- Despite bullish signals, the CVD showed that DOGE’s price might not hit $0.20 soon.

- Traders are convinced that the coin will be profitable in the long term.

Dogecoin’s [DOGE] price climbed by 6.21% in the last 24 hours after an earlier decline to $0.14. But analyst Ali Martinez posted that this could just be the start of an uptrend that could last four days.

According to Martinez, the Tom DeMark (TD) Sequential on the daily chart showed a buy signal. The TD Sequential is a technical used to identify trend exhaustion and potential reversal.

From the chart the analyst shared, sellers got exhausted after DOGE hit $0.14. Hence, an uptick was supposed to be the next step.

Source: X

DOGE Day came with good tidings

Apart from the technical perspective, AMBCrypto identified “DOGE Day” on the 20th of April as another reason the price of the coin jumped.

Previously, we reported how Dogecoin could experience a price increase in the lead-up to the day.

Interestingly, it seemed that the day that the project’s community designed to celebrate proved to be a “buy the rumor” event for the price.

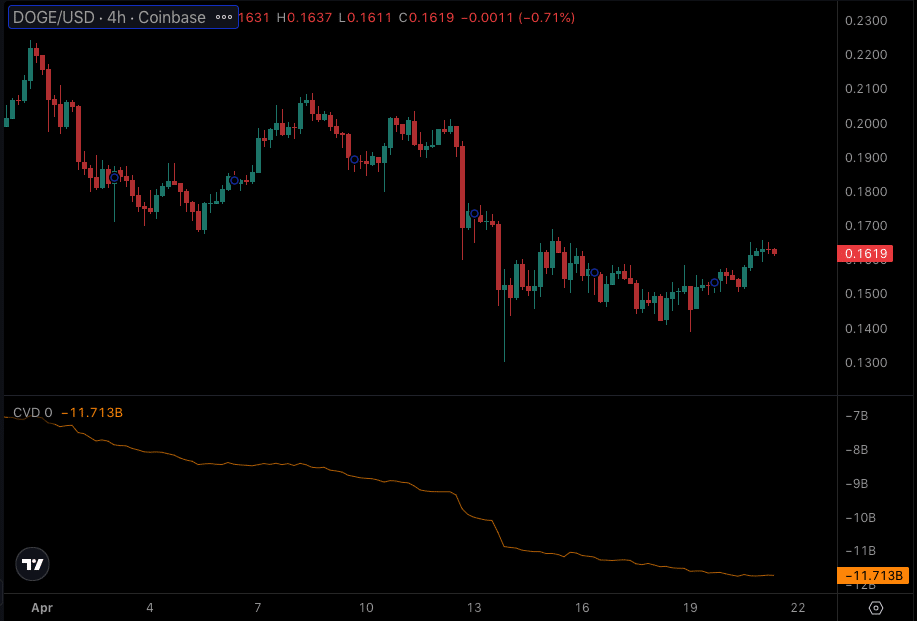

But will a “sell the news” effect come after? According to data from Coinalyze, the Cumulative Volume Delta (CVD) was down to negative territory.

This trend implied that sellers were likely to meet the bid and pay the current market price for the coin. If this continues, then DOGE might not be able to surpass $0.20 in the short term.

Source: Coinalyze

On the other hand, if the CVD rises, buyers might trade in the offer while sellers might be sidelined. In this instance, the value of the coin might continue to rise for the rest of the week.

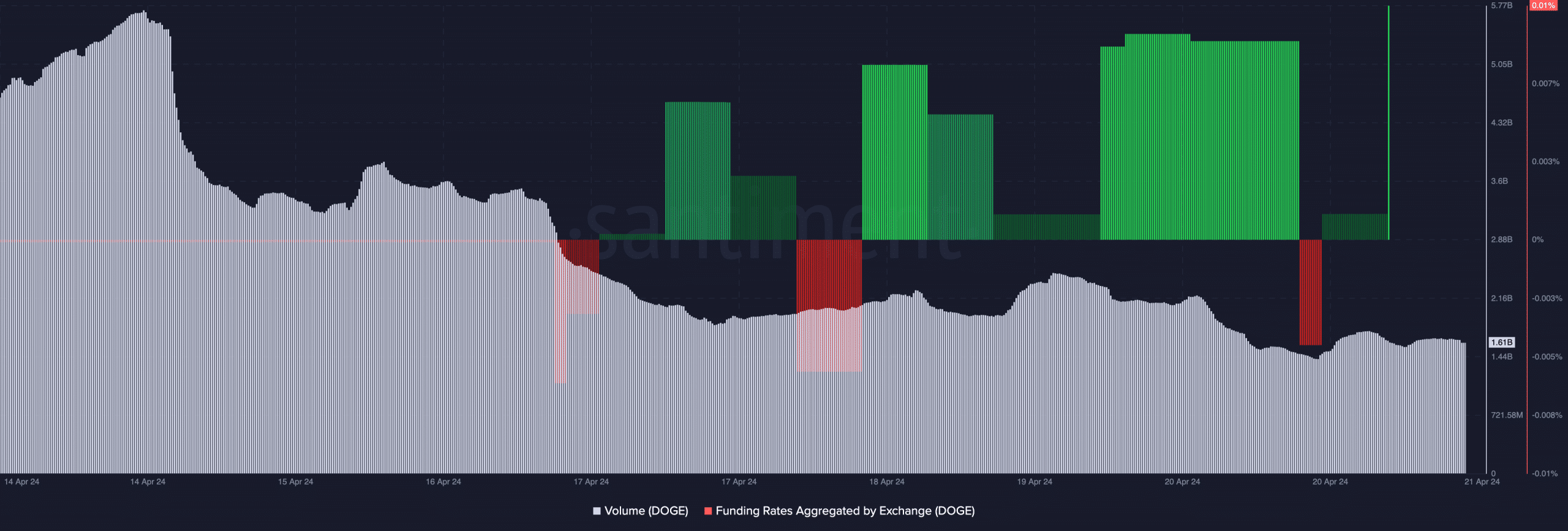

Furthermore, AMBCrypto considered the price prediction from an on-chain angle. One of the metrics we looked at first was the volume.

The price may slow down

As of this writing, Dogecoin’s increased slightly within the same period its price climbed. However, it seemed that the rising volume might not be enough to back a breakout.

Hence, DOGE’s price might stall at some point before the new week ends. But in a case where the trading volume rises significantly alongside the price, the bullish thesis might be invalidated.

In addition, Dogecoin’s aggregated Funding Spiked to 0.01%. Positive funding means long-positioned traders are paying shorts a fee to keep their positions open.

Source: Santiment

This indicates a bullish sentiment. However, Funding Rate could give an insight into the possible movement of the price.

For DOGE, the high positive funding with the price increase, suggests that perp longs are aggressive.

Is your portfolio green? Check the DOGE Profit Calculator

Interestingly, these traders are being rewarded for their position. In the short term, this is bullish for DOGE. However, if funding becomes lower, the bullish forecast might be invalidated.

But for now, DOGE seemed ready to rise higher than $0.16.