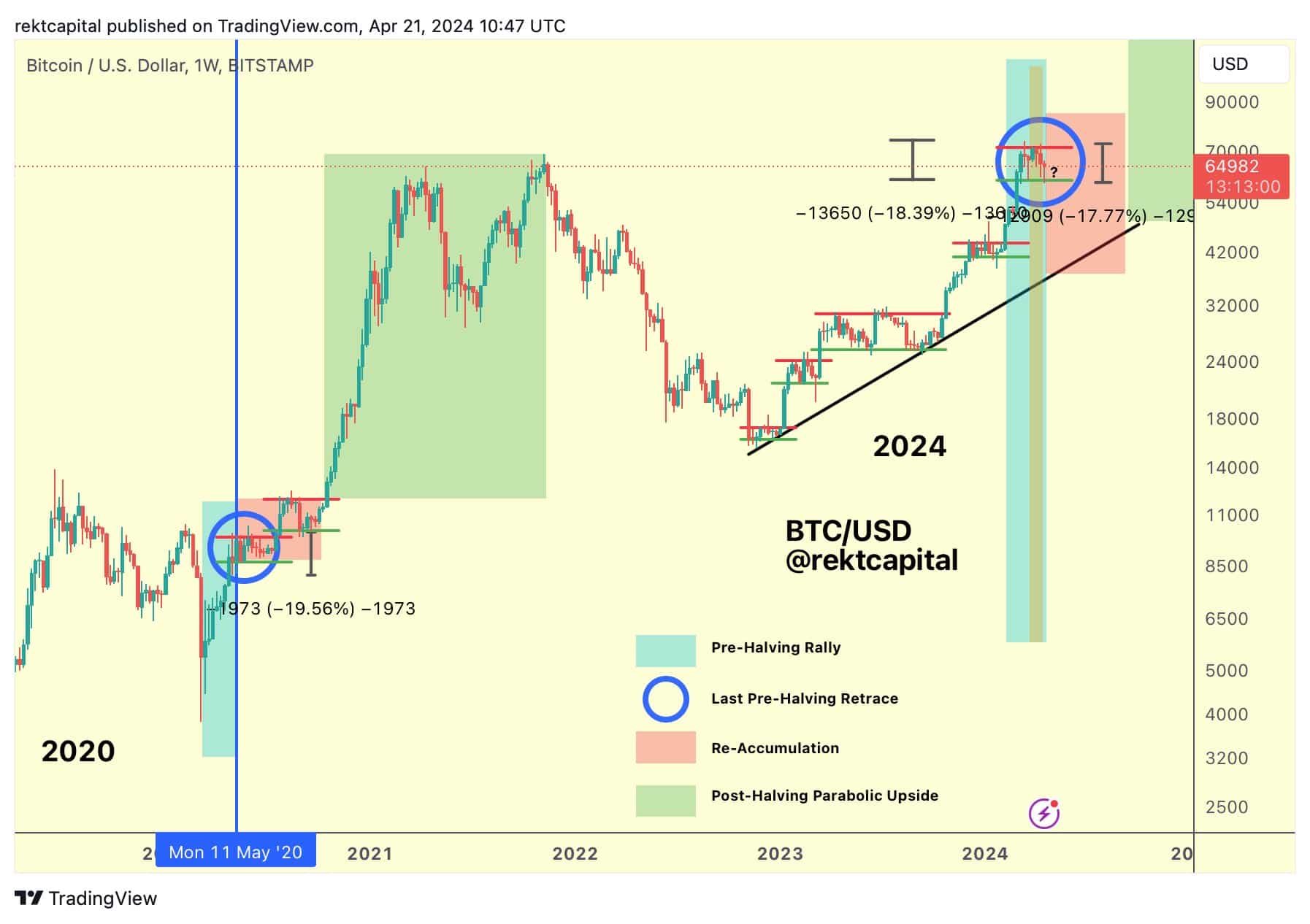

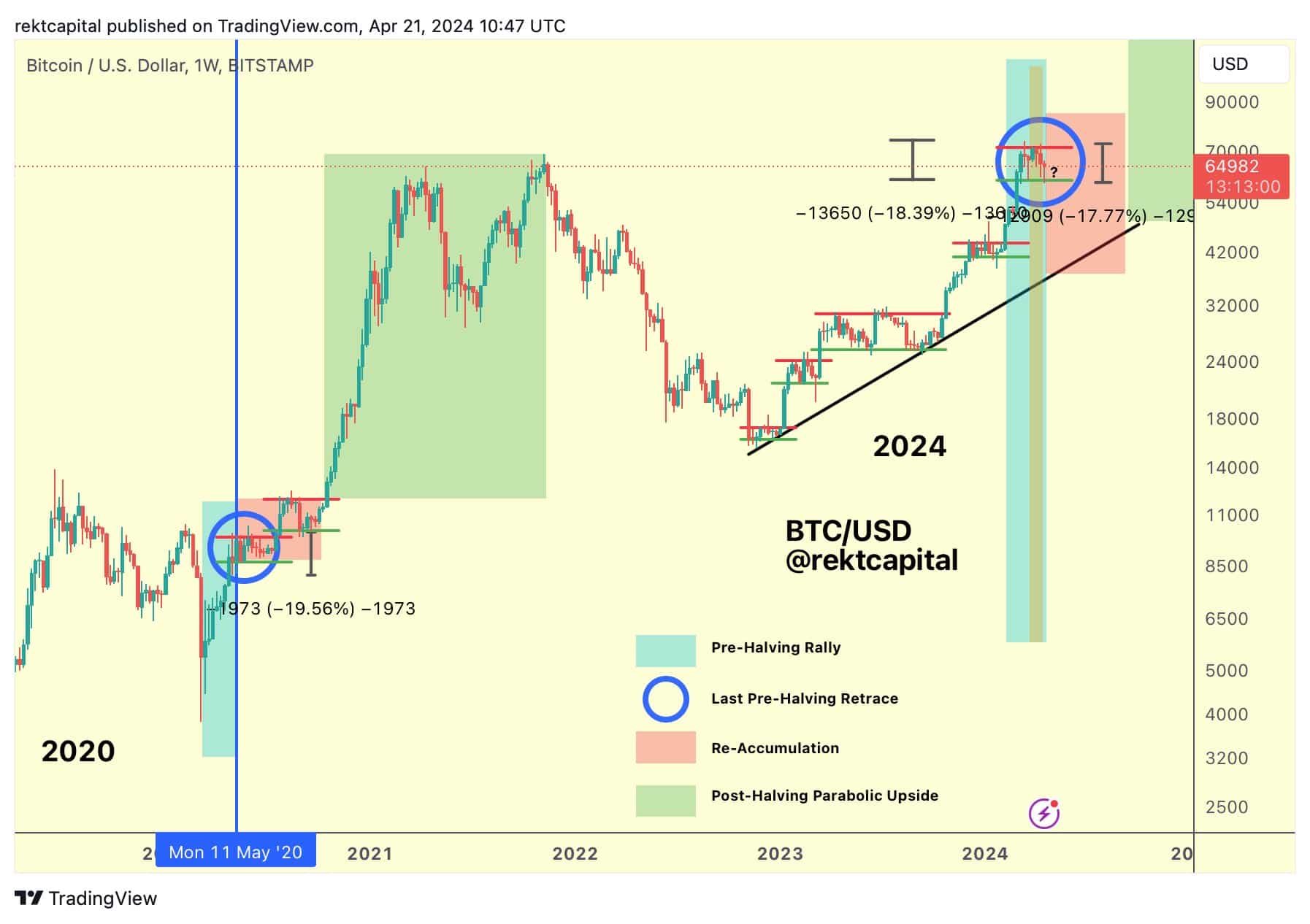

On his part, Rekt Capital, a renowned trader and market cycle analyst, opined that current prices could be the best bargain for BTC if we’re in the re-accumulation phase.

“What if Bitcoin has already revealed the top and bottom of its Post-Halving Re-Accumulation Range? Then the prices within this range would be the best we will be able to get before Bitcoin is finally ready Post-Halving Parabolic Upside.”

Source: X/Rekt Capital

Some market watchers expect better conditions starting in May.

In an early April statement, BitMEX founder Arthur Hayes projected market conditions could improve in May after US tax season and BTC halving. Part of his statement read,

“The timing of the halving adds further weight to my decision to abstain from trading until May.”

If the sideway movement extends and market conditions improve in May, the current range of $60K and $71K could be crucial watch levels going forward.