- Whales continued to HODL BTC and refused to sell their holdings for a profit.

- Accumulation by retail investors slowed down, and activity on the BTC network remained high.

After reaching the $70,000 mark, the price of Bitcoin [BTC] remained stagnant. Despite the plenty of opportunities for Bitcoin whales to indulge in profit-taking, most of them continued to HODL.

How are whales doing?

Data from Crypto Quant indicated that most whales had not caved into the temptation of selling their holdings.

This behavior can significantly impact Bitcoin’s future. Their continued confidence in Bitcoin can also boost overall market sentiment, attracting new investors and further increasing demand.

Additionally, whales holding onto their BTC can dampen price volatility, making the market more attractive to institutional investors who are wary of large swings.

Source: Crypto Quant

Anticipation of halving

Bitcoin whales may be holding onto their BTC due to anticipation surrounding the upcoming halving event. The halving, which occurs approximately every four years, is a programmed reduction in the reward for mining new blocks on the Bitcoin blockchain.

This event typically leads to a decrease in the rate at which new Bitcoin is created, ultimately reducing the available supply of BTC in circulation.

Historically, previous halving events have been associated with periods of increased scarcity and upward price pressure for Bitcoin. Therefore, whales may be strategically holding onto their BTC in anticipation of a potential price appreciation following the halving.

By retaining their Bitcoin holdings, whales not only position themselves to benefit from potential price gains but also contribute to the overall reduction in available supply, which can further drive up prices.

Additionally, the decision to HODL during this period may also reflect their confidence in Bitcoin’s long-term value proposition.

