Crypto investment products offered by asset managers such as Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares, and 21Shares registered their fourth week of consecutive inflows, adding $598 million globally last week, according to CoinShares.

Year-to-date inflows have now exceeded $5.7 billion — led by the new spot Bitcoin  BTC

BTC

+3.60%

exchange-traded funds in the United States — accounting for more than 50% of the record inflows generated in the whole of 2021, CoinShares Head of Research James Butterfill wrote.

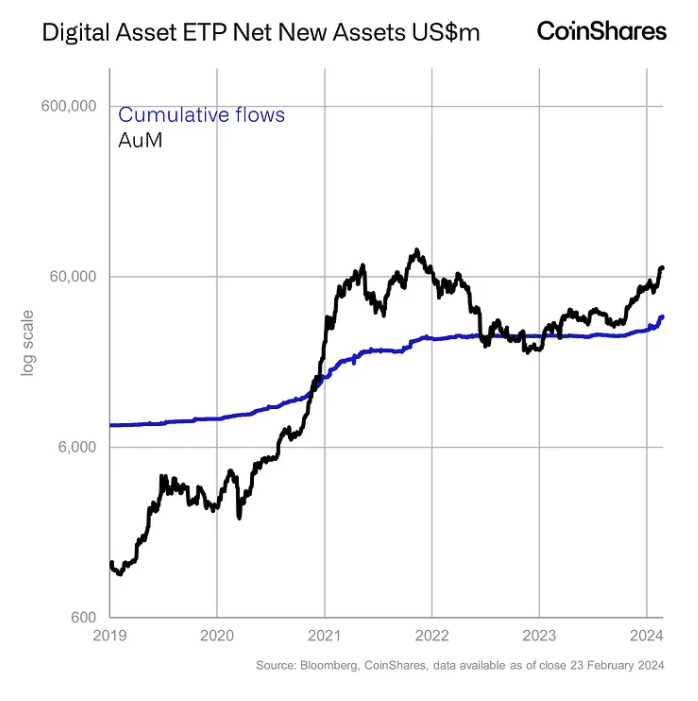

Total assets under management in the funds hit a peak of $68.3 billion during the week, though this remains more than 20% below the all-time high set in November 2021, Butterfill added — mirroring Bitcoin’s price action during the period.

AUM and cumulative flows. Image: CoinShares.

Focus remains on US and spot Bitcoin ETFs

Regionally, U.S.-based funds generated the largest inflows, adding some $610 million overall despite $436 million worth of outflows from the incumbent issuer Grayscale. Brazil and Switzerland registered minor inflows of $8.2 million and $2.1 million, respectively. The Canadian market witnessed the largest outflows from digital asset investment products, shedding $17.8 million.

Bitcoin-based funds generated $570 million worth of inflows last week — boosted by more than $588 million in net flows from spot Bitcoin ETFs in the U.S. — bringing year-to-date inflows to $5.6 billion. Total net flows for the spot Bitcoin ETFs alone — which launched on Jan. 11 — now stand at over $5.5 billion, according to data from BitMEX Research.

However, recent price action has “prompted minor inflows into short-Bitcoin positions which totaled $3.9 million,” Butterfill added.

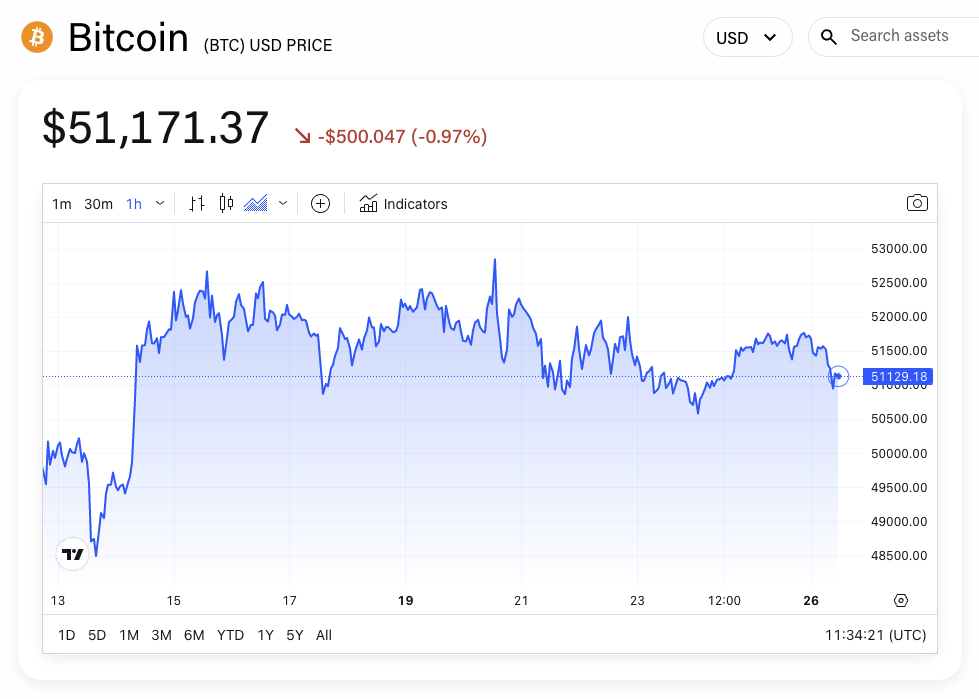

Bitcoin is currently trading at $51,171, according to The Block’s price page — down 2.3% over the past week and up 21% year-to-date.

BTC/USD price chart. Image: The Block/TradingView.

Ether investment products registered $17 million worth of inflows last week amid a period of outperformance against Bitcoin, gaining 5% over the past seven days to trade at $3,050. Chainlink  LINK

LINK

+2.74%

and  XRP

XRP

+0.81%

-based funds saw the next largest inflows, adding $1.8 million and $1.1 million, respectively.

Meanwhile, Solana  SOL

SOL

+5.53%

investment products witnessed a second week of outflows totaling $3 million, with Butterfill again citing the network’s recent temporary downtime as impacting sentiment amid a 10% drop in Solana’s price last week to $101.

The GM 30 Index, representing a selection of the top 30 cryptocurrencies, traded flat over the past week, down around 0.5%.

GMCI 30 Index. Image: The Block/TradingView.

Blockchain equities saw continued outflows of $81 million for the week, suggesting equity investors are a little cautious at present, Butterfill said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.