- UNI’s price declined significantly due to SEC’s actions.

- Whales sold their holdings, while long positions got liquidated.

Shockwaves were sent across the crypto sector as Uniswap [UNI] became the target for U.S regulatory bodies. Federal regulators formally notified Uniswap of a potential lawsuit with a Wells Notice on 10th April.

UNI holders take a hit

After this news broke, the price of the UNI token plummeted. In the past 24 hours, the price of UNI fell by 16.32%. Following actions by the SEC, numerous large holders initiated the sale of their UNI tokens.

According to data from lookonchain, three major holders offloaded a total of 2.03 million UNI tokens valued at $20 million, precipitating a 17% decline in the price of UNI.

Additionally, two whale addresses, transferred 1.25 million UNI tokens worth $11.7 million to Binance. Their potential profit from selling these tokens could amount to approximately $3.5 million.

Furthermore, another address sold 472,691 UNI tokens for $4.59 million in USDC, resulting in a profit of $1.67 million. Moreover, six wallets deposited a total of 316,430 UNI tokens, equivalent to $3.16 million, into Binance.

When whales sell off substantial amounts of tokens, it can trigger a cascade effect, causing other investors to panic sell as well, leading to further declines in price. This phenomenon is often observed in volatile markets, where sudden sell-offs can result in sharp price drops.

Moreover, if the selling pressure from whales persists over an extended period, it could erode investor confidence in UNI and Uniswap, leading to a prolonged bearish trend.

This, in turn, could deter new investors from entering the market and could even prompt existing holders to liquidate their positions, exacerbating the selling pressure.

Bulls continue to bleed

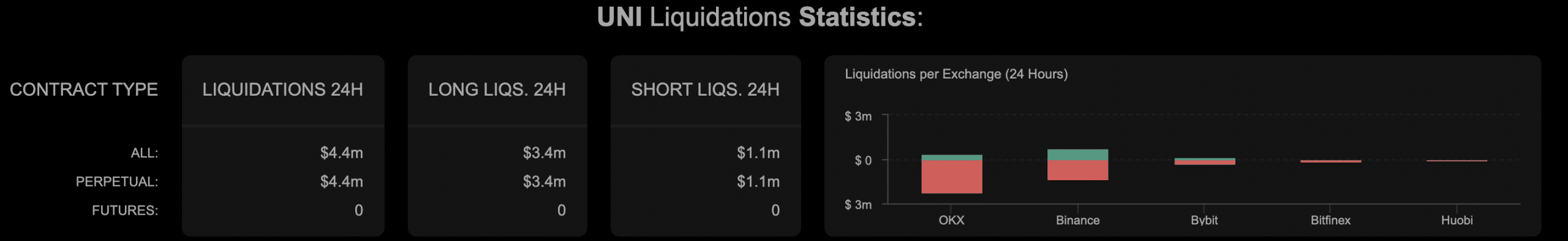

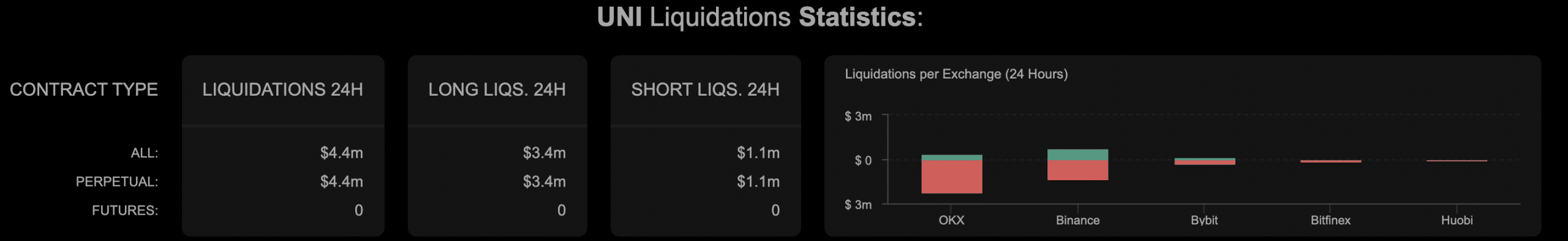

Traders also suffered immensely due to UNI’s recent correction. An analysis of coinalyze’s data by AMBCrypto indicated that in the last 24 hours, $4.4 million worth of positions had been liquidated. Out of this, $3.4 million were long positions.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Traders who experienced liquidations have suffered substantial financial losses and may face emotional distress, potentially leading to reduced confidence in trading and the market.

For UNI, this event can contribute to increased price volatility and can also affect market liquidity.At press time UNI was trading at $9.32.

Source: coinalyze