Prominent crypto analytics firm Glassnode says Bitcoin is in a long-lasting uptrend powered by traders who are still doubting the strength of BTC.

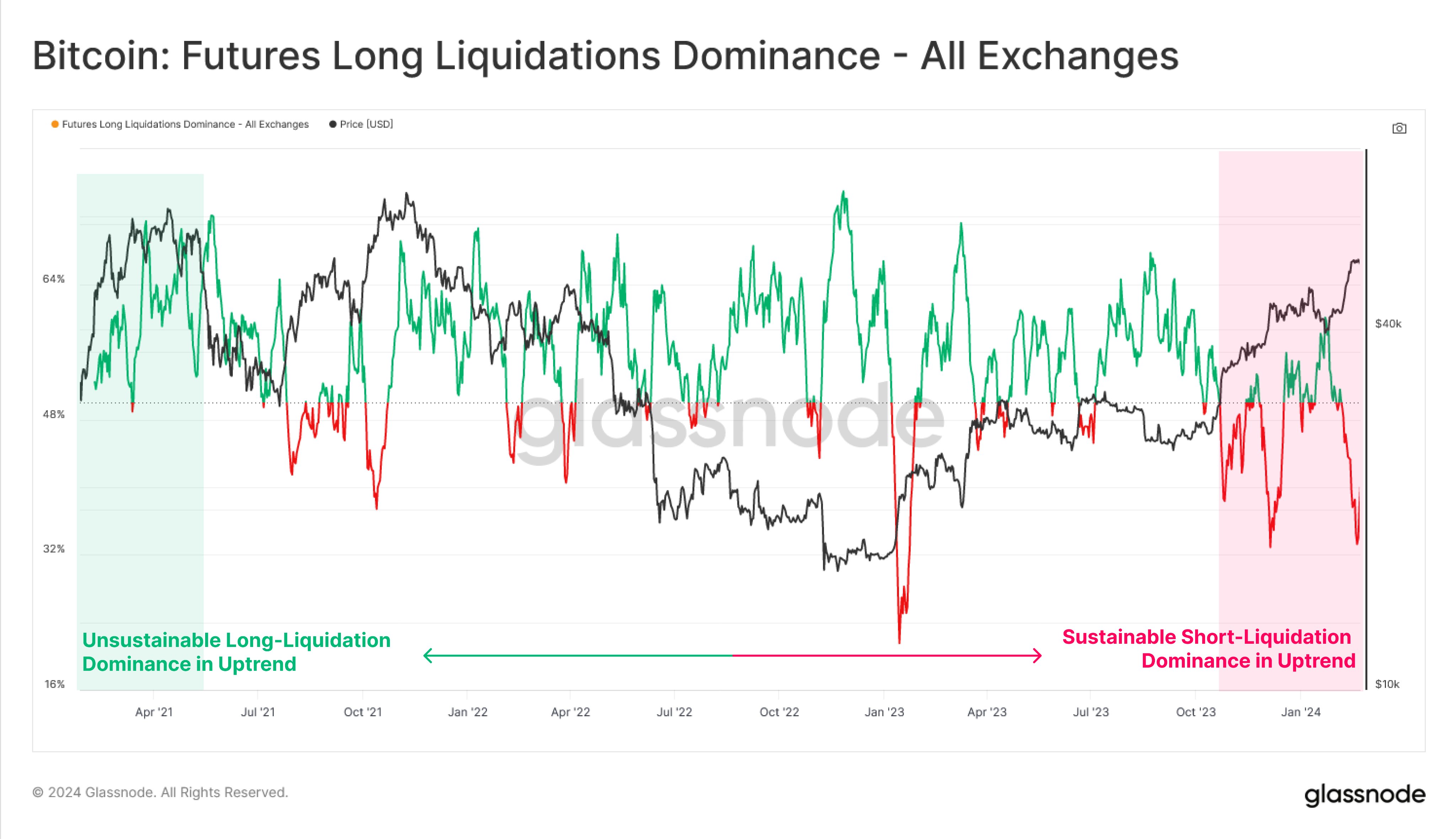

In a new post on the social media platform X, the analytics firm says Bitcoin’s current bull run looks very different from the one witnessed in 2021 when BTC bulls were using excessive leverage to drive up the price of the crypto king.

According to Glassnode, bears who are shorting BTC are getting liquidated, triggering short squeezes and providing fuel for Bitcoin rallies.

A short squeeze happens when traders who borrow an asset at a certain price in hopes of selling it for lower to pocket the difference are forced to buy back the assets they borrowed as momentum moves against them, triggering further rallies.

