- Higher timeframe bullish structure came hand in hand with a consolidation phase for Shiba Inu

- Futures market showed bearish sentiment in the short-term

Shiba Inu [SHIB] has been in a retracement and consolidation phase over the past six weeks. The price action chart did not show any reason for holders to panic. On the contrary, a good buying opportunity would arise if SHIB prices drop another 15%.

A recent AMBCrypto report on Shibarium revealed that transaction fees on the network have been dropping. This is worrying because it is a sign of reduced user activity and a potential drop in demand.

Short-term support level was flipped to resistance once again

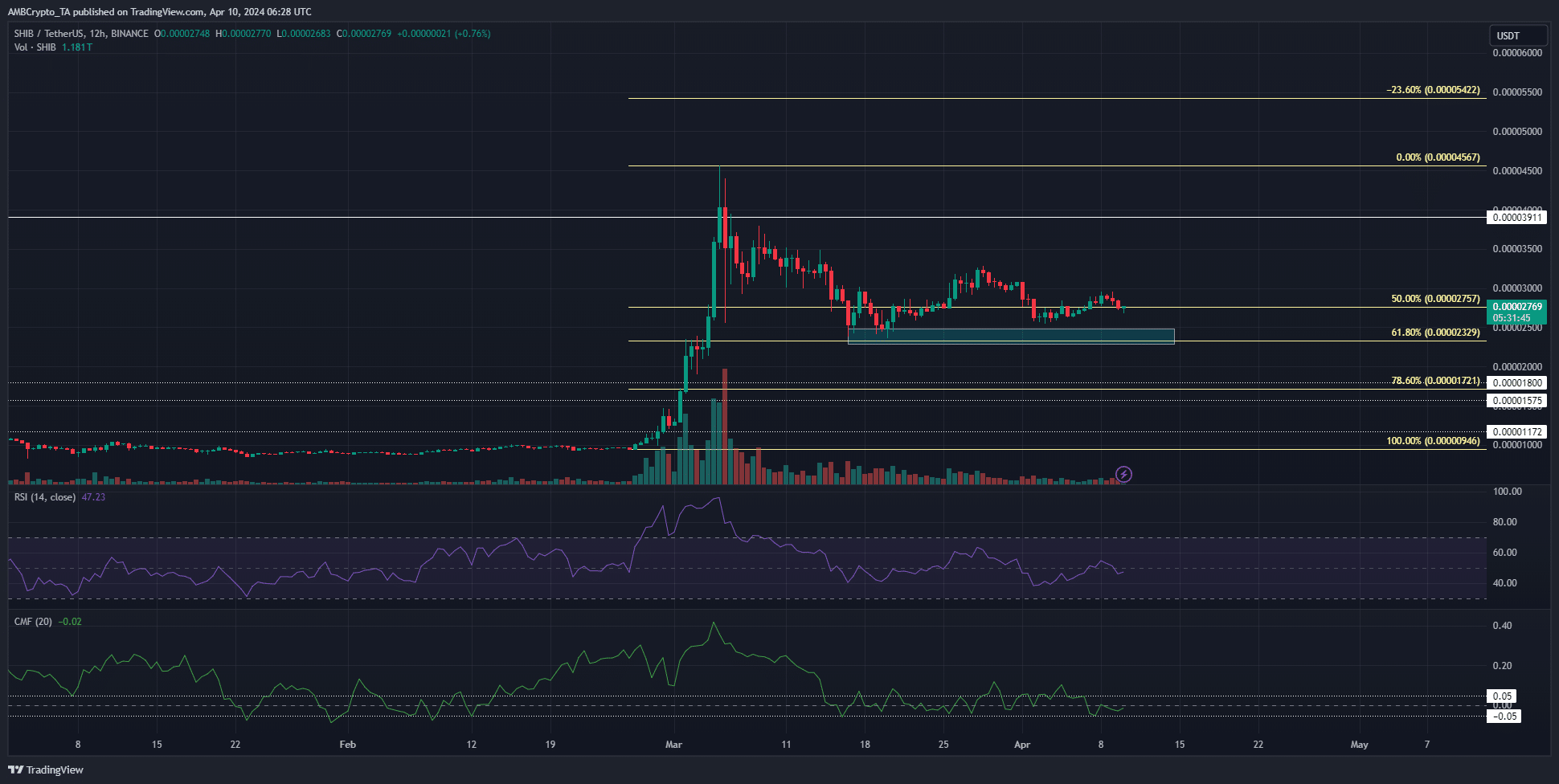

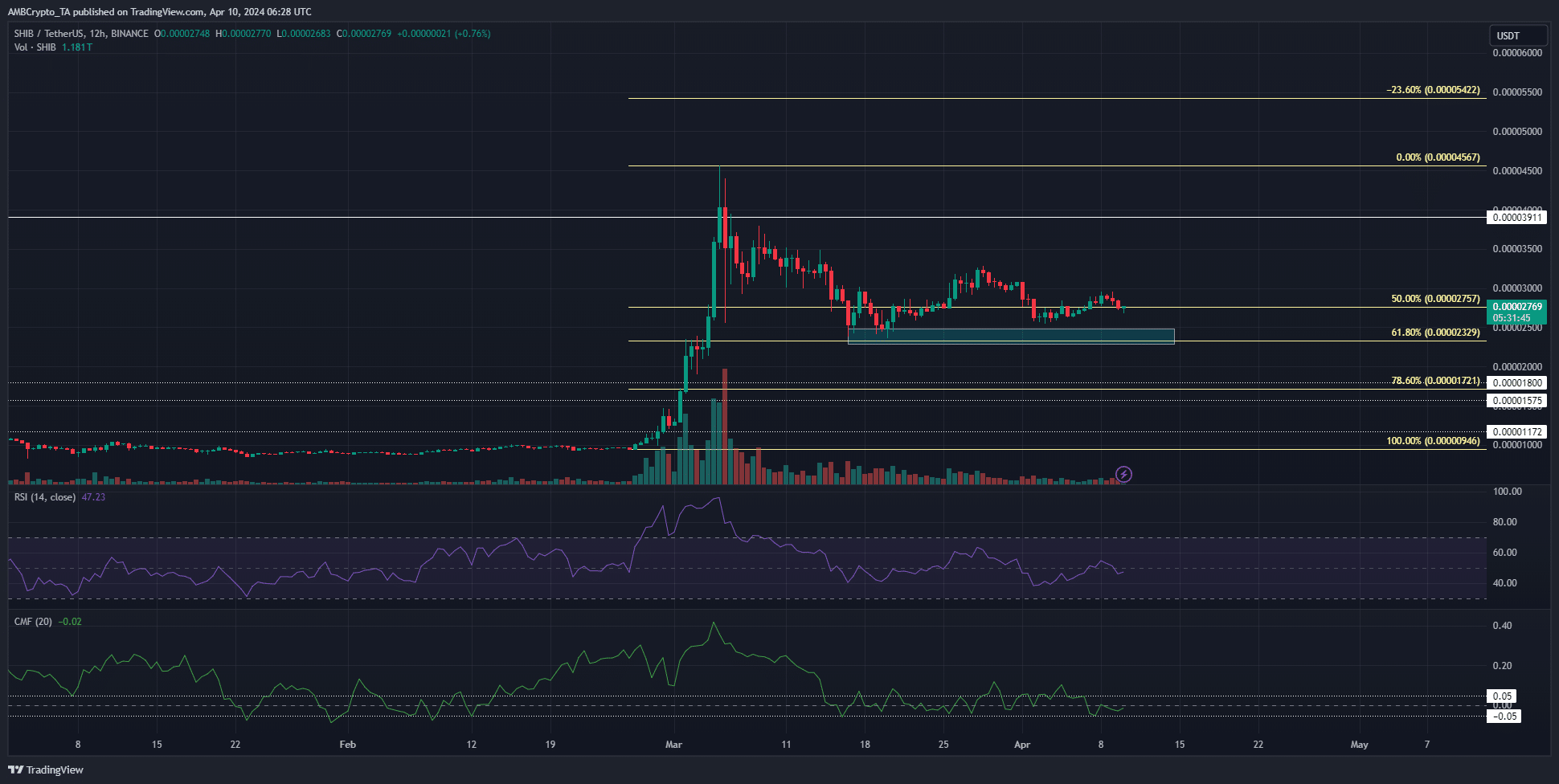

Source: SHIB/USDT on TradingView

The 12-hour price chart revealed that since 15 March, the $0.00003-level has been important. The bulls briefly flipped it to support in the final week of March, but were unable to hold on.

