- Ethereum bulls have strong support just below the $2900 mark.

- A rally to $3500 could commence if the bullish sentiment continues to intensify.

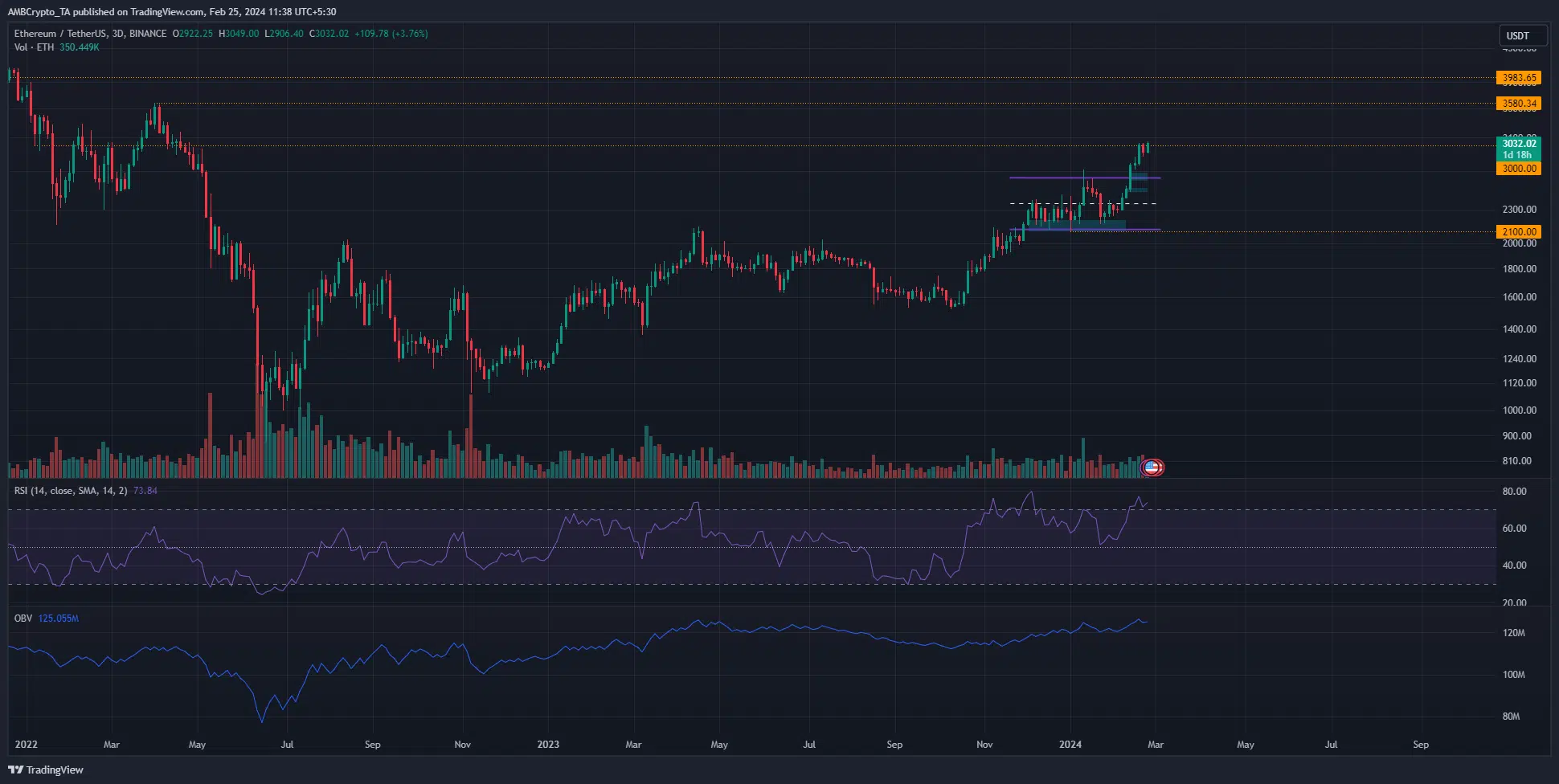

Ethereum [ETH] sailed above the psychological $3000 resistance on the 25th of February. It closed the daily trading session at $3014 on the 20th, but ETH dipped to the $2900 area in the days that followed.

The NFT sales on the Ethereum network reached their ten-month high recently. The sales volume amounted to $400 million, AMBCrypto reported.

The on-chain analysis highlighted ETH outflows from exchanges worth $2.4 billion in 2024, pointing to the accumulation of the asset.