Says Glassnode,

“It is worth noting that at both Bitcoin ATH (all-time high) peaks in 2021, long traders dominated liquidation volumes, as leveraged positions were force-closed within the intra-day volatility.

As such, seeing such a strong dominance of directional short traders being liquidated suggests many traders have been betting against the prevailing uptrend since October.”

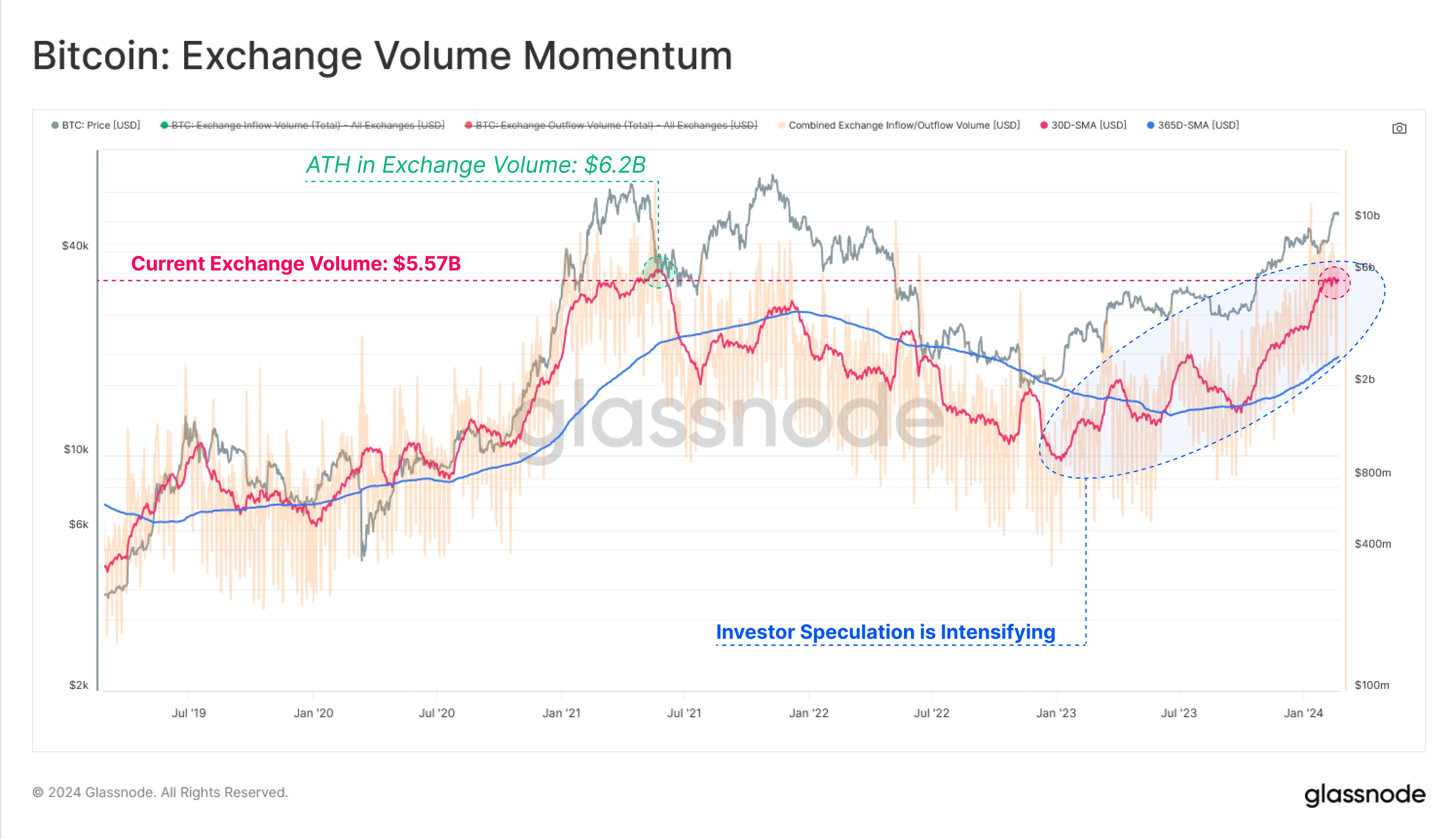

Glassnode also notes that Bitcoin is moving in and out of crypto exchanges at a rate reminiscent of November 2021, when BTC printed its all-time high of about $69,000.

“The total volume of Bitcoin deposits and withdrawals to exchanges has continued to expand, reaching a staggering $5.57 billion in daily volume flowing in and out of exchanges, rivaling activity seen during the November [2021] market all-time high.”

At time of writing, BTC is trading at $61,825.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney