- BTC’s price moved marginally in the last 24 hours.

- Market indicators looked bearish on the coin.

Bitcoin’s [BTC] price has been in a consolidation phase for the last few days, as it was sticking near the $70k mark. In fact, there were chances of BTC falling near the $60k zone in the short term. If that happens, then it would be the right opportunity for investors to stockpile.

Is Bitcoin under threat?

AMBCrypto reported earlier that BTC’s price was in a consolidation phase and was moving in between $60k and its ATH. Our analysis of IntoTheBlock’s data revealed that more than 97% of BTC holders were in profit. At first glance, this might look optimistic, but in reality, it can cause trouble.

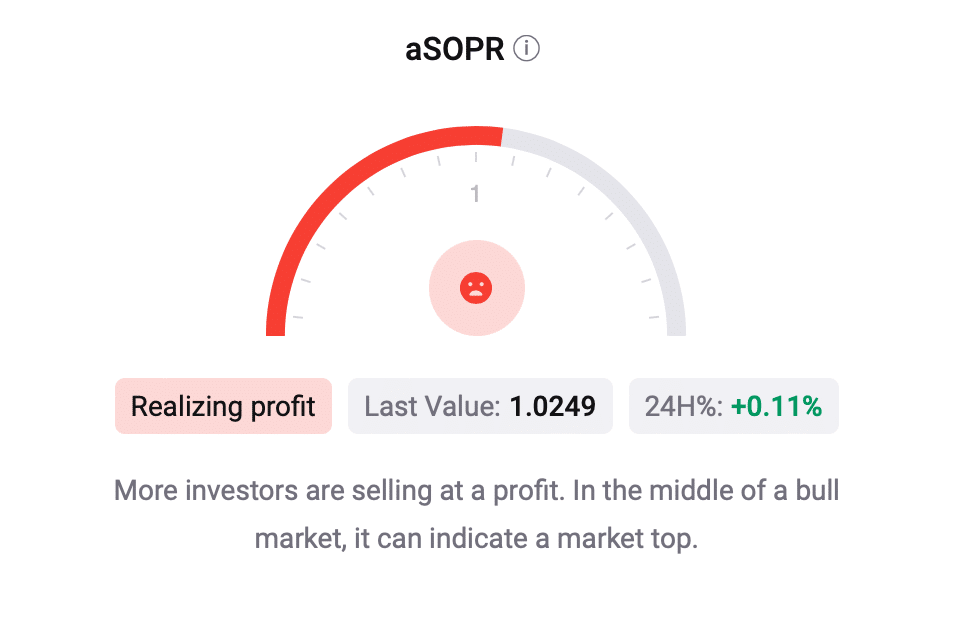

When such a high number of investors are in profit, they often sell their holdings to take an exit with the cash, which increases selling pressure. When we checked CryptoQuant’s data, it was found that BTC’s aSORP was red.

Source: CryptoQuant

This meant that more investors are selling at a profit. In the middle of a bull market, it can indicate a market top, hinting at a price decline.

According to CoinMarketCap, BTC’s price moved marginally in the last 24 hours and, at press time, was trading at $70,446.45.

Investors are still buying BTC

It was interesting to note that despite these aforementioned red flags, BTC investors showed immense confidence in the coin as they continued to accumulate.

Ali, a popular crypto analyst, recently posted a tweet highlighting that BTC showed a strong accumulation score while consolidating around all-time highs.

An analysis of BTC’s metrics also suggested that buying pressure remained high. For instance, BTC’s exchange reserve was green. As per CryptoQuat’s data, BTC’s Coinbase Premium was also green, meaning that buying sentiment was dominant among US investors.

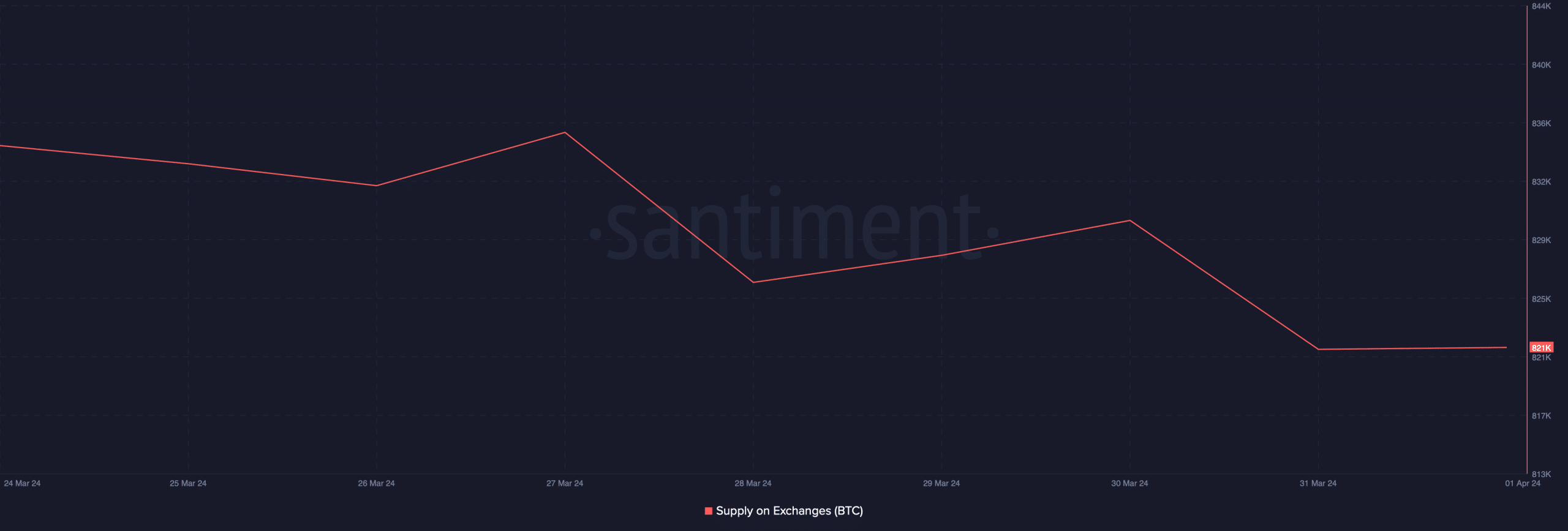

On top of that, BTC’s supply on exchanges dropped over the last week, further establishing the fact that investors were buying BTC while the coin was in a consolidation phase.

Source: Santiment

High buying pressure might not be enough to stop the bears, as moist market indicators suggested a price correction, increasing the chances of BTC hitting $60k.

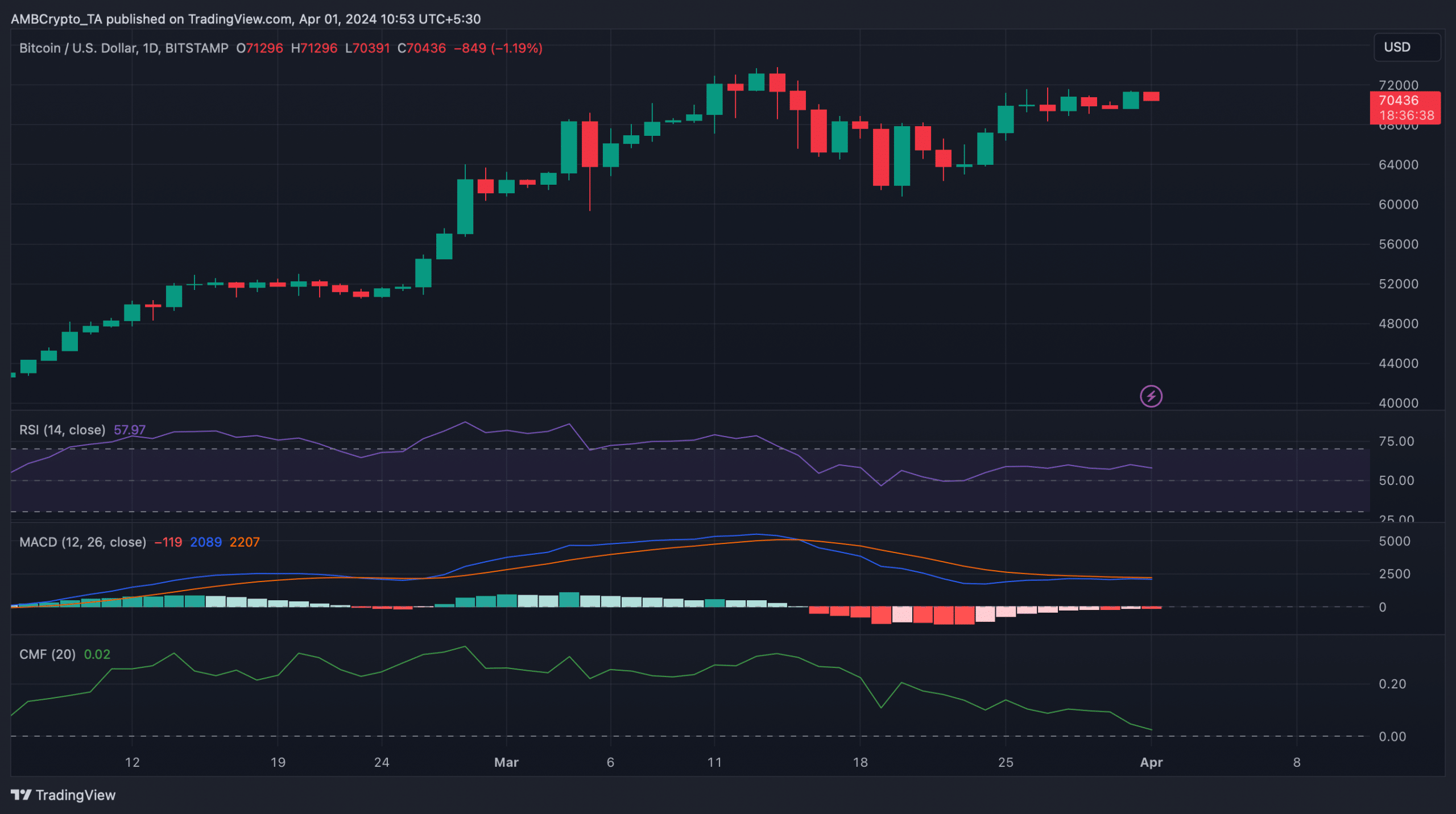

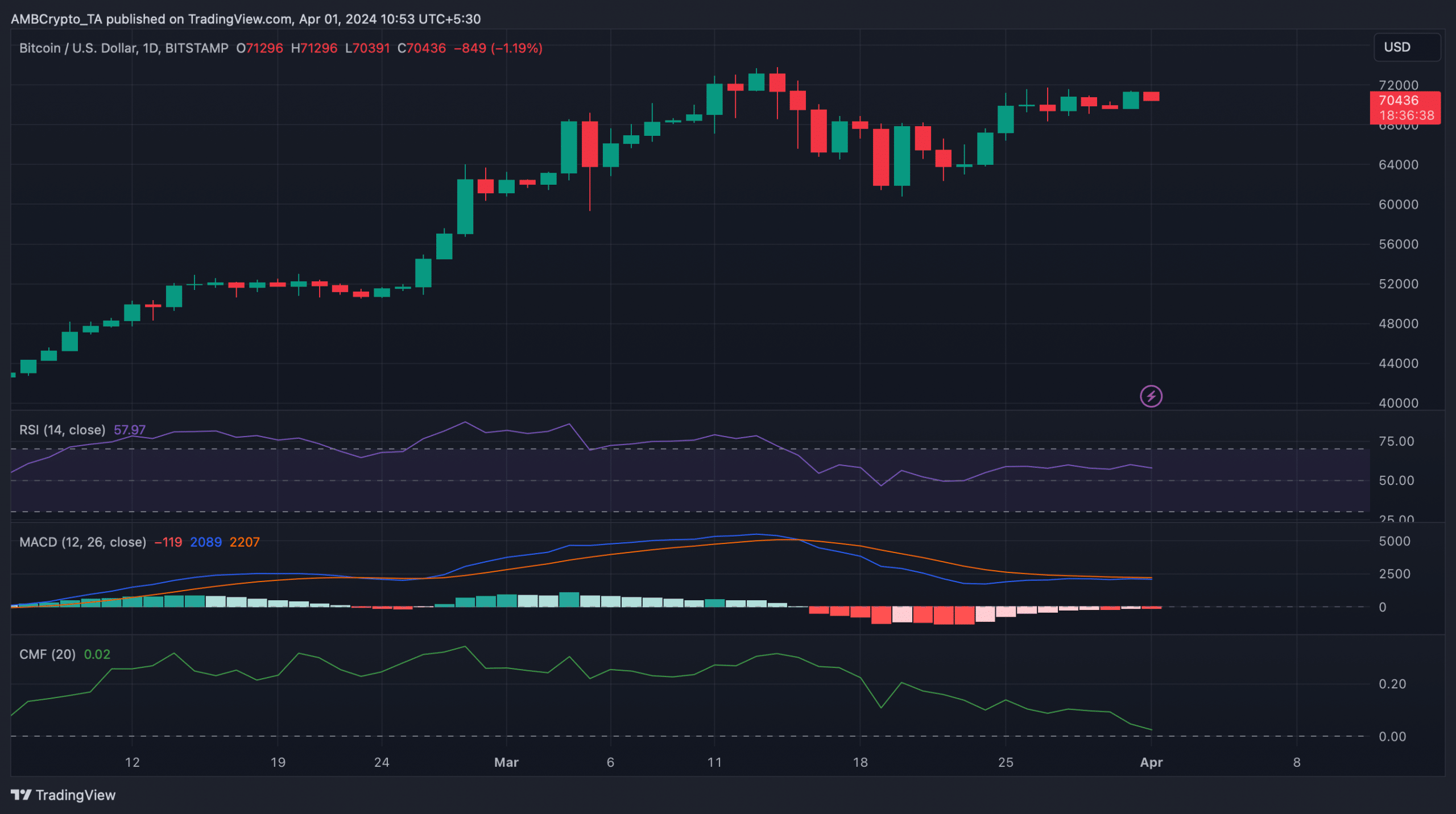

For example, the MACD displayed a bearish crossover. The Relative Strength Index (RSI) registered a downtick after days of sideways movement.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Moreover, Bitcoin’s Chaikin Money Flow (CMF) went down sharply and was headed towards the neural mark. These indicators hinted that BTC might soon witness a price correction.

Therefore, investors might consider waiting longer before increasing their accumulation.

Source: TradingView