- NFT sales volume has steadily declined since the beginning of March.

- This has impacted the values of Blue-Chip NFTs.

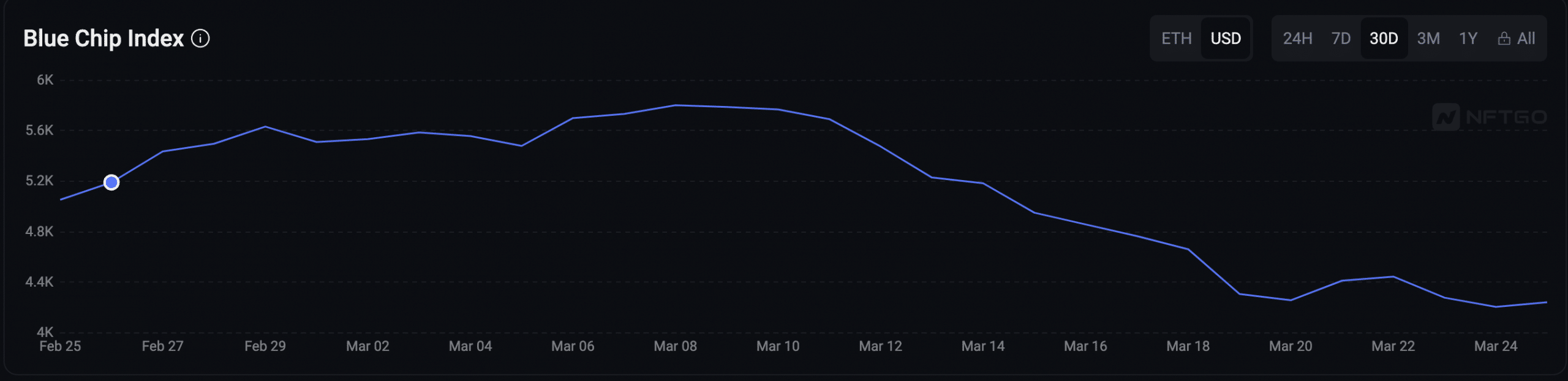

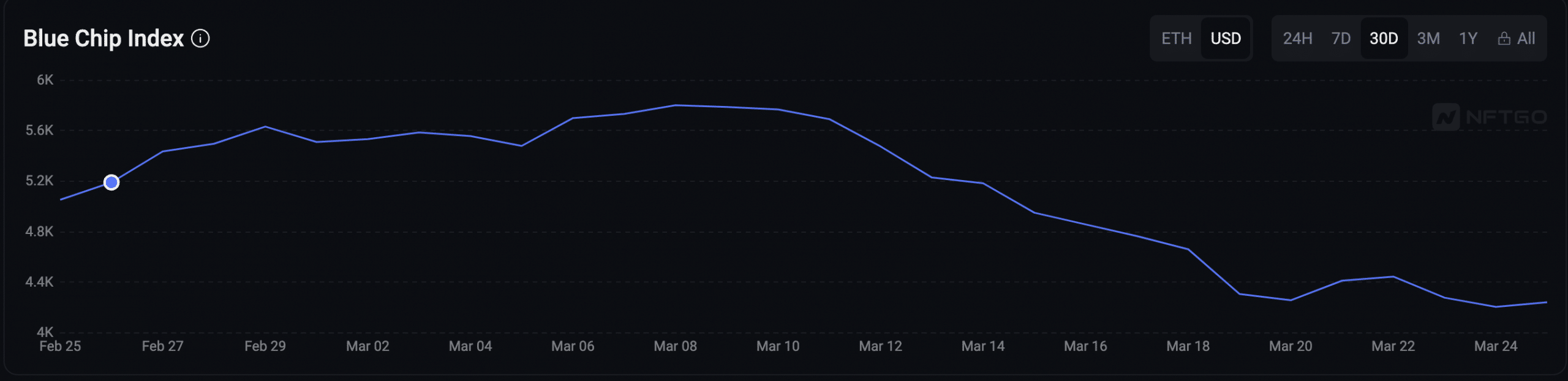

According to NFTGo’s data, the decline in non-fungible token (NFT) sales volume this month has pushed the Blue-Chip NFT Index to a 30-day low.

Blue-chips are NFT collections considered to be high-quality and have a high potential for future growth. They are often characterized by their high floor price, strong community, and potential for future utility.

NFT projects such as CryptoPunks, Bored Ape Yacht Club [BAYC], CryptoKitties, and Milady make this list.

The Blue-Chip Index tracks the performance of these digital assets by weighting their market capitalization to determine their performance.

When this index climbs, it indicates that the values of top NFT collections are rising. Conversely, when it declines, these NFTs are declining in performance.

Data from NFTGo showed that the index has declined by 26% since the 11th of March, suggesting a drop in the performance of top NFT collections in the past two weeks.

Source: NFTGo

Top collections lose their shine, but there is a silver lining

Ranked by market capitalization, CryptoPunks, and BAYC are the top two leading NFT projects.

Per NFTGo’s data, the CryptoPunks collection has a market capitalization of 506,000 ETH, while BAYC trails behind with a market capitalization of 136,000 ETH.

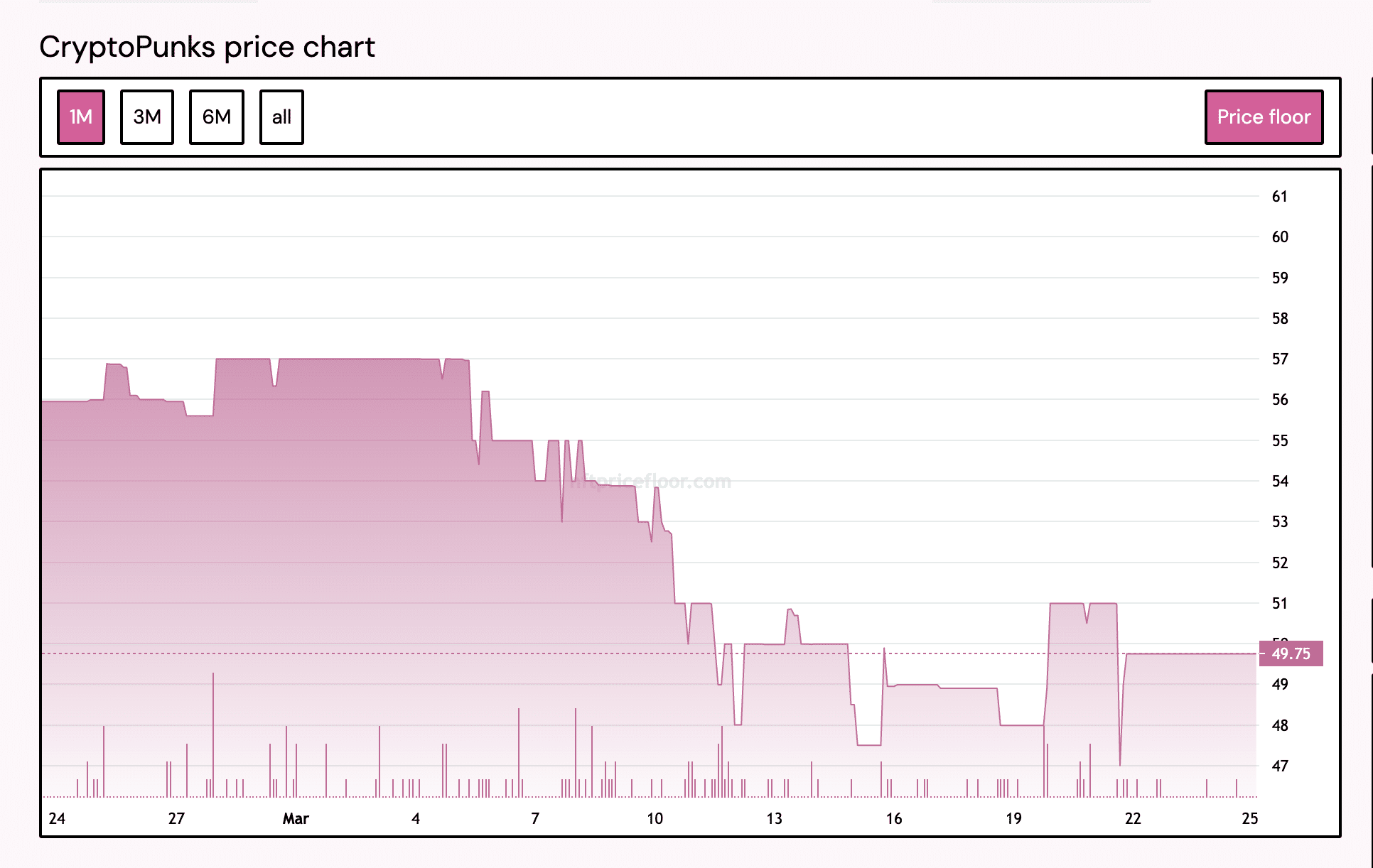

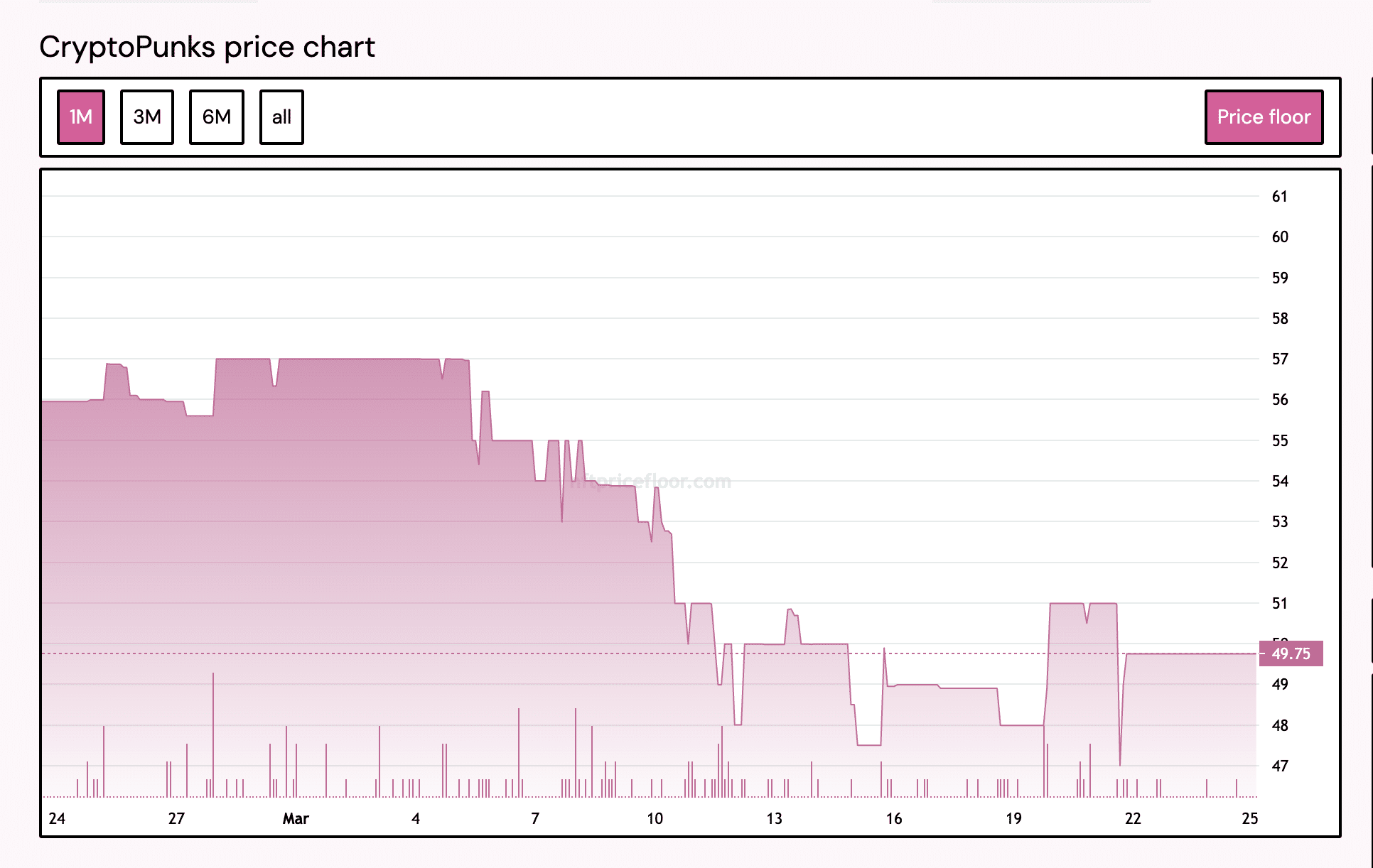

A look at CryptoPunks’ floor price showed a steady drop since the beginning of March.

As of this writing, an NFT from the CryptoPunks’ collection could be obtained for an average floor price of 49.75 ETH, worth around $172,000. At the beginning of the month, this went for $197,000.

Source: NFT Floor Price

Traders have taken advantage of the drop in CryptoPunks’ floor price, as the collection has seen more sales in the past 24 days than in the first two months of the year.

According to CryptoSlam’s data, CryptoPunks’ sales volume so far this month has totaled $56 million, surpassing February’s $21 million by 166% and January’s $33 million by 70%.

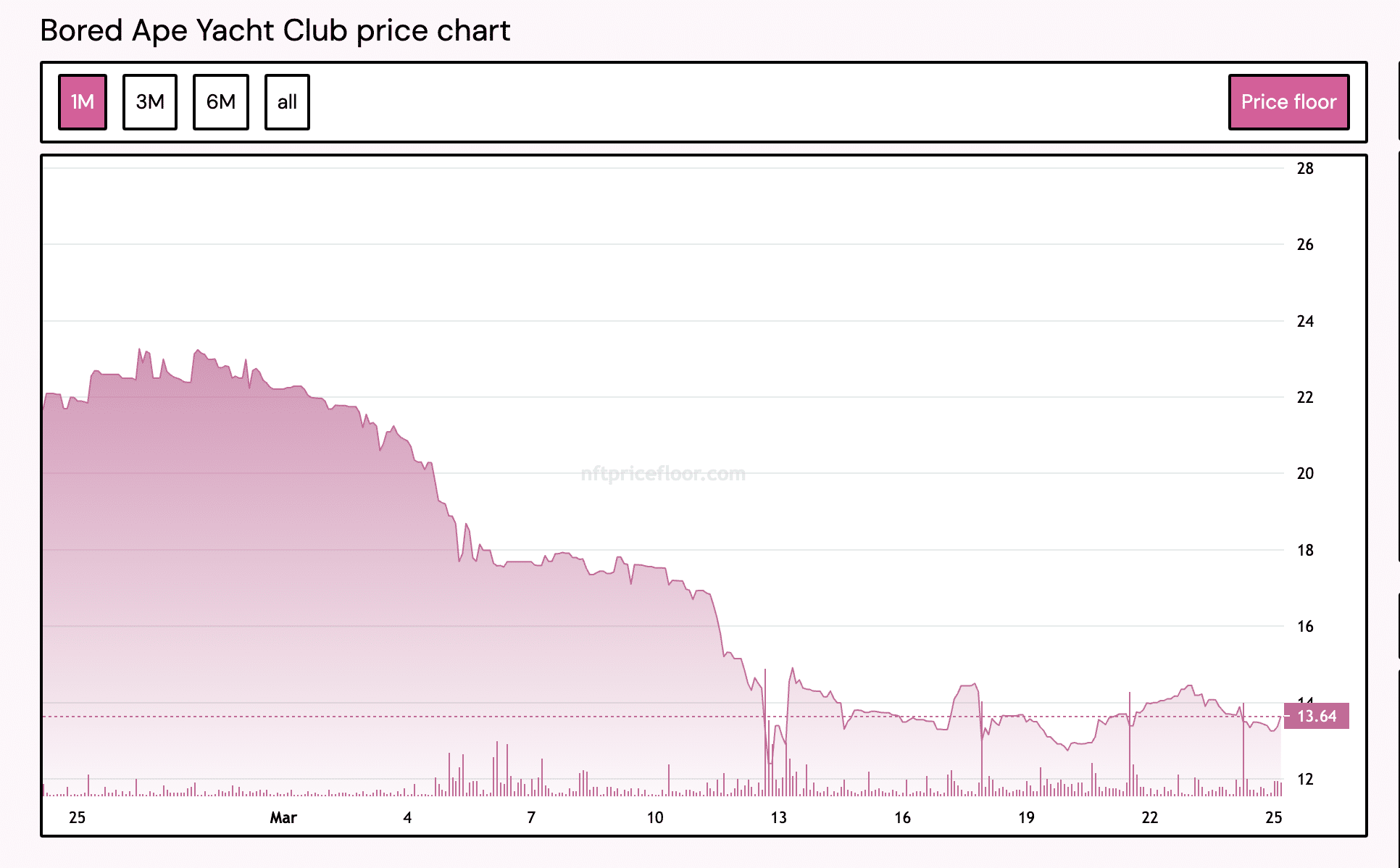

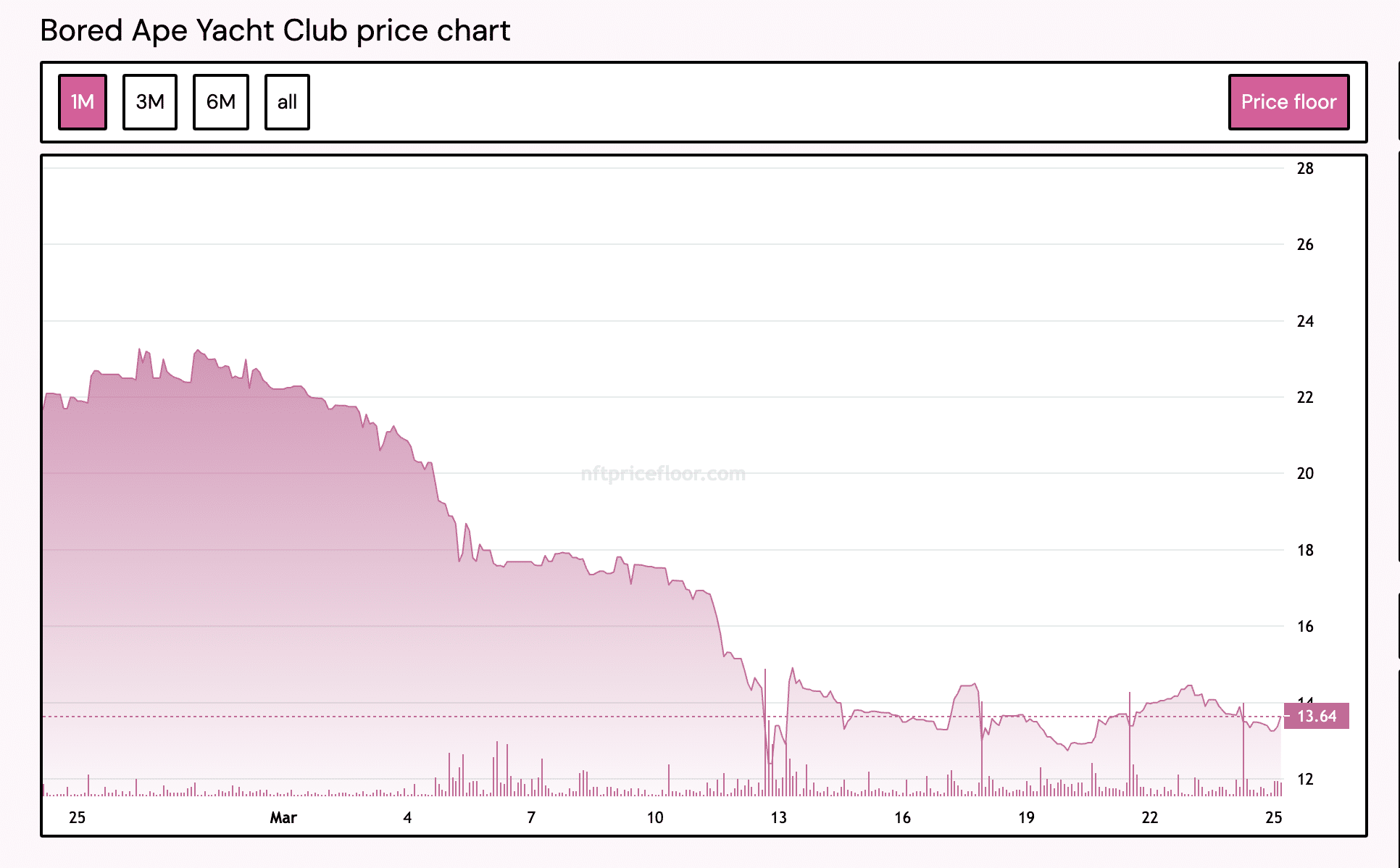

Regarding BAYC, its floor price has also trended downward since the beginning of the month. Data from NFT Floor Price showed that this has since fallen by 40%.

At press time, an NFT from the BAYC collection could be acquired for $45,000.

Source: NFT Floor Price

Following a similar trend, the month so far has also witnessed a sharp rise in BAYC’s sales volume. In the past 24 days, this has totaled $36 million, exceeding February’s $21 million by 71%.