- Sentiment around Shiba Inu turned bearish over the last few days.

- Most metrics looked bearish on SHIB.

After weeks of bull rallies, the entire crypto market somewhat turned sluggish, and Shiba Inu [SHIB] did not stray from the norm.

While the meme coin’s price action did not impress, it’s much-talked about Layer 2, Shibarium, showcased an impressive performance.

Shiba Inu lies low

According to CoinMarketCap, the world’s second-largest meme coin’s value has surged by nearly 9.5% in the last seven days. However, the momentum slowed down over the past few days.

In the last 24 hours, SHIB’s value only moved up by 2%. At the time of writing, the meme coin was trading at $0.00003047 with a market capitalization of over $17.9 billion.

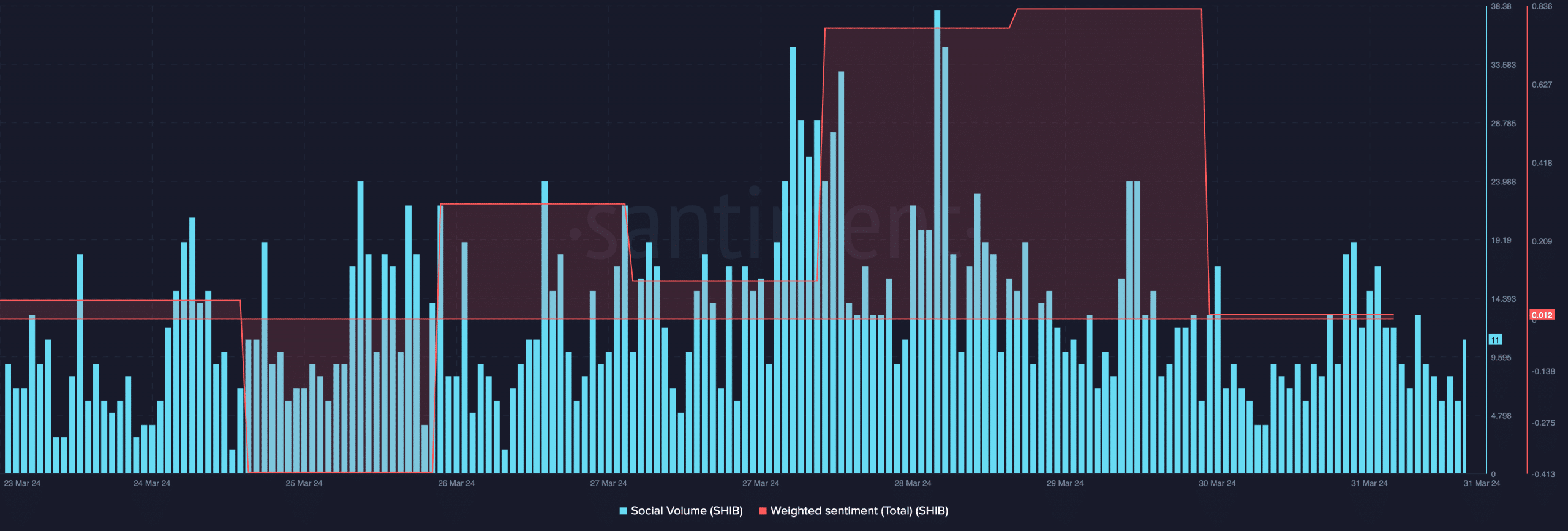

The slow-moving price action took a toll on SHIB’s social metrics. AMBCrypto’s analysis of Santiment’s data revealed that SHIB’s Social Volume dropped last week.

Bearish sentiment around it also increased, which was evident from the drop in its Weighted Sentiment.

Source: Santiment

Shibairum is taking the baton forward

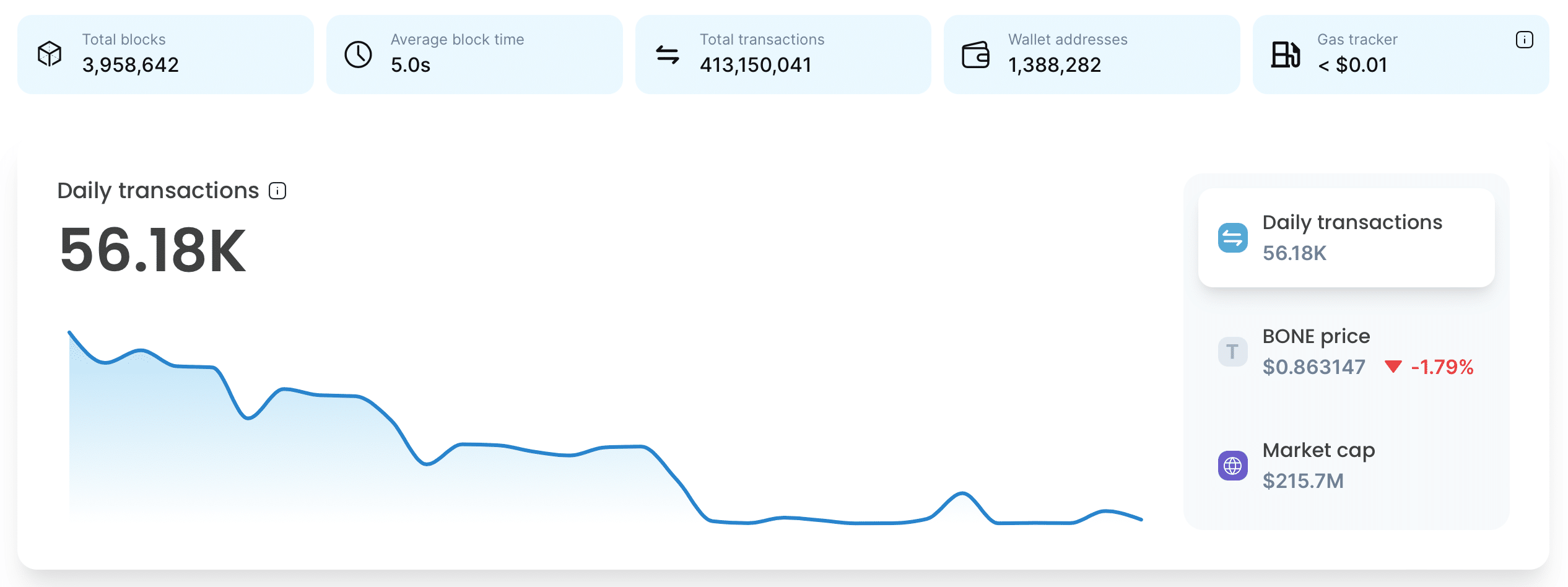

While Shiba Inu remained sluggish, Shibarium’s network activity surged. AMBCrypto’s look at Shibariumsca.io’s data revealed that the L2 had already processed over 400 million transactions.

At press time, its total number of transactions exceeded 413 million. Its number of processed blocks was also high, with only about 40k left from reaching the 4 million mark.

During this time, it had a daily transaction count of over 58k, with a total number of wallets touching 1.38 million.

Source: Shibariumscan.io

Will this help SHIB?

Though Shibarium’s performance was remarkable, SHIB might not positively react to this anytime soon.

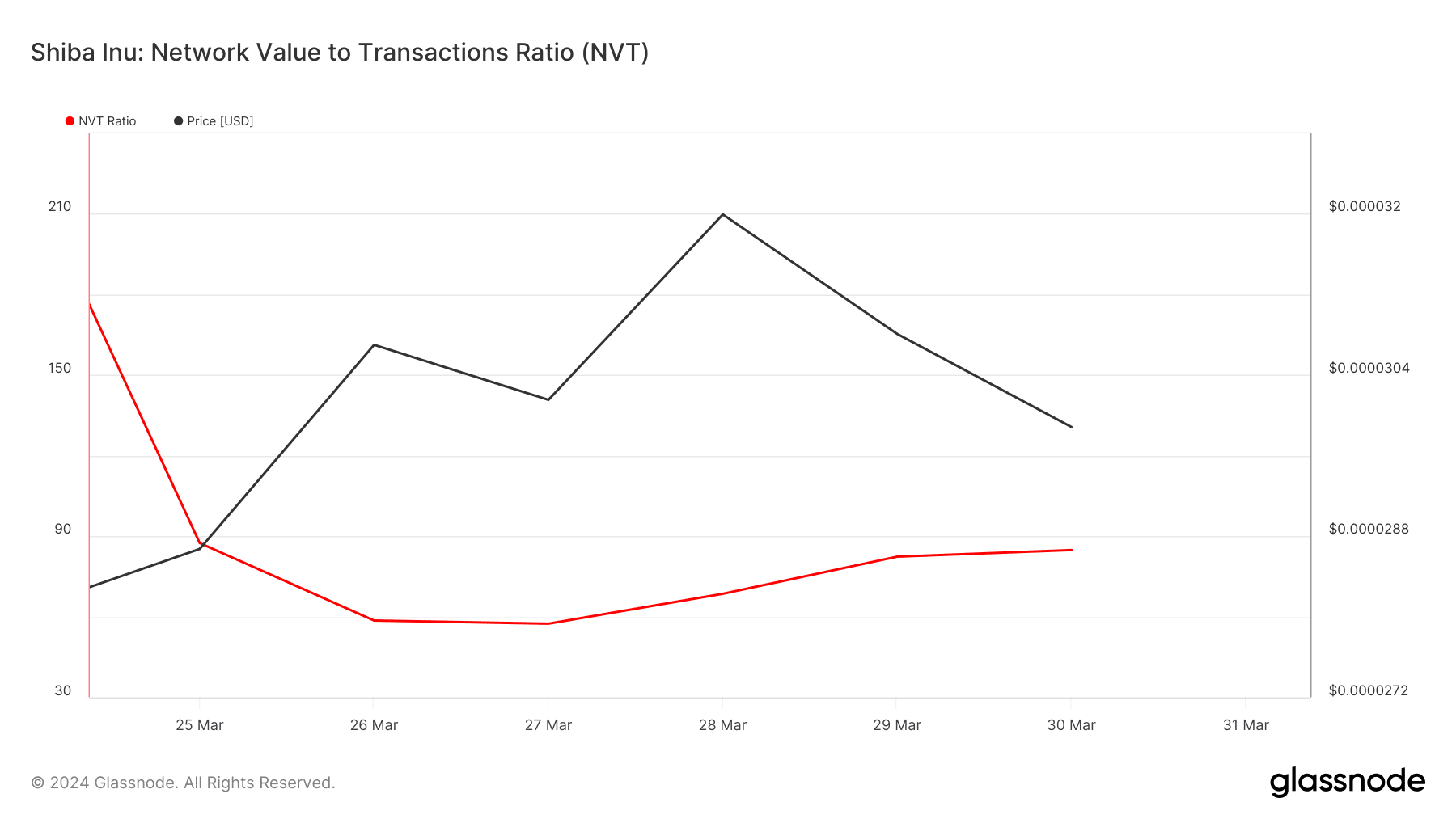

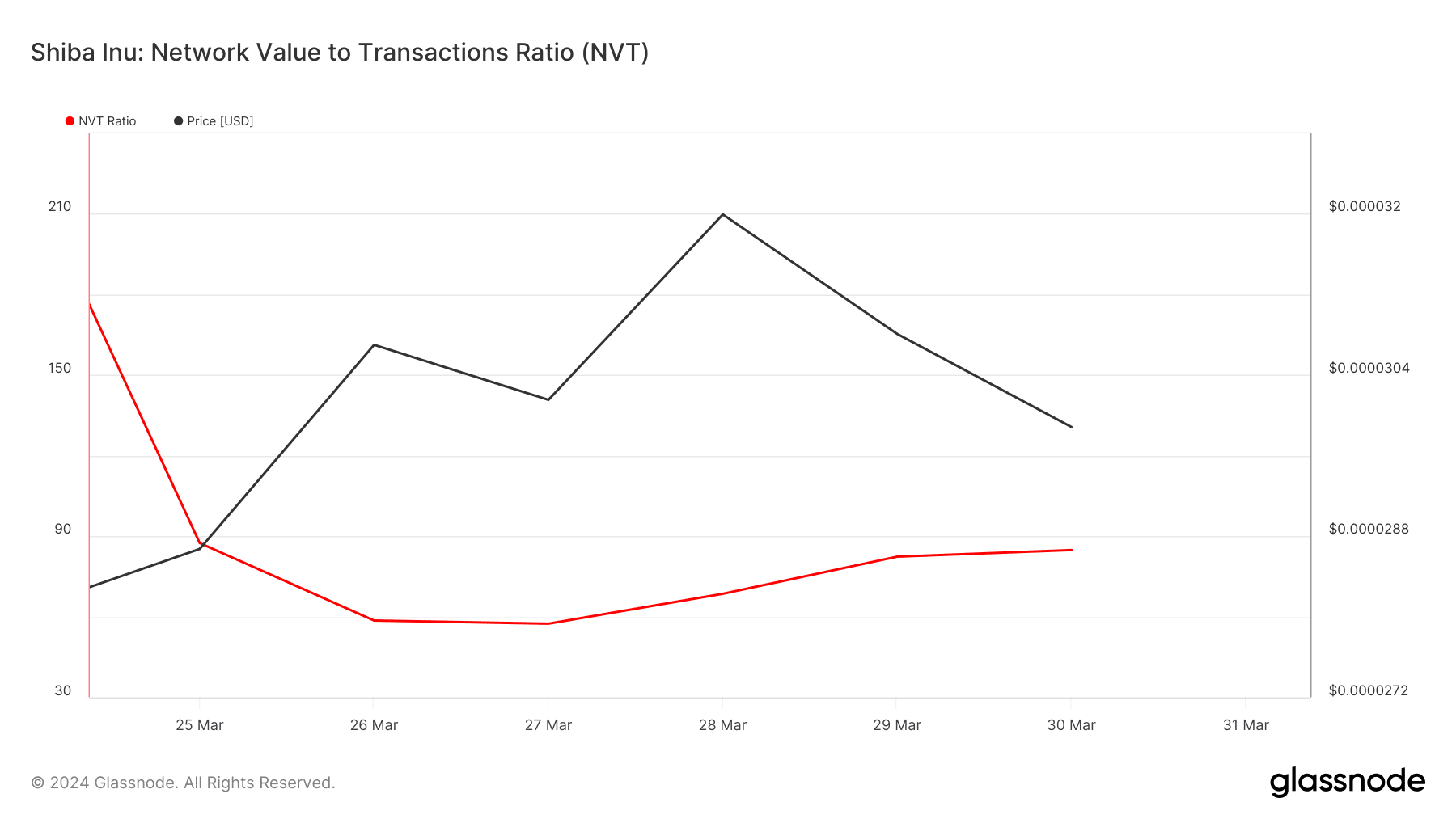

AMBCrypto’s analysis of Glassnode’s data revealed that Shiba Inu’s network-to-value (NVT) ratio registered a slight uptick on the 28th of March.

A rise in the metric suggests that an asset is overvalued, hinting at a price drop.

