- Polygon maintained high NFT trading volumes over the past month

- Both revenue collected and activity soared across the network

Polygon [MATIC] has solidified its standing as a powerhouse within the realm of NFTs. Despite heightened attention directed towards competing ecosystems in recent months, Polygon has steadfastly maintained its dominance in the NFT sector.

NFTs save the day

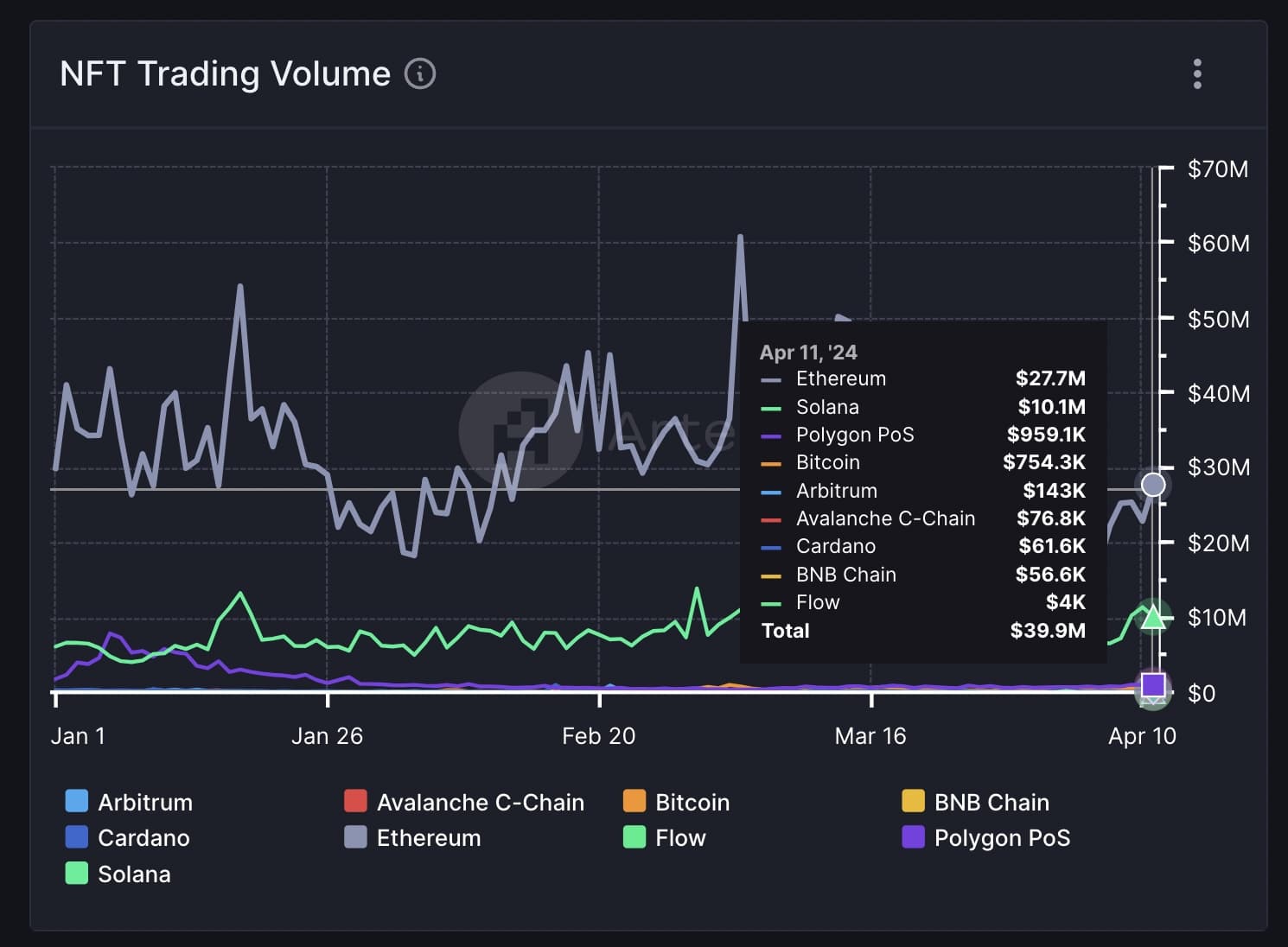

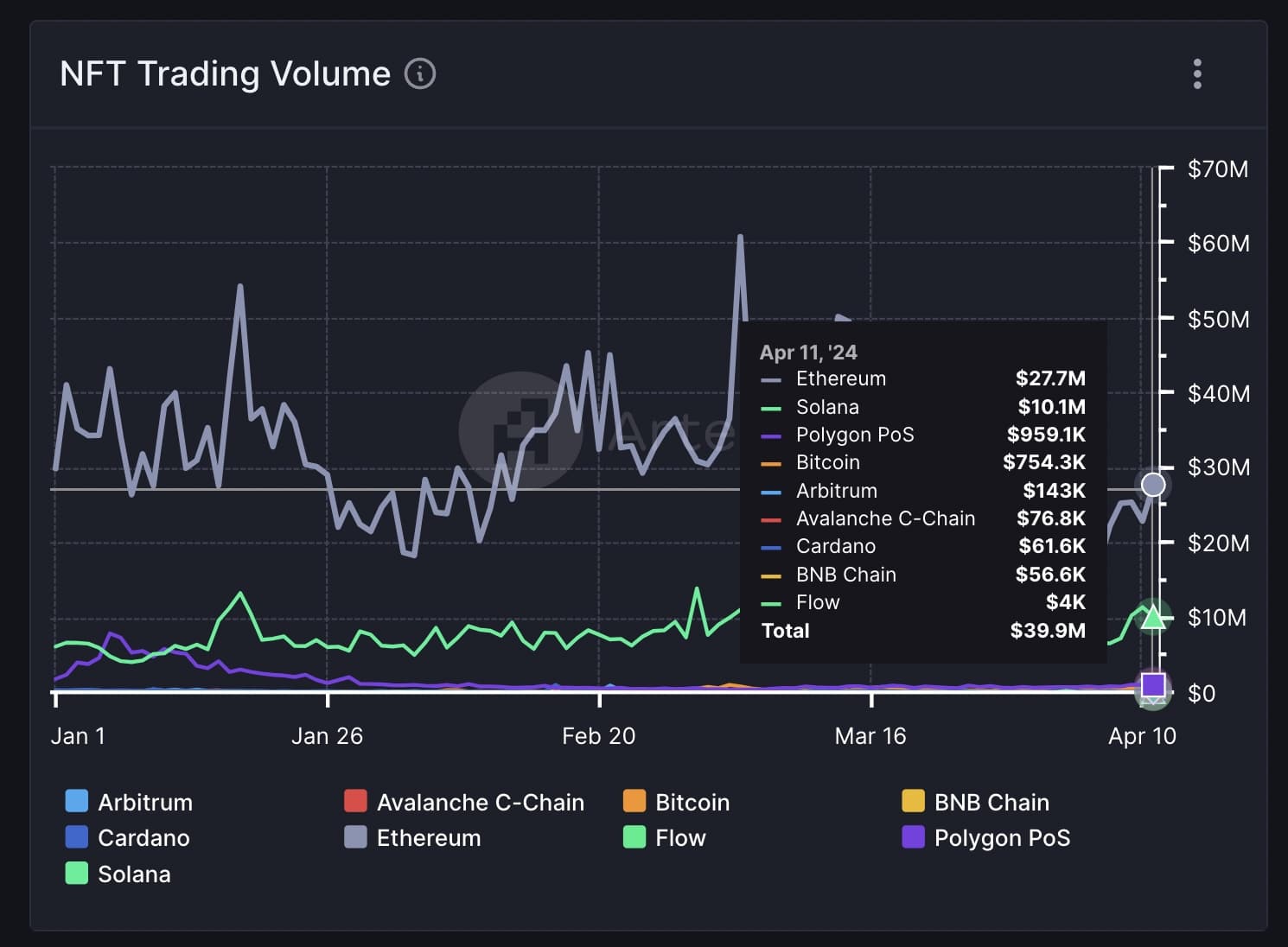

In fact, Artemis’ data indicated that Polygon was ranked third in terms of NFT trading volume on the charts. Due to the popularity of its NFT ecosystem, the protocol even managed to surpass established networks like Bitcoin and Arbitrum on the front.

Source: Artemis

The sustained success of Polygon in the NFT arena highlights the strength of its infrastructure and the popularity of its ecosystem. Despite facing stiff competition from other blockchain platforms, Polygon has succeeded in attracting multiple users and has solidified its reputation as the go-to platform for NFT transactions and projects.

Polygon has also had a history of collaborating with large brands for NFT-related projects which further aid in attracting new users to its ecosystem.

