- XRP has seen an almost 2% increase in the current trading window.

- Trading volume has crossed over $1 billion with the current uptrend.

Ripple sparked discussions within the crypto community by announcing plans for a stablecoin launch. This news arrived at an opportune moment for XRP, which began the month with notable losses.

Has XRP started to recover?

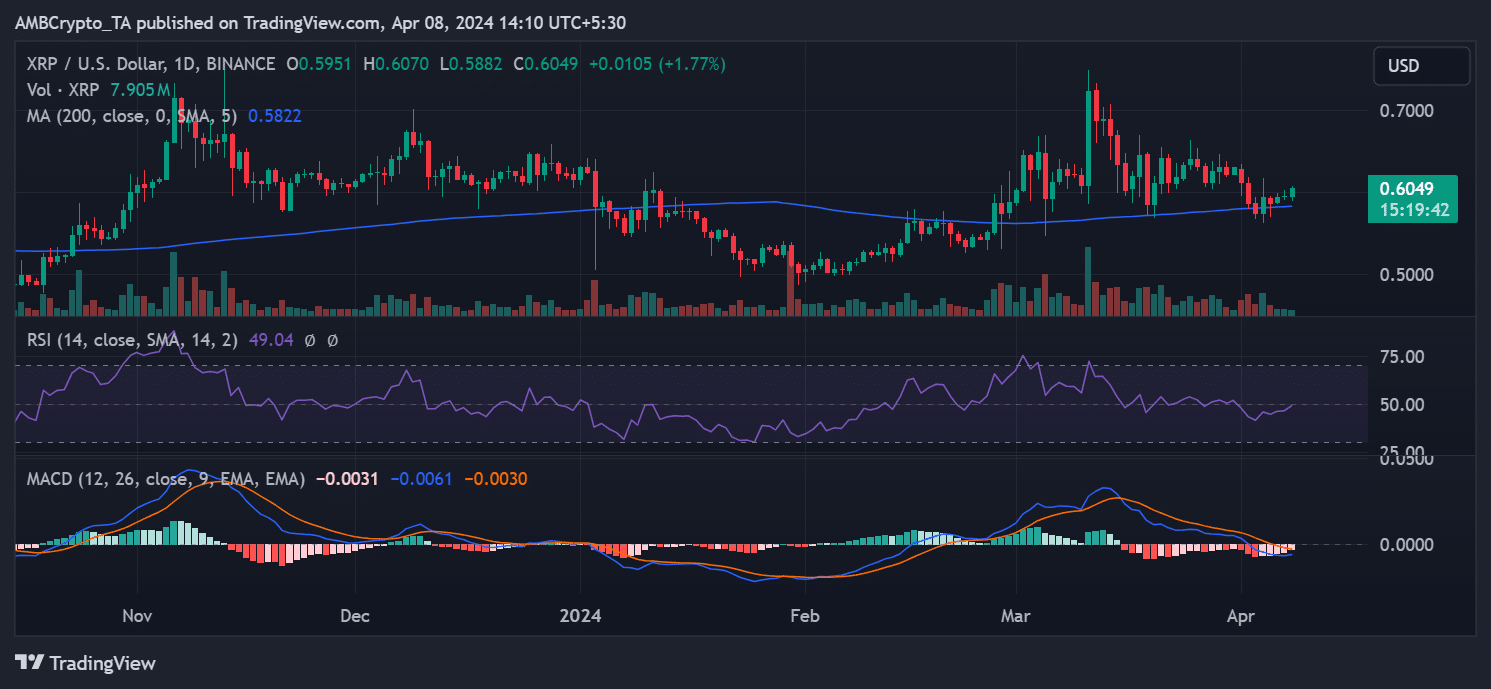

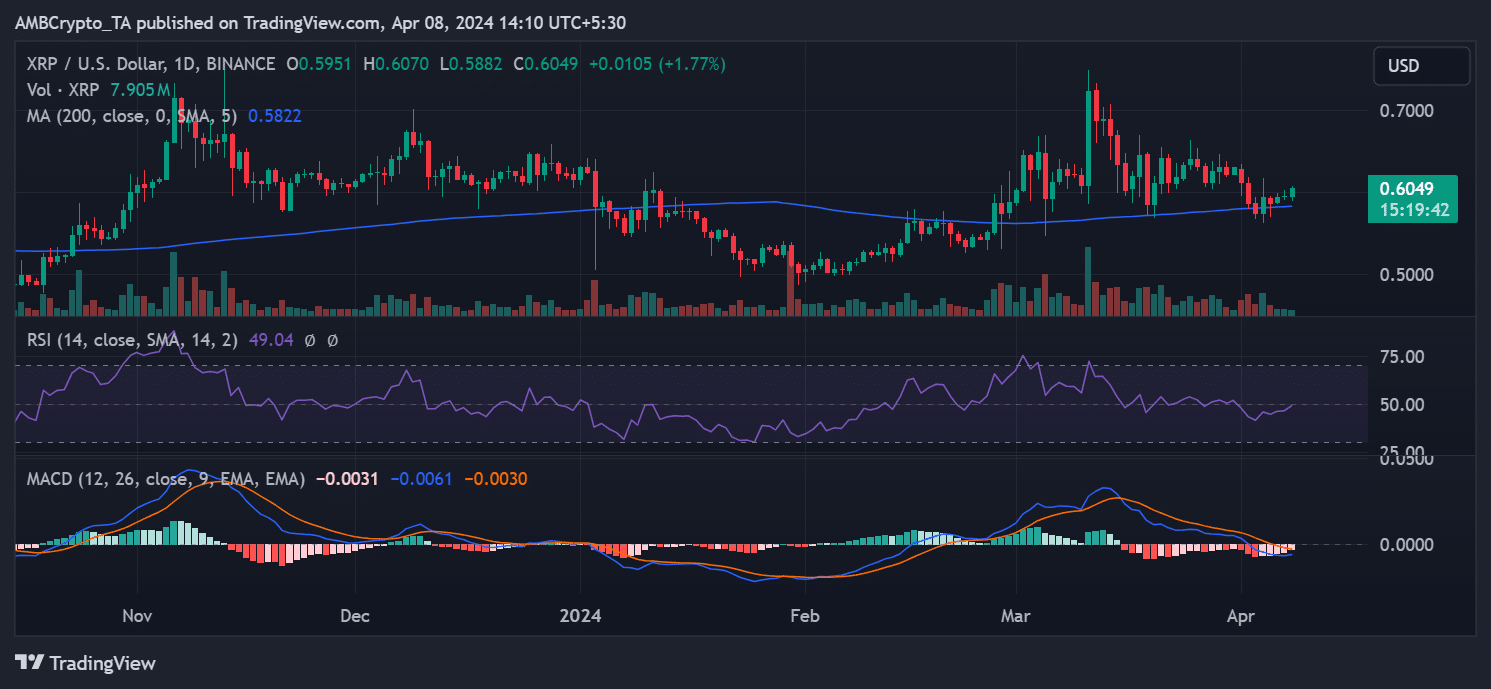

AMBCrypto’s examination of the XRP daily timeframe chart showed consecutive uptrends in recent days, signaling a positive development for the asset.

This positive momentum follows an initial decline of over 8% in the first three days of the month. Initially, what appeared to be a consolidation around $0.6 eventually turned into a decline, with the price dipping to the $0.5 range.

Source: Trading View

However, following the announcement of the upcoming stablecoin launch later in the year, XRP experienced a notable response, surging by over 3%.

Despite a brief setback where it lost over 1%, XRP has since seen consecutive gains, albeit slight, after that.

At the time of writing, XRP was trading around $0.60, reflecting an increase of over 1.6%. Furthermore, it was on the verge of re-entering a bullish trend, as indicated by its Relative Strength Index (RSI).

Currently, it is nearing a crossover above the neutral line on the RSI, suggesting a positive price movement.