Read Bitcoin’s [BTC] Price Prediction 2024-25

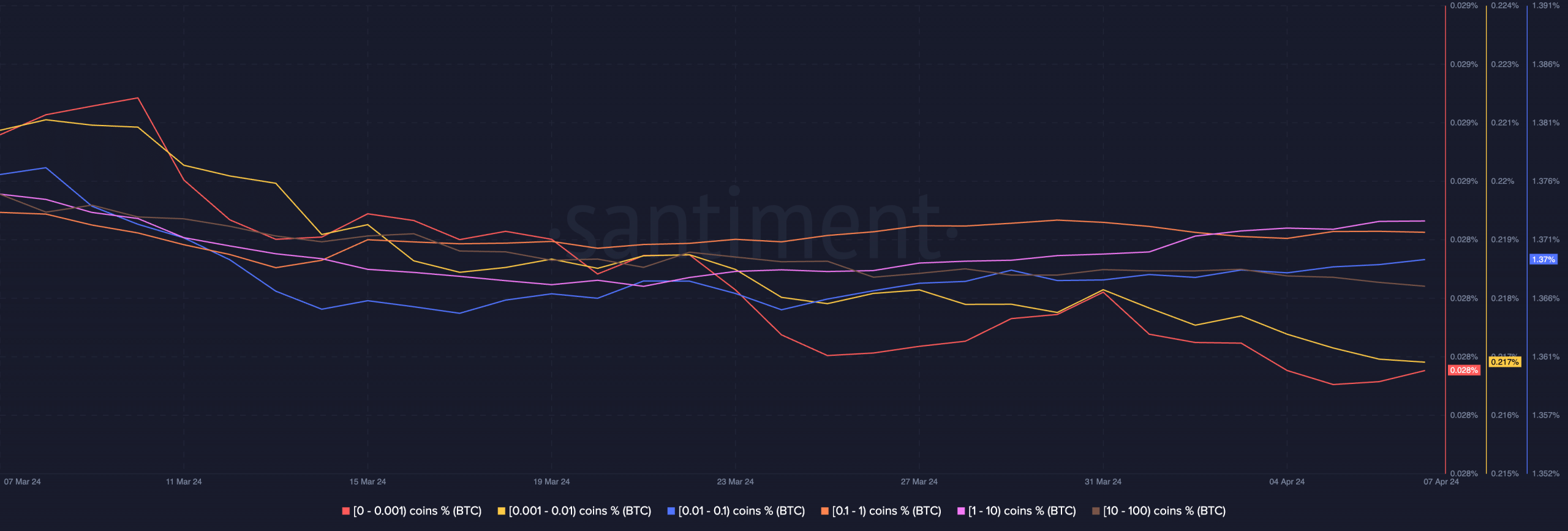

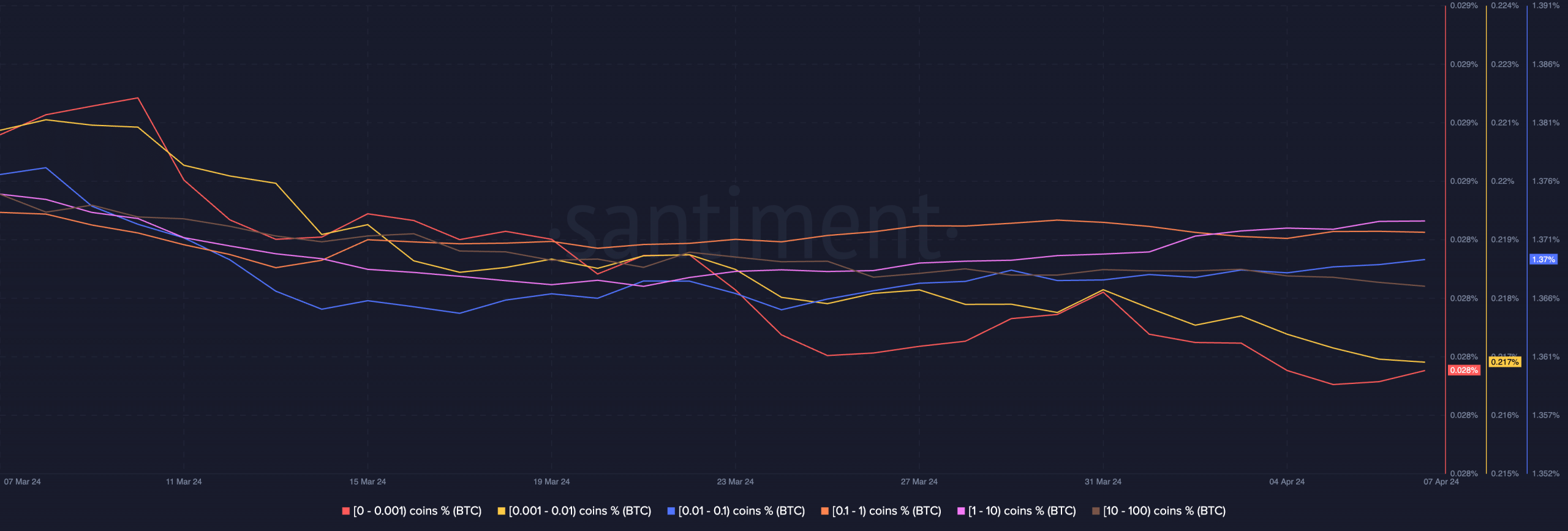

Surprisingly, retail investors weren’t as invested in BTC. AMBCrypto’s analysis of Santiment’s data revealed that the supply of BTC held by addresses holding 0.01 t0 1 BTC had declined significantly over the past week.

