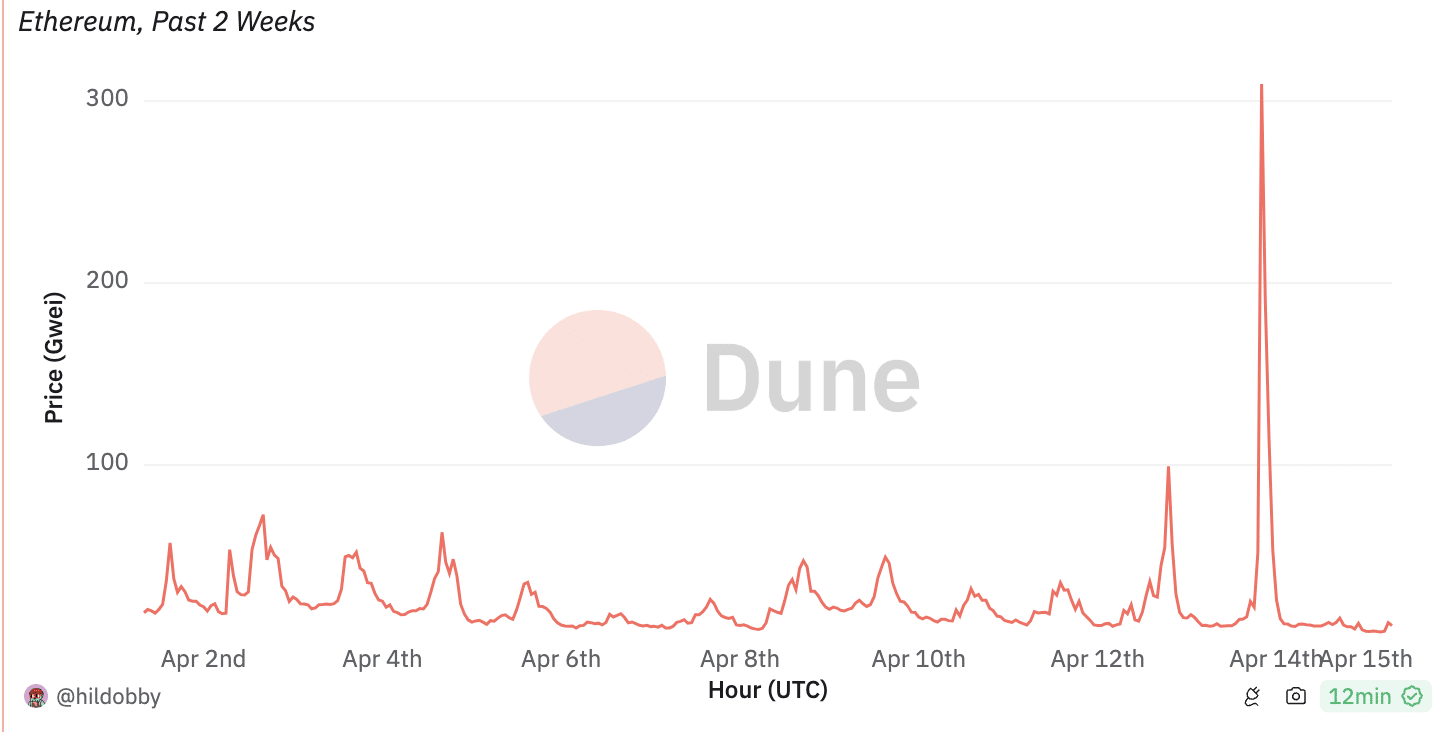

- Ethereum gas usage declined along with overall activity.

- Whales show interest in ETH as prices surge.

Ethereum [ETH] has been having a tough time over the last week as its price has declined significantly. However, it wasn’t just prices that were impacted during this period.

Activity on Ethereum declines

Ethereum’s median gas plummeted to as low as 12.5 gwei, marking the lowest level witnessed this year. At press time, the network’s Gas stood at 8 gwei, as reported by Dune Analytics.

This happened as more users started preferring blockchains like Solana [SOL] and Base.

While lower gas fees might initially seem beneficial for users, it could signify reduced demand for transactions on the blockchain.

This decline in activity could potentially indicate a slowdown in user engagement or dApp usage, which could have negative implications for Ethereum’s ecosystem.