XRP draws more attention

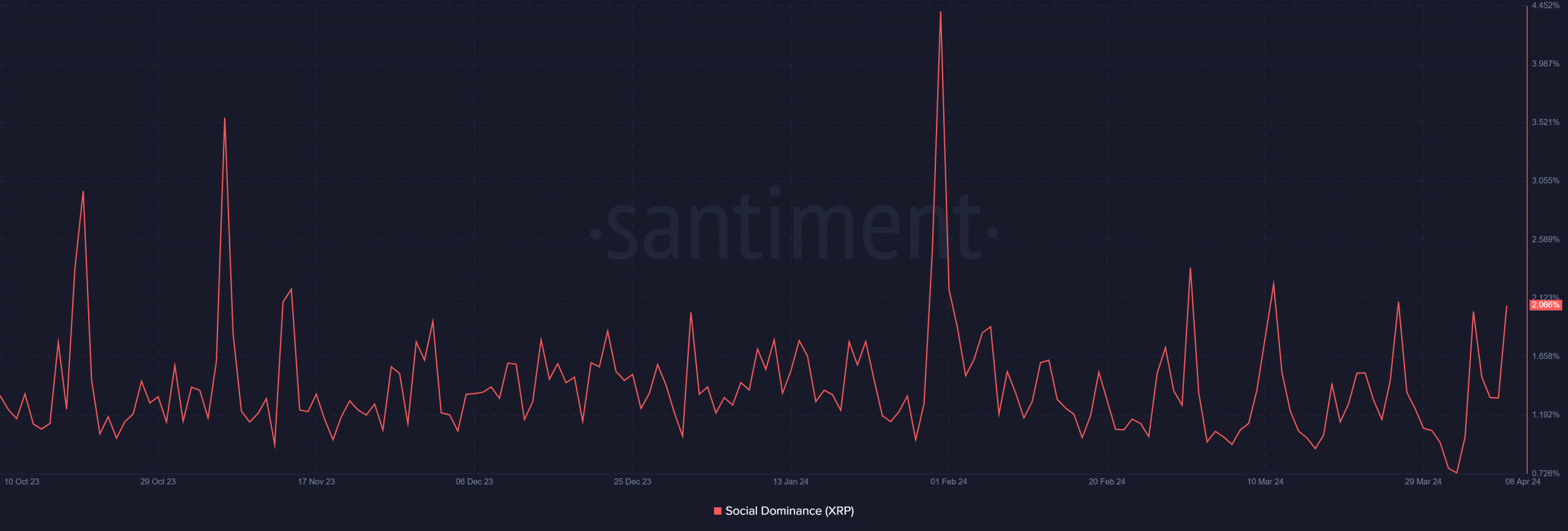

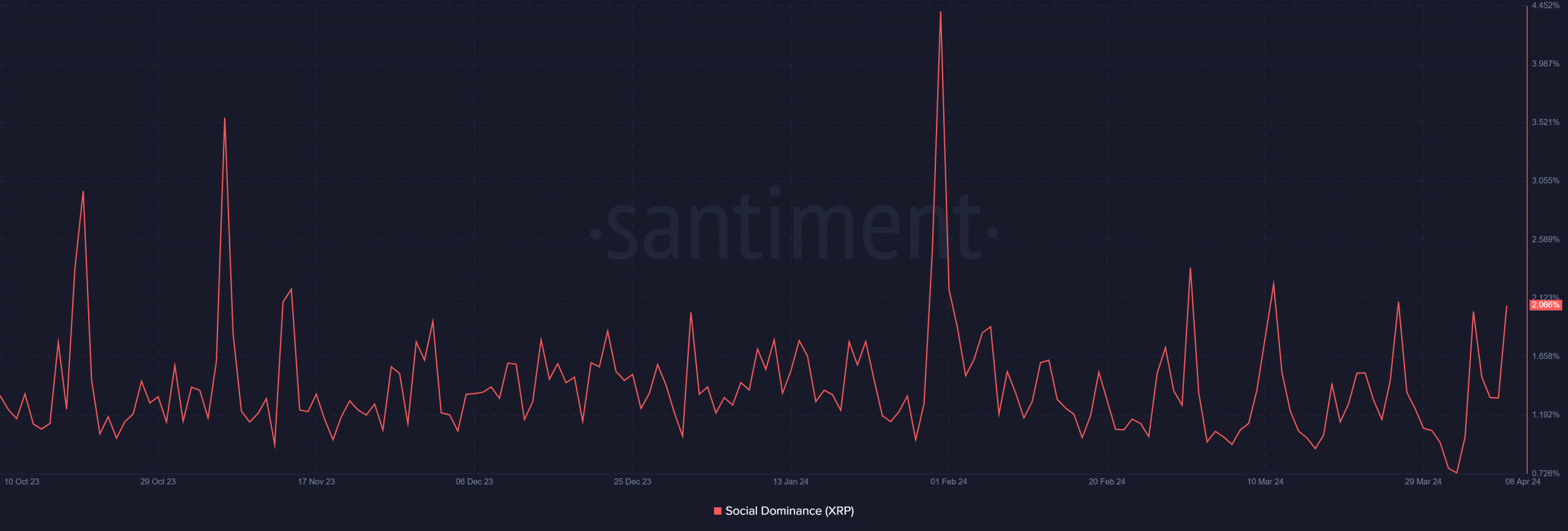

AMBCrypto’s analysis of the social dominance metric on Santiment revealed an increase in the social dominance of XRP over the last 24 hours.

Its Social Dominance had also risen to around 2.08% at the time of writing. This marked a slight uptick from the 2.02% observed when Ripple announced the plans for the stablecoin launch on the 4th of April.

Source: Santiment

This increase suggests that XRP has recently captured a larger share of the cryptocurrency discussion. Such heightened social engagement could positively impact the price and attract more attention to the asset.

Realistic or not, here’s XRP market cap in BTC’s terms

Volume goes back over $1 billion

The seven-day active addresses metric showed a peak in active addresses on the 7th of April. The chart illustrated that the number surged to over 158,000, marking the highest level observed in months.

As of the current writing, the number has slightly decreased to around 153,000, yet it remains one of the highest volumes recorded in months. Additionally, its volume rose slightly, to over $1 billion.