Looking at the data

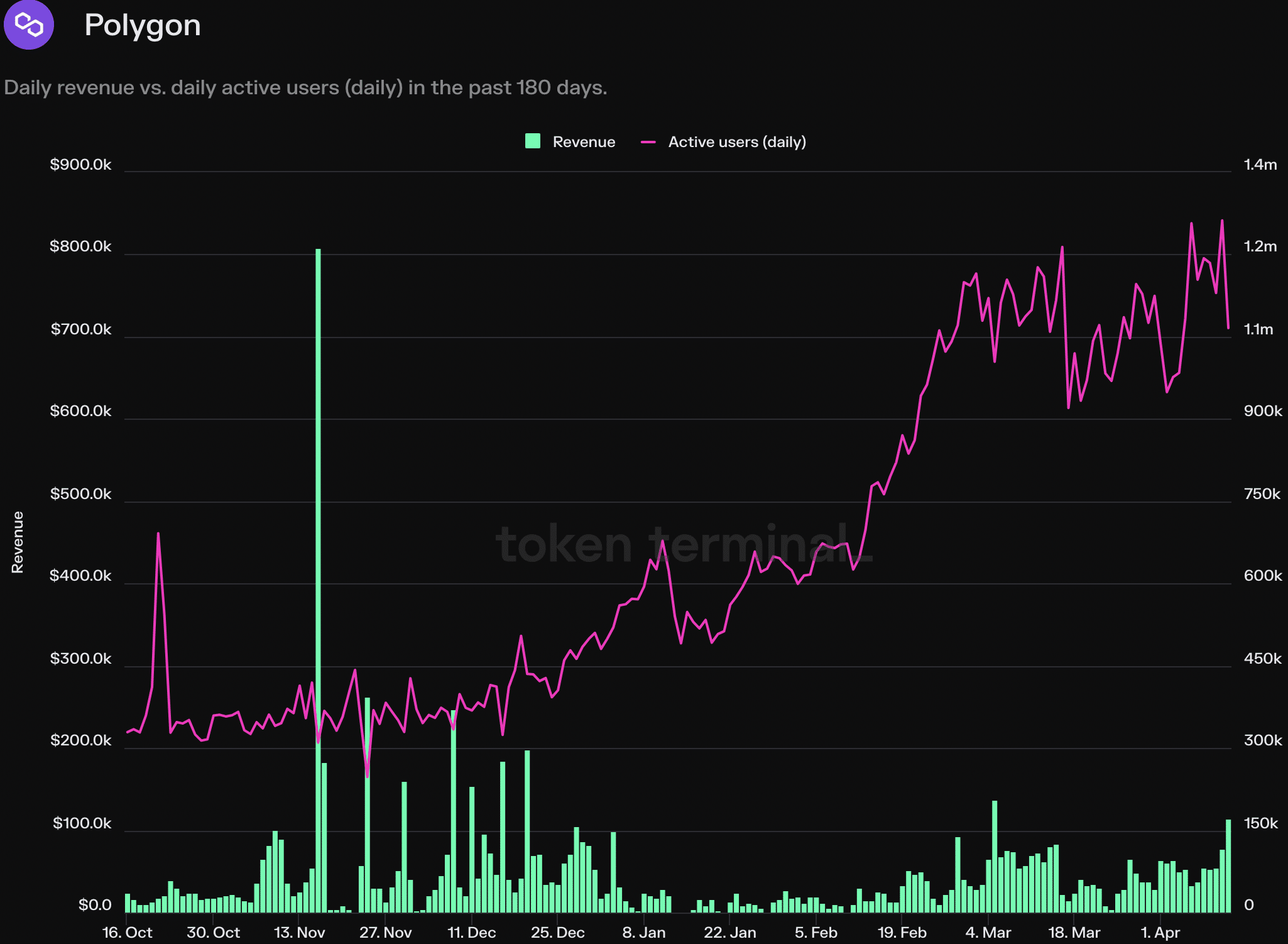

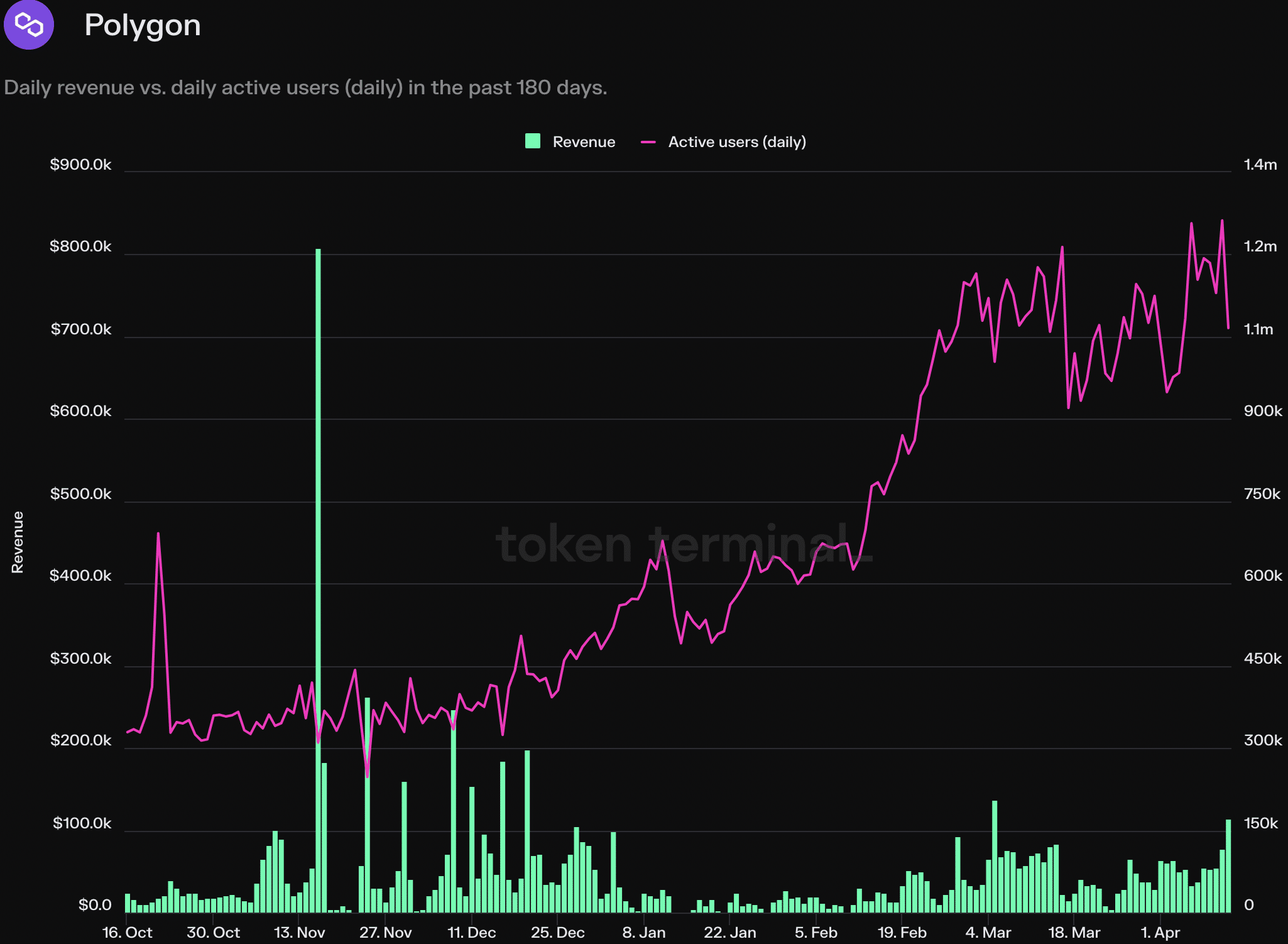

AMBCrypto’s analysis of the Polygon protocol revealed signs of growth and resilience. According to data from Token Terminal, active addresses on the Polygon network witnessed a remarkable surge over the past month.

Furthermore, the revenue generated on the network also skyrocketed by an impressive 93.1% in 30 days – A testament to the hike in adoption and utilization of Polygon’s features and services.