Source: Dune Analytics

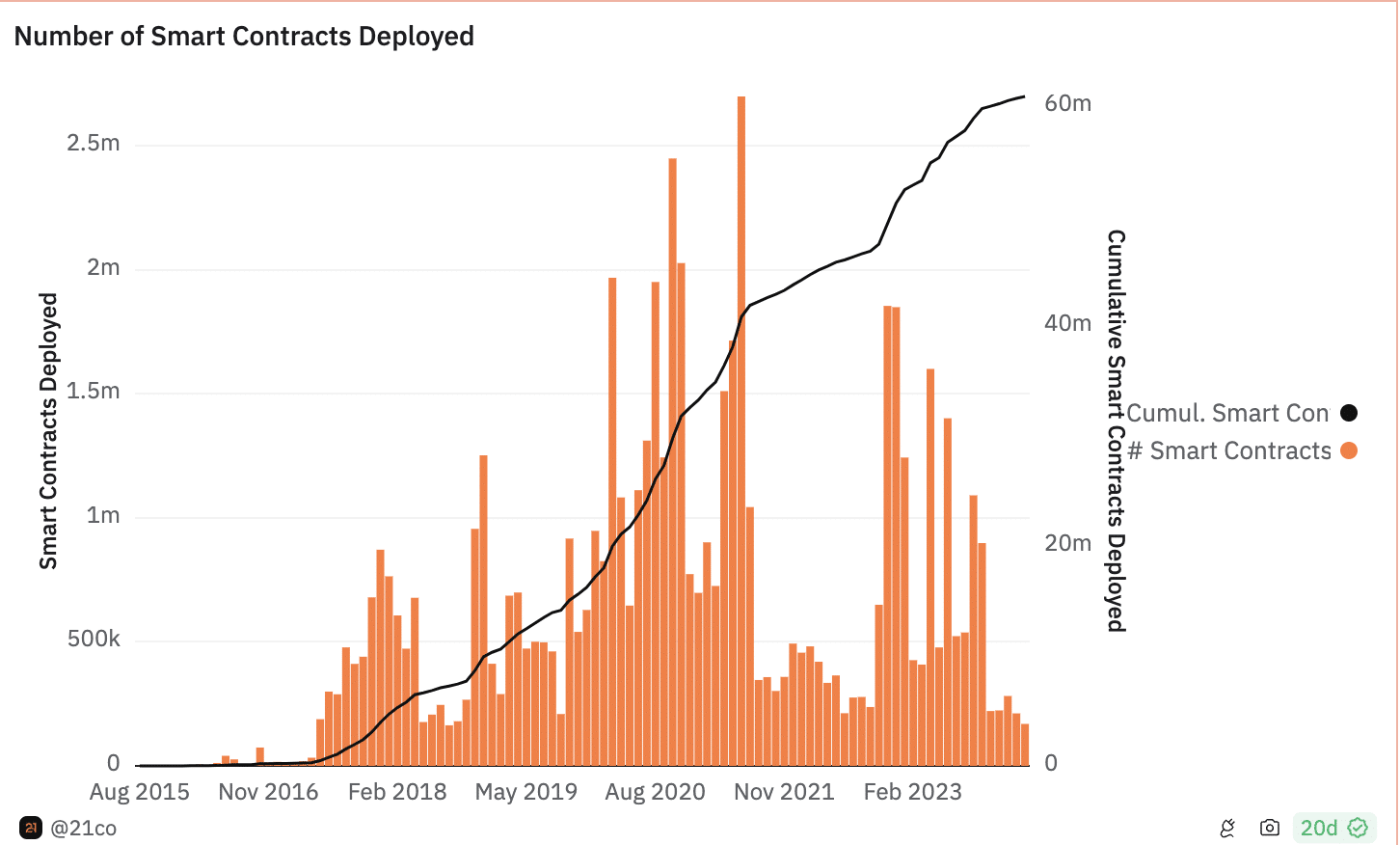

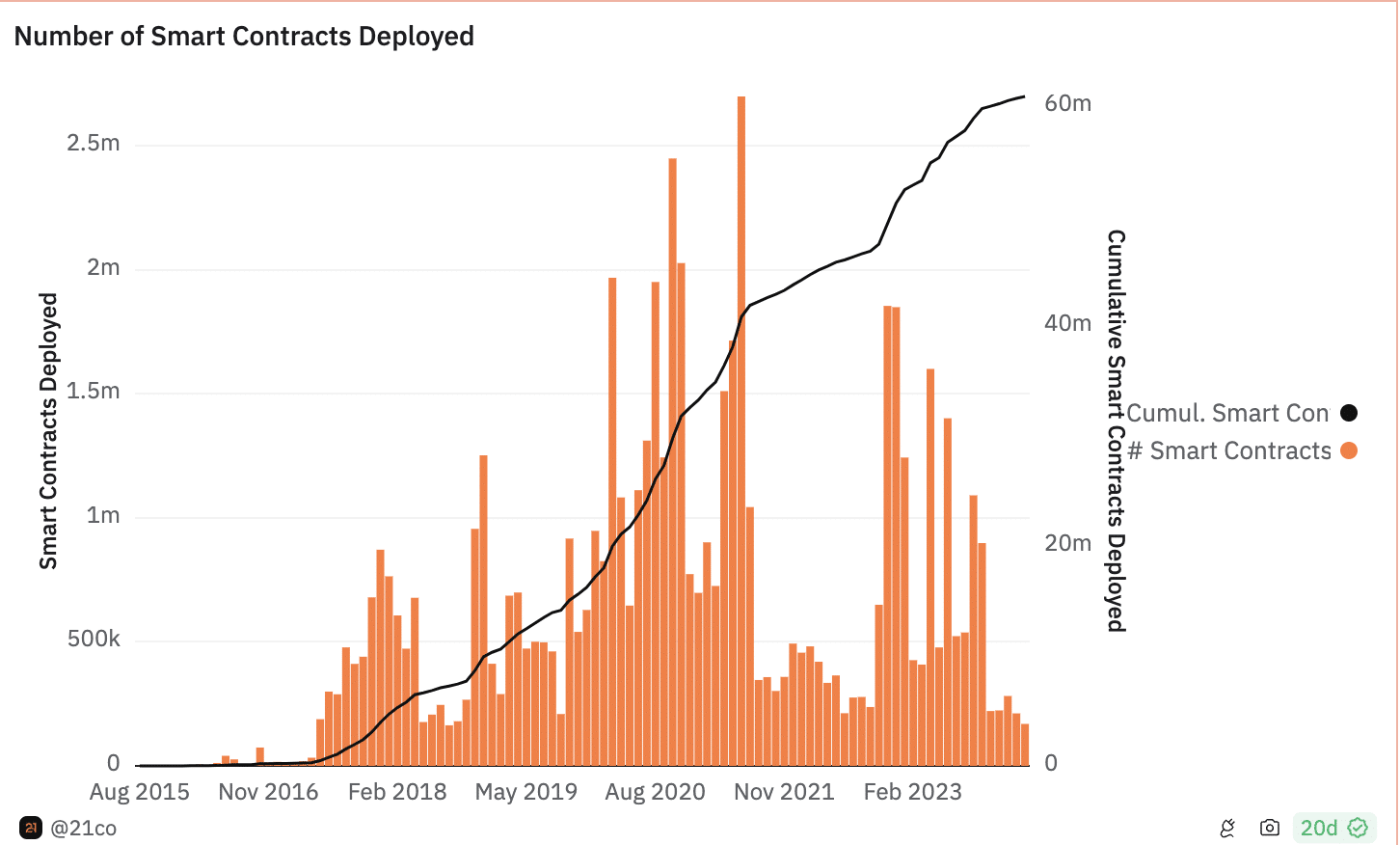

The number of smart contracts being deployed on the Ethereum network fell as well.

This may signal a decline in developer activity and innovation within the Ethereum ecosystem, potentially leading to reduced user engagement and adoption.

Additionally, fewer smart contracts being deployed could result in decreased transaction volume and network activity, impacting Ethereum’s overall transaction fees and revenue.