Source: Glassnode

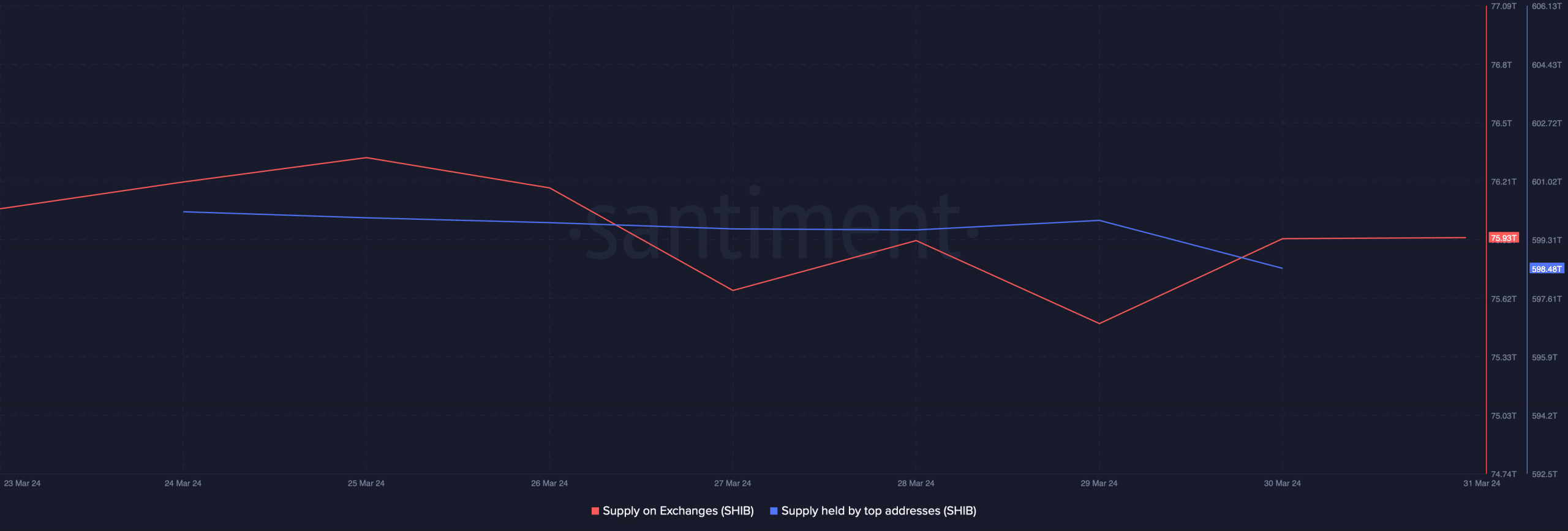

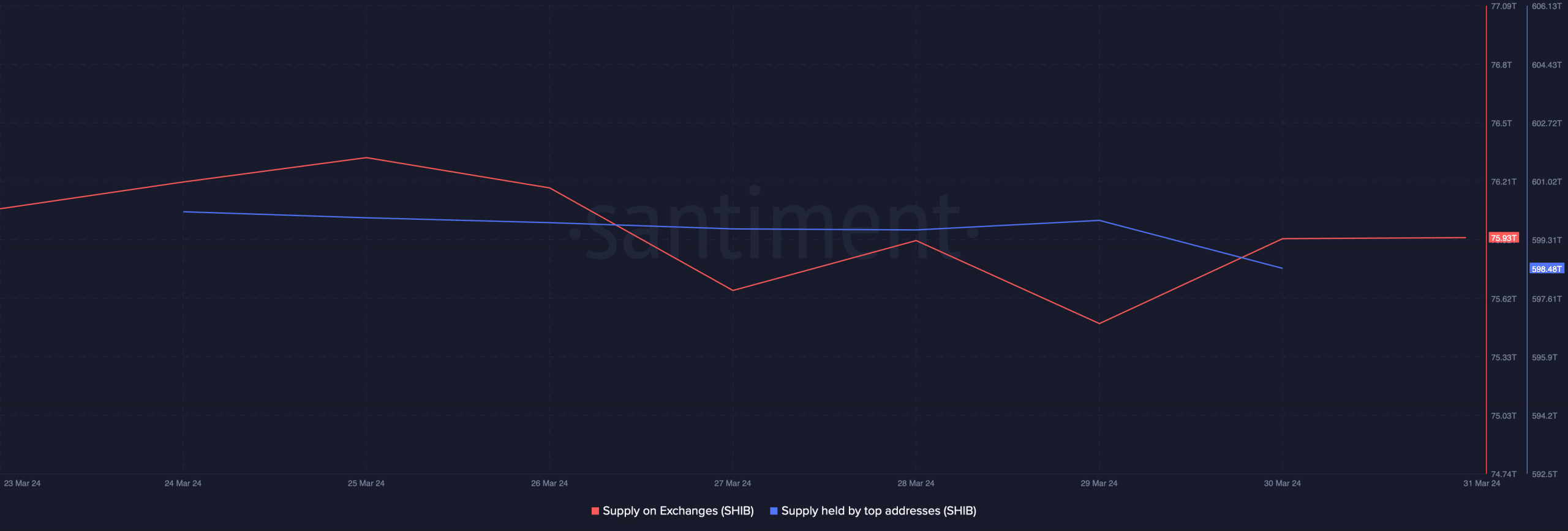

SHIB’s Supply on Exchanges increased slightly after a drop in the last few days. Additionally, its supply is held by top addresses declined.