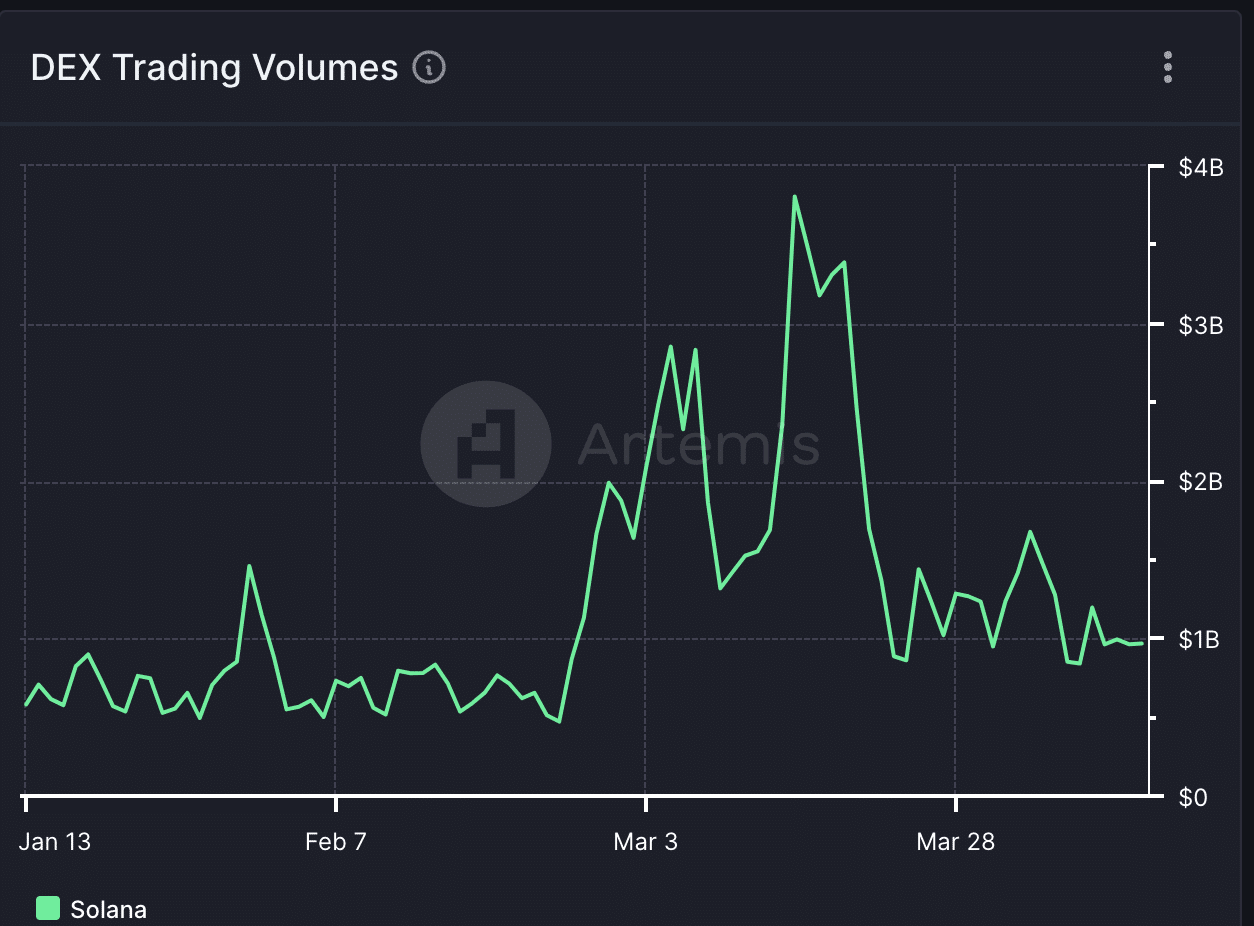

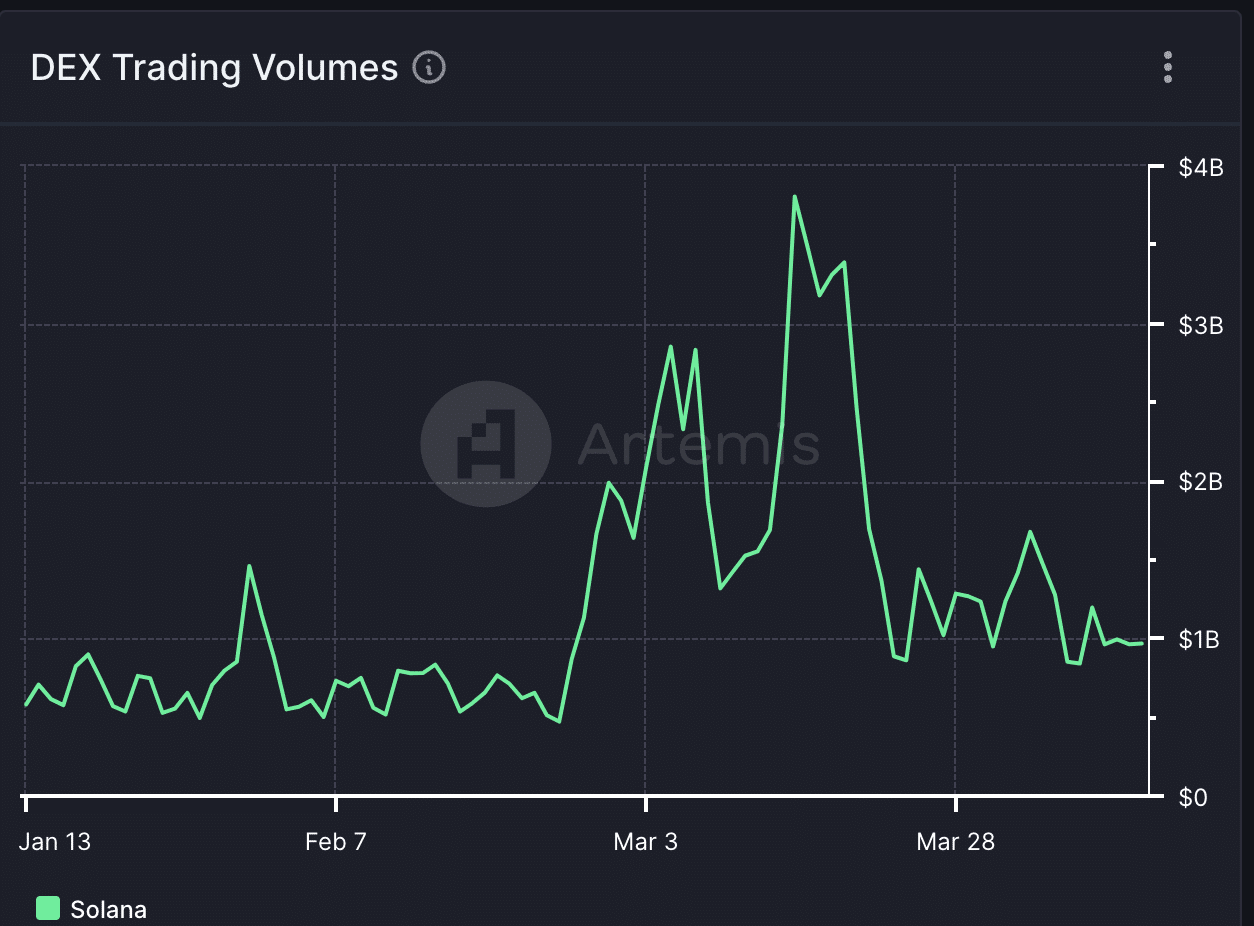

Source: Artemis

However, Polygon’s journey has not been without its challenges. Despite its strong performance in the NFT sector, certain metrics indicate areas of concern.

For instance, decentralized exchange (DEX) volumes on the Polygon network have seen a noticeable decline. Additionally, the total value locked (TVL) on Polygon has fallen over the past month – A sign of waning investor interest.