Source: Dune Analytics

Whales show interest

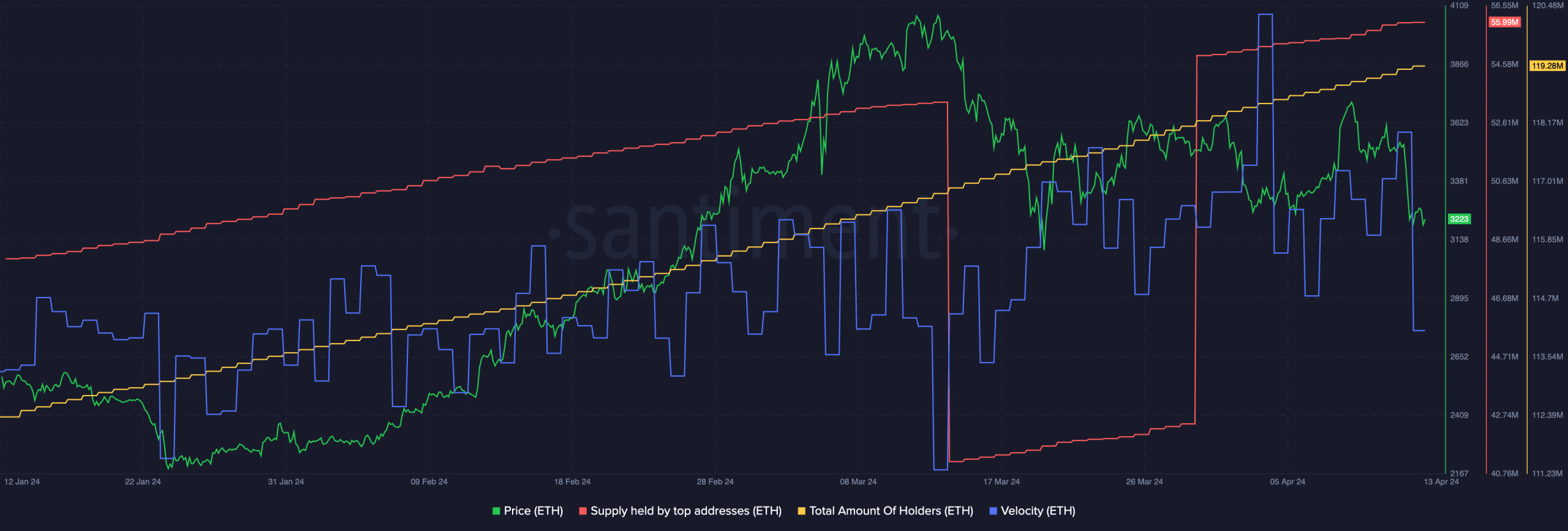

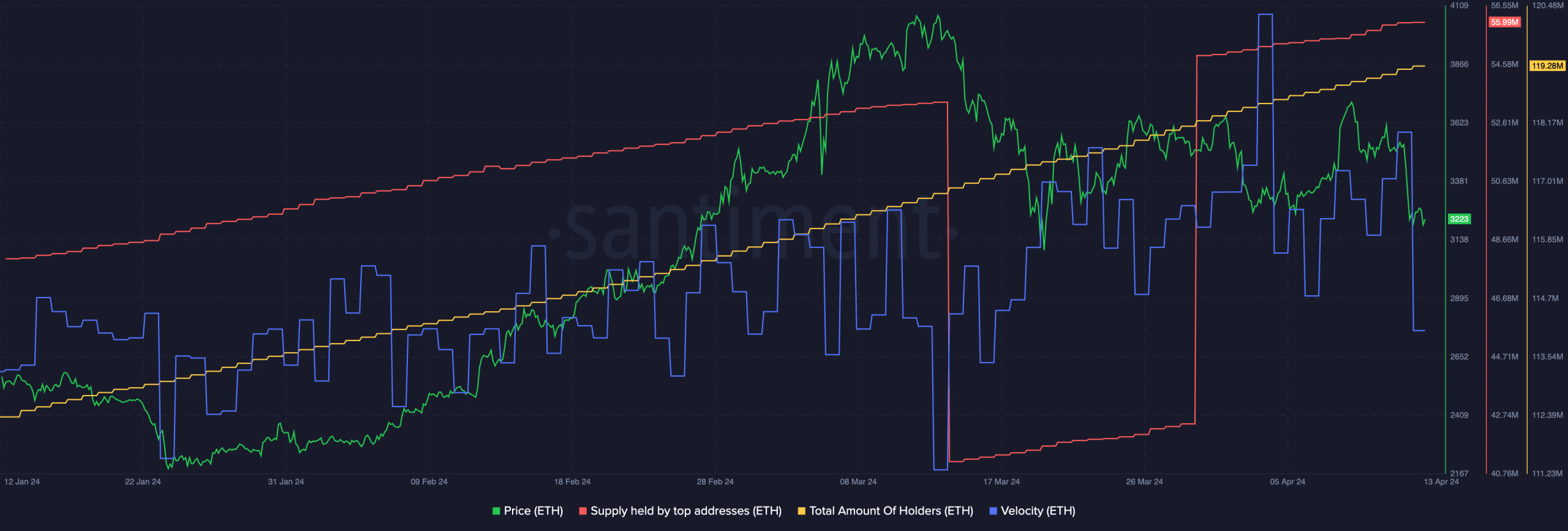

However, the price has started to see green. In the last 24 hours, ETH’s price grew by 5.61%. At press time, ETH was trading at $3,242.75. This surge in price could have been caused by whale interest.

AMBCrypto’s analysis of Santiment’s data revealed that the percentage of large addresses holding ETH had shot up.

While a surge in Ethereum’s price driven by increased whale interest may initially seem positive, it could potentially have negative implications for the broader Ethereum ecosystem.

The heightened concentration of ETH in the hands of large addresses, may lead to increased market manipulation and volatility, as their trading activities can significantly influence price movements.

Read Ethereum’s [ETH] Price Prediction 2024-25

Moreover, the total number of addresses holding ETH had also grown. This indicated that not only whales, but even retail investors were showing interest in ETH.

ETH’s velocity had declined, which indicated that the frequency with which ETH was trading had decreased significantly. This suggested that ETH transactions had fallen, which could hinder prices in the future.

Source: Santiment