Both of these metrics suggested that selling pressure was high on Shiba Inu, further indicating that its price might drop.

Source: Santiment

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

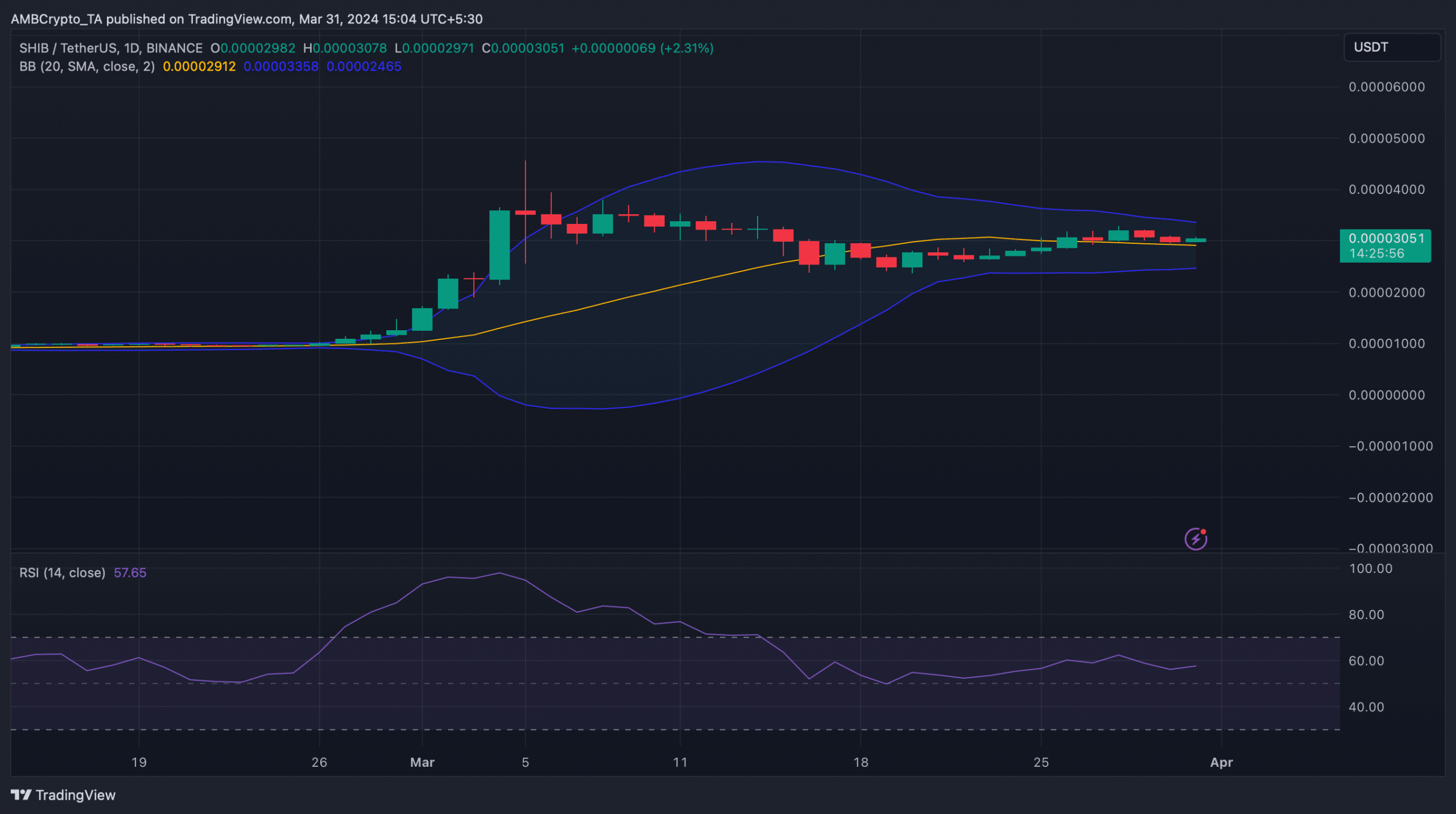

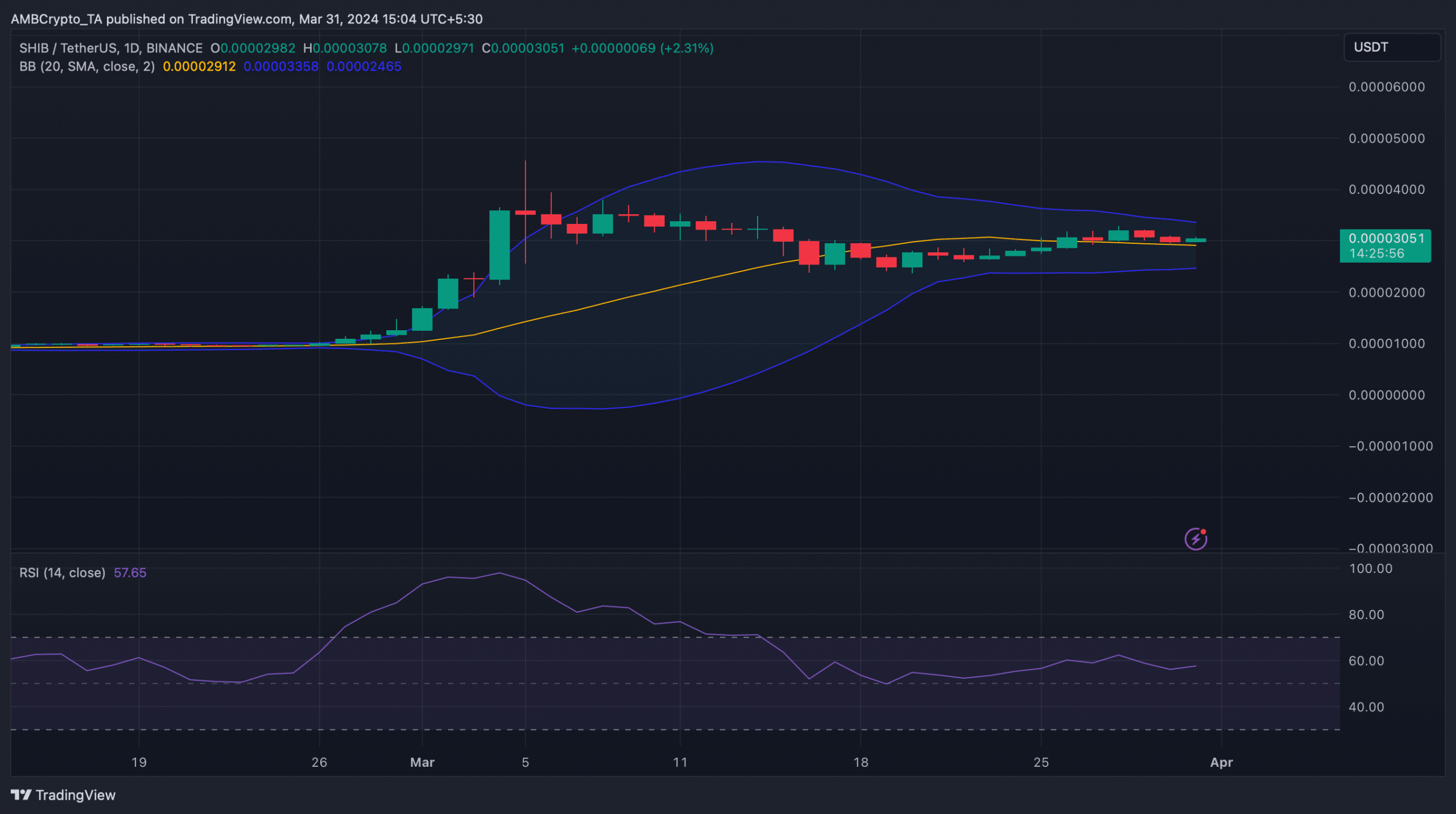

As per the Bollinger Bands, SHIB’s price was in a less volatile zone, minimizing the chances of a northbound price movement. Nonetheless, the Relative Strength Index (RSI) rose above the neutral mark.

This indicates that, despite the negative metrics, SHIB’s price action might turn volatile in the coming days.

Source: TradingView