Source: Santiment

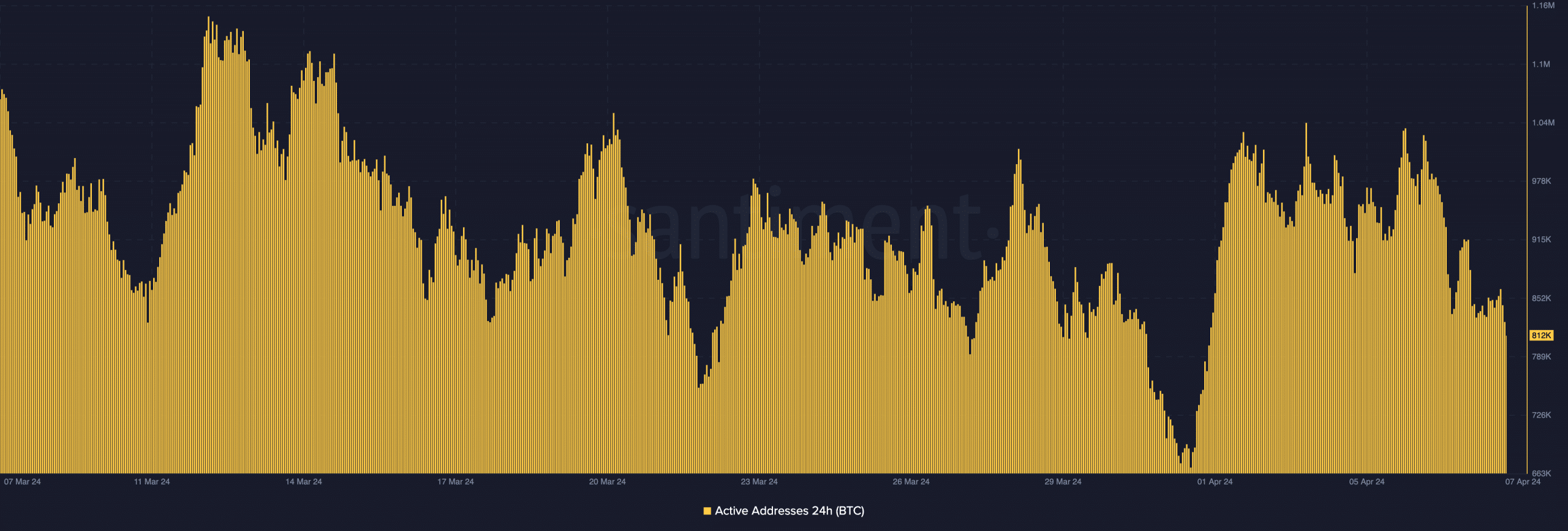

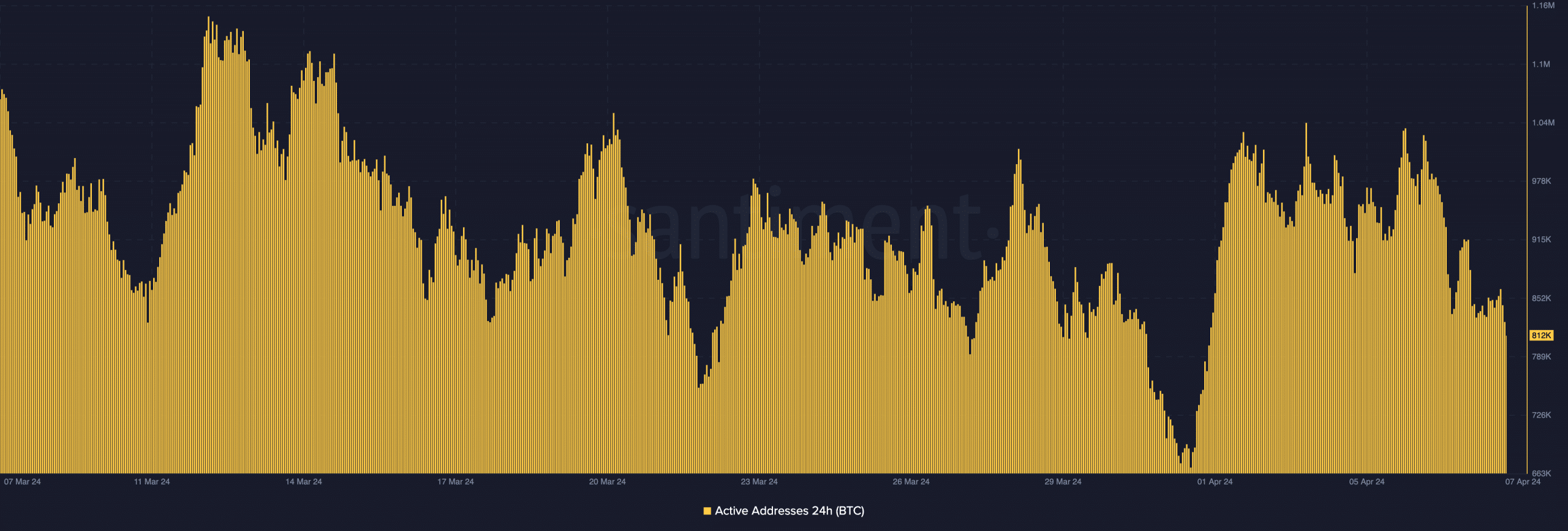

In terms of the overall health of the network, it was seen that the number of active addresses on the Bitcoin network remained consistent. One of the reasons for the same would be the rising popularity of BTC NFTs.

Source: Santiment