The range breakout has not yet stalled

Highlighted in purple was a range that ETH exhibited in the second half of January. It extended from $2100 to 2600. On the lower timeframe charts, two demand zones were identified at $2500 and $2650.

The price was yet to retest either region.

The market structure and momentum on the 3-day chart were firmly bullish. The rising OBV signaled heavy buying volume. Together, they showed that Ethereum prices are expected to continue to rally.

The move above the $3000 psychological resistance level is a significant one. It could heighten the bullish fervor already present in the market.

The next higher timeframe resistance level sat at $3580, and ETH may rush to this area before a significant retracement arrives.

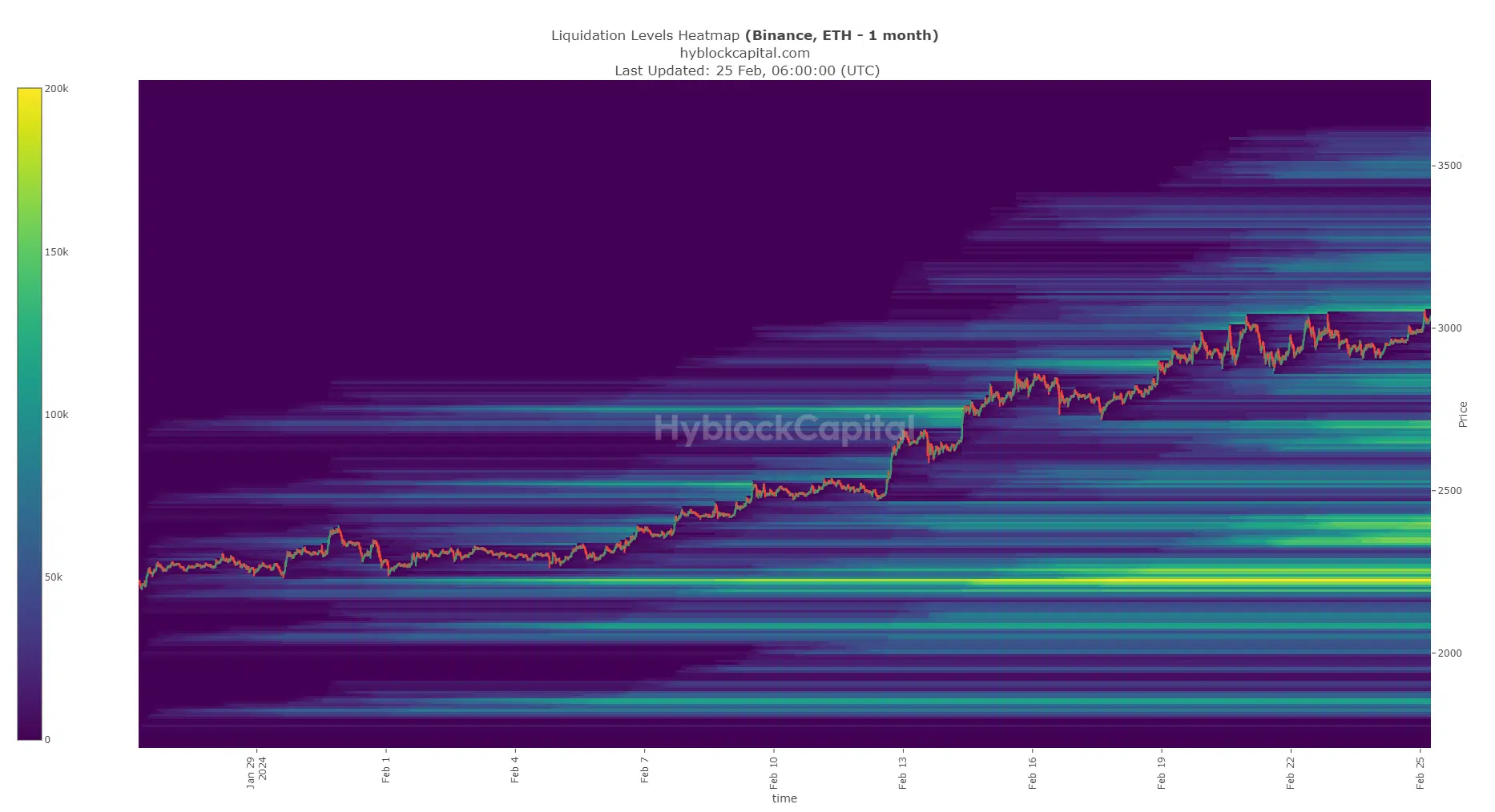

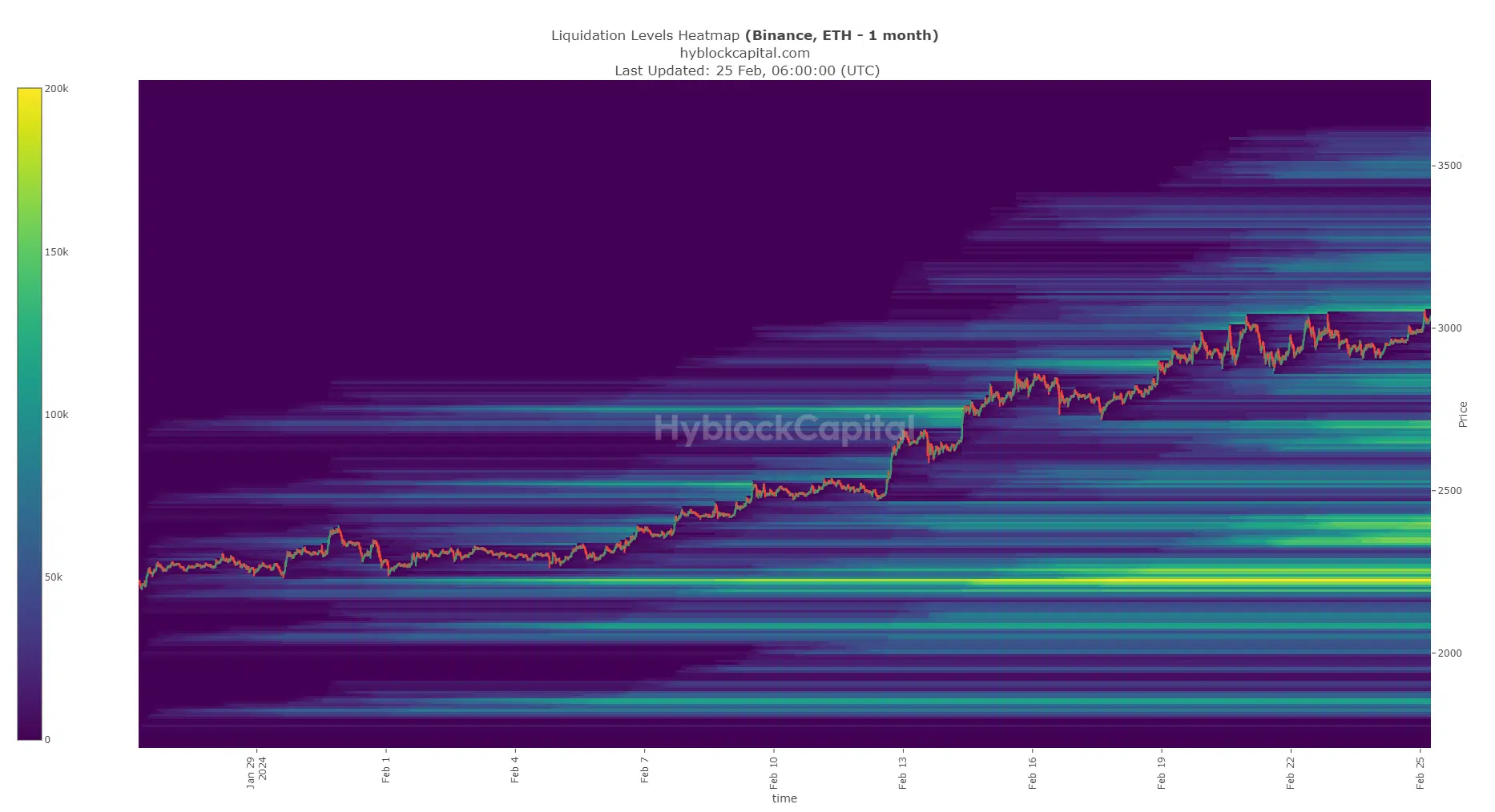

The liquidation heatmap showed three key areas of interest

Source: Hyblock

The 3-month look back period liquidation heatmap showed that the $3050-$3110 region was estimated to have multiple levels whose liquidations were in the $2 billion to $4 billion window.

The $3050 level has already been tested, but more liquidity resided till $3100.

Further north, the $3190-$3225 region was estimated to have multiple liquidation levels measuring from $1.4 billion to $2.3 billion. Similarly, the $3460-$3520 had liquidation levels in the $2 billion territory.

Is your portfolio green? Check out the ETH Profit Calculator

Hence, these regions will be key resistances towards which prices could be attracted before a bearish reversal.

In terms of support, the $2800-$2880 area also presented a significant pocket of liquidity. A retest of this area would likely see prices rebound.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.