The recent bounce also halted at $0.00000295, just below this level. The RSI highlighted that the momentum was indecisive with a reading of 47. The Chaikin Money Flow was also similarly indefinite. It has not moved significantly beyond +0.05 or -0.05 since mid-March.

The price action and the indicators showed that SHIB is in a consolidation phase. A CMF move beyond dotted white lines could be an early signal of rising buying (or selling) pressure and an impending SHIB move in that direction.

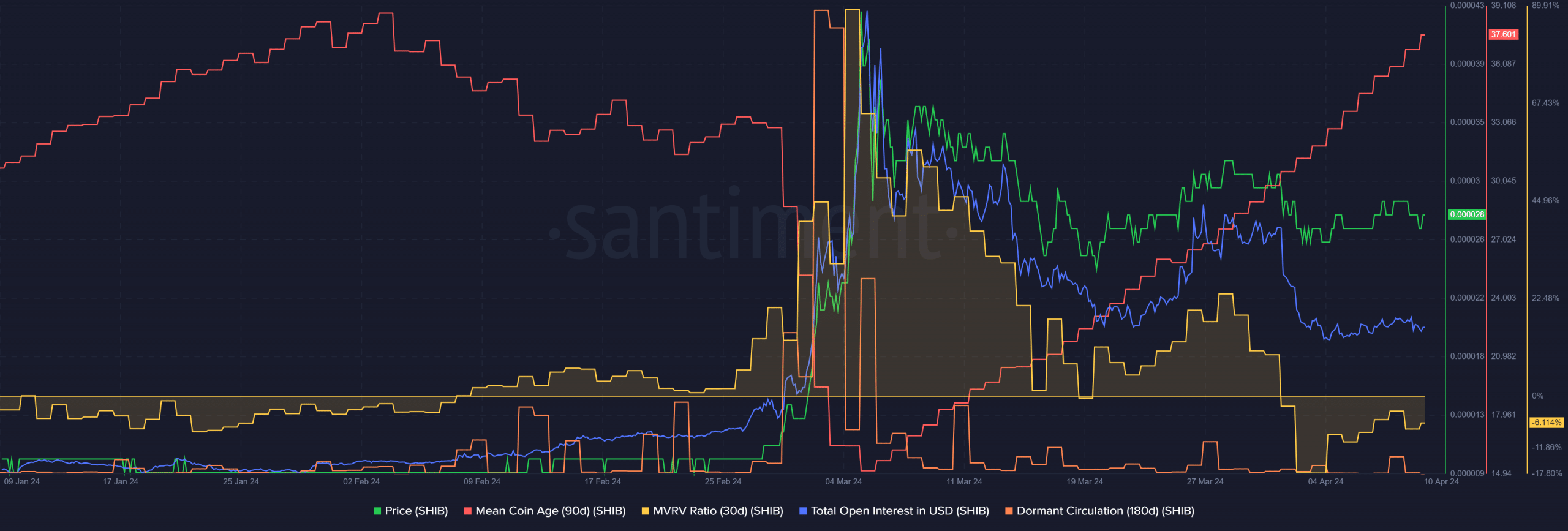

Dormant circulation gave investors confidence

The 30-day MVRV ratio dropped into negative territory earlier this month, signaling an undervalued asset. The mean coin age, on the other hand, has strongly trended upwards since early March. It is a strong buy signal, especially since the token is consolidating under resistance.

The Open Interest has also dropped substantially over the past ten days. It showed that speculators preferred to remain sidelined and have not been willing to bet on SHIB’s price movement on the charts.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

Dormant circulation had sizeably spiked in early March, when the mean coin age nosedived. Since then, the dormant circulation has been quiet. This is another sign that significant selling pressure and token movement has been absent in recent weeks.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.