Source: Artemis

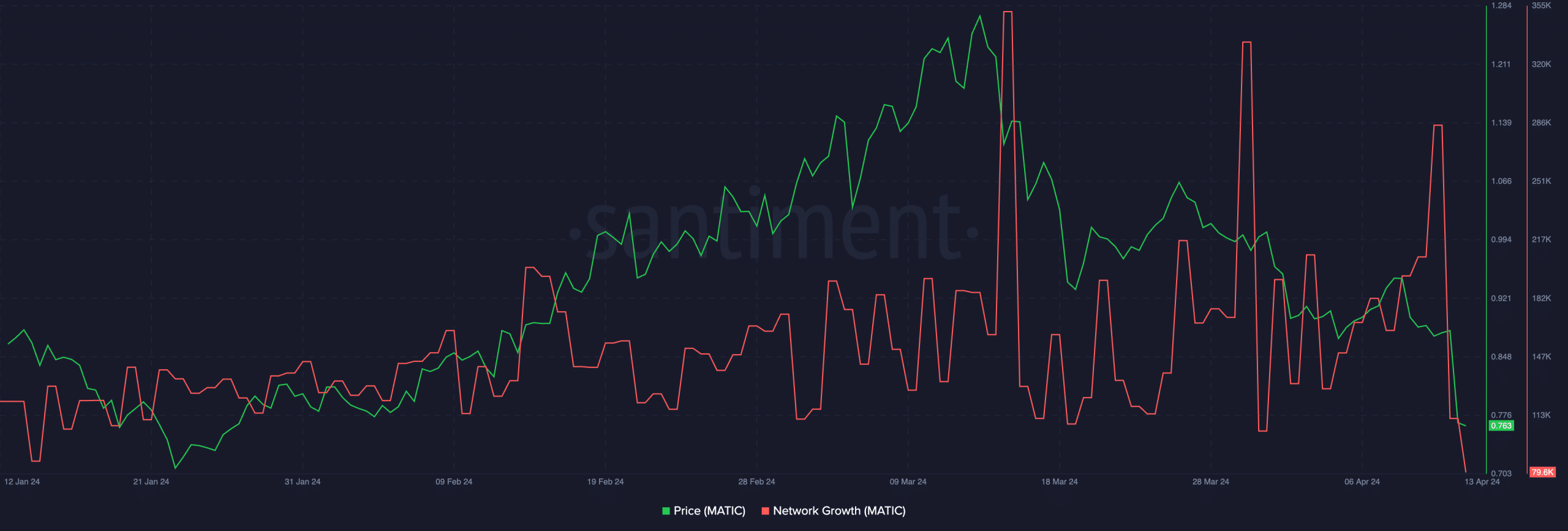

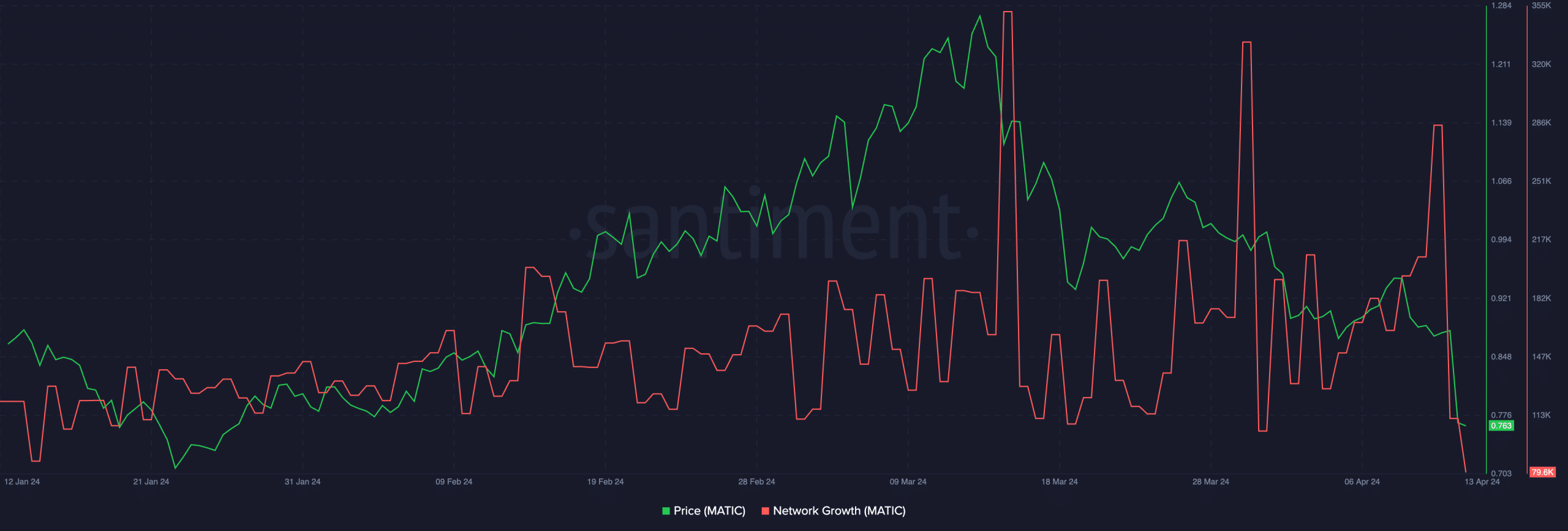

As far as MATIC is concerned, its state at press time seemed to present a mixed picture of challenges and opportunities. At the time of writing, MATIC was trading at $0.7599, following a decline of 13.13% on the charts.

Network growth metrics for MATIC pointed towards an uptick, indicating sustained interest from existing users. However, there seemed to be some signs of stagnation in the influx of new addresses, hinting at a potential loss of interest among new investors.

Read Polygon’s [MATIC] Price Prediction 2024-25

Source: Santiment

What this means is that both MATIC and Polygon are struggling a tad as far as new users and investors are concerned. With the bull run well and truly in motion, that will be important.